👋 Welcome to cBridge

.png)

cBridge introduces the best-in-class cross-chain token bridging experience with deep liquidity for users, highly efficient and easy-to-use liquidity management for both cBridge node operators and Liquidity Providers who do not want to operate cBridge nodes, and new exciting developer-oriented features such as general message bridging for cases like cross-chain DEX and NFTs. All of the above is made possible by extending the existing functionality and services provided by the Celer State Guardian Network (SGN) powered by validators and stakers in the system with value capture.

Architectural Benefits

A quick summary of improvements and additions brought by 2.0 architecture.

For users

- Deep liquidity: supports much larger transfer sizes.

- Simpler to use: offer an option to reduce two-step operations to a single click.

- Native gas token unwrapping: e.g. transfer WETH from BSC to unwrapped ETH on Arbitrum.

- Extend to even more tokens and chains

- Insured bridge node Service Level: did you initiate a transfer but the bridge node was not available? Slash cBridge node’s bond to cover your opportunity cost!

For LPs and cBridge node operators

- LPs don’t have to run a cBridge node: in cBridge 1.0, the only way to provide liquidity is to run a cBridge node. In 2.0, we added a second mode where the SGN itself acts as a “cBridge node.” For LPs satisfied with PoS-consensus-level security based on CELR token economics in the SGN, they can directly delegate liquidity to the network without operating a node themselves.

- Simple Liquidity Provider (LP) experience: No minting synthetic tokens, no volatile token pair AMM pool, no high impermanent loss, no complicated rebalancing. Simply add liquidity to the chain of your choice and start to earn fees!

- High liquidity efficiency: No double liquidity locking, fully utilize liquidity with the highest yield.

- Incentivized liquidity rebalance: lopsided liquidity movement? No worries! An AMM-style bonding curve and a flexible liquidity mining mechanism are in place to incentivize LPs and arbitrageurs to rebalance liquidity cross-chain.

- High Quality-of-Service node scheduling: For LPs operating self-custodial cBridge nodes, the SGN becomes the decentralized layer to allocate user transfer requests to different LPs through policies that incentivize high-quality service and competitive pricing.

Fo staker and validators participating in State Guardian Network

- Value capture: In return for their active services and roles in supporting cBridge 2.0, PoS stakers and validators in the SGN directly capture the value of cBridge via fees paid to the block producer facilitating user’s bridging request. This is very much like fee being paid for any PoS blockchain validators.

- Governance: Various system parameters including pricing curve, fee percentage, and more are governed through a decentralized governance process built in the active service SGN.

For developers:

- White-label frontend SDK: Allows multi-chain dApp to have a built-in cross-chain experience.

- Cross-chain messaging for NFT and more: Allows developers to build applications beyond simple cross-chain asset transfers, including cross-chain DEX and NFT cross-chain minting.

So, how do we achieve all of these cool improvements and innovations? What bridging design tradeoff space do we cover in the 2.0 architecture? At a high level, how exactly do all of these things work?

Answer: The State Guardian Network (SGN).

State Guardian Network

.png)

The Celer State Guardian Network (SGN) has been an essential part of Celer Network’s architecture. In Celer’s layer-2 scaling architecture, the SGN is a specialized Proof-of-Stake (PoS) chain that serves the purposes of monitoring L1 transactions related to L2 state and faithfully passing layer-2 information back to layer-1 when needed.

In the Celer State Channel, the SGN helps store channel states and respond to malicious settlements on L1 when needed. In the Celer layer2.finance rollup chain, the SGN extends as a decentralized block producer network to pass call data and state roots back to the L1 blockchain and submit fraud-proof from any SGN node even when the entire PoS consensus fails.

CELR holders can stake their tokens into the SGN by becoming a validator or through delegation and actively provide the above-mentioned services. SGN participants receive staking rewards as well as fees in exchange for the services they help provide.

SGN and cBridge

The SGN serves multiple roles in the cBridge 2.0 architecture:

- The SGN as a cBridge node gateway and Service Level Agreement (SLA) arbitrator

- The SGN as a Shared Liquidity Pool Manager

In the next two sections, we introduce the detailed utility of SGN in cBridge 2.0.

The SGN as a cBridge node gateway and Service Level Agreement (SLA) arbitrator

.png)

Design Choices and Limitations of 1.0

In cBridge 1.0, when a cBridge node joins the network, it registers to a gateway service with various information such as fee schedule and liquidity status. This gateway will continuously monitor the status and performance of the cBridge node. When a user request is made, it is directed to the gateway. The gateway evaluates the registered nodes based on liquidity availability, historical bridging success rate, fee, and more. Then it suggests the most suitable bridge node for the request. In 1.0, we chose to use a centralized gateway to quickly learn operation experiences on various scheduling policies.

Basically, what the 1.0 gateway provides to the user is really an “FYI” suggestion to use certain cBridge nodes. Although cBridge 1.0 is built with non-custodial architecture and users NEVER need to put trust in nodes for their fund’s security, there is indeed a user experience issue related to node availability. As an example, if after a user sends a conditional transfer to a node but the node goes offline before the two-step HTLC transfer is complete, they will have to wait until the conditional transfer times out, without any penalty to or compensation from this offline cBridge node.

We solve both of these limitations in 2.0 via the SGN.

Decentralized bridge node scheduling via the SGN

In 2.0, we first decentralized all of the gateway logic by migrating it as a service on top of the SGN. Instead of registering with a centralized gateway service, cBridge nodes will register with the SGN with their fee preference, availability of liquidity, and more.

When a user request is made, this is the “happy” system flow:

- The user queries the current state of the SGN to get an estimated transaction fee and liquidity availability.

- If the estimation is acceptable, the user sends the first half of the HTLC transfer with max fee tolerance specified.

- The SGN monitors and picks up the transaction. It assigns one or more registered cBridge nodes to the transaction based on node selection rules. This transaction assignment is written on the SGN chain and also marked on the user’s HTLC transfer.

- The assigned node picks up the assignment and responds by completing the rest of the conditional transfer.

- The SGN continues to monitor and track the transaction and once the transaction is successfully completed, the state related to this transaction is purged from the SGN chain.

This allows for a much more scalable cBridge node onboarding process with a consensus-based and unbiased node selection process. But we didn’t stop there.

Bridge node SLA bond and slashing mechanism

As opposed to 1.0’s gateway, the SGN-as-a-gateway architecture monitors the whole process of the cross-chain transaction. As a decentralized PoS chain, the SGN can now offer more than just a “friendly suggestion.” It can also enforce penalties to registered cBridge nodes that cannot complete transactions assigned to them “as promised.”

When a cBridge node registers with the SGN, it can put down an “SLA bond” (i.e. a bunch of tokens with value) associated with some SLA promises (e.g. availability, fee level, and liquidity reserve) in a pool contract. If the SGN determines that this node violates the SLA, such as being offline with an assigned transfer, the SGN can slash the bond as compensation to the user for the degraded user experience and liquidity opportunity cost. (remember, no fund loss for users is possible, this is just for “fund getting stuck” cost.)

During node selection, the value available in the SLA bond is a key factor in how the node is prioritized in the transfer assignment process. Honest and reliable cBridge nodes are heavily incentivized to invest in a reasonable SLA bond to increase their chances of getting selected in the bridging process. On the other hand, less reliable nodes will be driven out of the system or will only be called upon as a last option. Finally, cBridge nodes can only be de-registered with the SGN once there are no pending cross-chain transactions.

With the SLA bond slashing capability powered by the decentralized “SGN gateway,” the node availability challenge, and more generally, the SLA assurance concerns, are solved. This is aimed to facilitate a healthy, fast-growing, and decentralized cBridge node operator network for liquidity providers who want to maintain their self-custodial liquidity.

Some may argue that the SLA bond is not a 100% self-custodial setting due to the possibility of having the SLA bond wrongly slashed because of the possibility of a PoS consensus failure.

While this is true, we want to highlight that the SLA bond only needs to be a very tiny portion of the total liquidity in order to become highly efficient in ensuring a smooth user experience and a self-healing cBridge node operator ecosystem. This is a very worthwhile tradeoff to make and most importantly, the entire transfer process stays 100% non-custodial.

Node selection rule

The principle of the node selection rule design is to optimize for user experience. We build an empirical Node Quality Score formula to incorporate multiple factors such as the parameters in a node’s SLA (fee, response time) as well as historical performance. (e.g. success rate, average response time) When selecting nodes for user requests, we prioritize the nodes according to this score. We expect this formula to iterate and optimize over time with empirical operation experiences through protocol governance.

The SGN as a Shared Liquidity Pool Manager

\

Provide liquidity without running a cBridge node

The above improvements are designed more for self-custodial LPs who are capable of running their own cBridge nodes. However, we recognize that there are a large number of LPs and users who want to provide liquidity without running a cBridge node themselves and are satisfied with the security level provided by the SGN’s PoS consensus with CELR staking. In addition, through a shared liquidity pool model, the entire network liquidity can be easily bootstrapped to facilitate a much better user experience much faster.

So in cBridge 2.0, we are introducing an entirely new model of operation where the SGN manages shared liquidity pool contracts on multiple chains. This effectively treats the SGN and its managed liquidity pool as a single “node” along with all the other non-custodial LP-managed nodes and gives an option to the LPs to delegate liquidity easily without the hassle of running a node.

So, without any ambiguity, what security level does this model offer?

PoS-level security and decentralized governance

In cBridge 2.0, shared liquidity pool contracts are managed through the SGN’s PoS consensus. CELR staking weighted multi-signatures are needed to move funds in the pool contracts and malicious or faulty nodes will be slashed out of their staking token. It is only when nodes with more than ⅔ of the total stake are malicious, that the fund pool will be at risk. We want to stress that as the number of cBridge transactions grows and the total value captured by the network grows, it will be a naturally increasing economic deterrent for any node to try to behave maliciously.

The validator governance model in the SGN is open and decentralized: the SGN allows new validators to be elected and join the validator set through the staking governance process without any special coordination processes.

Simple Liquidity Provider (LP) experience and high liquidity efficiency

So how do LPs manage their liquidity in this model? Existing solutions require LPs to put canonical token liquidity along with another protocol-controlled settlement token in on-chain AMM pools. But this model has a few drawbacks:

- Some models require LPs to use a highly volatile settlement token and therefore inherently expose LPs to a significant impermanent loss.

- Even in the case of minting synthetic tokens through canonical liquidity tokens, LPs still suffer from complicated operational overhead when adding, removing, and rebalancing liquidity across multiple chains.

- In the case where “bonder” liquidity is required, the liquidity efficiency is lower because the liquidity requirement for any transfer is double what’s necessary.

cBridge 2.0 provides a simple LP experience and high liquidity efficiency through a new design to solve the “liquidity attribution problem.” To understand our system design, we will first explain what “liquidity attribution” means. In any multi-chain bridging system, when a user sends funds from a source chain to a destination chain, LP(s) (or aggregated pools) essentially pay funds to the user on the destination chain while receiving funds from the user on the source chain. Now, let’s say there is an LP providing liquidity to the system on chain A. When a user sends funds from chain B to chain A, the LP’s liquidity essentially is “redistributed”: their liquidity on chain A is reduced and their liquidity on chain B is increased. The liquidity attribution problem is defined as “how does the system allow every LP to know where all of their liquidity is?” and hence how to effectively manage the liquidity to optimize for transaction fee yield.

An AMM pool-based solution tracks LPs liquidity implicitly via the distribution of settlement tokens and canonical tokens in the AMM pool. The bridging fabric (e.g. TSS validators or L2-to-L1 messaging protocols) only manages the minting and burning of the settlement tokens cross-chain. The user will always need to pay for an AMM swap from the settlement token to the canonical token on the destination chain; sometimes even on the source chain as well. When a lopsided liquidity movement happens in the network, it makes sense to move liquidity from the liquidity-abundant chain to the liquidity-scarce chain to arbitrage the slippage. Arbitragers will have an incentive to rebalance the liquidity by sending funds from the liquidity-scarce chain to the liquidity-abundant chain.

Active LPs have stronger incentives due to that they don’t need to pay additional bridging fees to harvest the arbitrage gain. However, the rebalancing process for LP is quite complicated. As an example, if we denote the liquidity-scarce chain as S and liquidity-abundant chain as A, an LP would need to take the following steps:

- Remove liquidity from the AMM pool in S.

- Move the settlement token from S to A.

- Sell the settlement token to the canonical token on A at a premium

- Move the canonical token back to S.

- Purchase the settlement token on S.

- Add liquidity back into the AMM pool on S.

The above steps not only cause operational overhead but can also incur significant transaction and time costs. (e.g. in the case of the bonder model)

In cBridge 2.0, we argue that the bridging fabric (in our case the SGN) is specialized and can be highly optimized to have fundamentally lower costs when compared to on-chain smart contract operations. Therefore, in the cBridge 2.0, every LP’s liquidity in the system is explicitly tracked. Adding liquidity is super simple: just one transaction to add the canonical token into the liquidity pool contract and the SGN will record each LP’s liquidity amount in the SGN’s chain state. In essence, the SGN maintains a table of (chain_id, LP_address, token_type, balance) in its chain states.

When processing cross-chain transfer requests, the SGN will use the entire pool’s liquidity to calculate the slippage and pricing. (more on this in the next section) The SGN then treats LPs as “virtual cBridge nodes” and allocates the transfer request against the LP’s liquidity. A simplified conceptual understanding is that, for every transfer request, every destination chain’s LP’s balance is reduced proportionally to their available liquidity while their liquidity balance is increased on the source chain. Of course, various methods including random sampling and approximation algorithms are used to minimize state changes and hence costs, all while maintaining statistical fairness among LPs. More details are in our technical documentation.

The same arbitrager-based rebalance incentives applies, but this design additionally gives LPs the utmost flexibility when managing their liquidity. Every LP can clearly see exactly how their liquidity is distributed at any given time. This allows them to be fully informed when choosing to remove or add liquidity to any chains. This significantly simplifies the liquidity rebalancing process from 6 steps to 3 steps with no AMM swap costs:

- The LP removes liquidity from A directly in canonical tokens. Due to system-wide pricing difference, with this first step, the LP locks in the arbitrage gain.

- The LP moves the canonical tokens from A to S.

- The LP adds the canonical tokens on pools in S.

It is still possible for LPs to remove all liquidity from a single chain or any combination of specific chains. In cBridge 2.0, the way to do this is to trigger an internal cross-chain transfer and treat the LP as a user and transfer their liquidity to the desired chains and then remove the liquidity. Note that in this case, the LP will shoulder the system slippage for the cross-chain transfer. However, this is no different than directly swapping settlement tokens for the on-chain AMM-based solutions and in fact, has a lower cost.

What’s more, as described in this model, LPs use canonical token liquidity directly and therefore do not suffer from high impermanent loss. Plus, it provides the highest level of liquidity efficiency without any additional bonder liquidity lockup requirement.

Cross-chain bridge pricing to incentive balanced liquidity

In a cross-chain bridging system, liquidity for the same canonical token exists on multiple chains. As the demand for the same canonical token shifts for different chains, the inherent pricing between the same token on different chains also dynamically changes. This is based on the underlying costs to use those native bridges to move across different chains and the supply-demand balance of liquidity on those different chains.

It is very important for any bridging solution to be able to capture this inherent pricing shift with a properly designed bonding curve. This creates important incentives for LPs to leverage the “economies of scale” and rebalance liquidity across multiple chains to maintain a network with sufficient and balanced liquidity to process all of the user requests.

Continuing with our design principle of having an “intelligent fabric,” we build a Curve-inspired bonding curve pricing mechanism inside the SGN. When a user transfers tokens from one chain to another, the SGN will calculate the received token based on the available liquidity on the source and destination chains. In addition to the slippage and pricing, a flat fee is deducted from the transaction as payment to LPs.

Specifically, for any pair of chains, i and j, let xiand xjbe the balance on-chain i and chain j for a given token, respectively. Then the following invariant should always hold true when we calculate the pricing and slippage of token transfers between chain i and chain j:

- A is a per-chain-pair constant. For the same chain pair, A is the same for all tokens.

- D is a variable. The initial D can be obtained by solving a cubic equation against D given the initial liquidity on the two chains. After that, D should be iteratively updated based on liquidity status.

- wi and wj are the relative weights for the two chains, which is used to control the pricing asymmetry for the transfers. Note that the configuration of weights is per-chain-pair and should satisfy wi+wj=2.

The reason we have these weight parameters in the bonding curve is to capture the inherent asymmetry of certain chains. For example, transferring into optimistic rollups, such as Arbitrum and Optimism, is much simpler and lower cost than the 7-day delay of transferring out. Therefore, we can control the weight in the bonding curve to reflect this inherent difference created by each and every chain.

In the above red asymmetric curve with the blue symmetric reference line, we can see the curve creates more slippage for transfers from chain i to chain j when the imbalance happens. If wi=1, wj=1, it reduces to the Curve invariant.

It is also possible to treat an entire network of similar canonical liquidity as a single multi-variable bonding surface. More analysis is needed on the effects of these two different potential designs in terms of slippage effectiveness and cost of operation.

General cross-chain messaging

cBridge 2.0 creates an intelligent cross-chain fabric based on the SGN. This fabric can do more than just cross-chain asset transfers. Under the asset bridging functionality is actually a general cross-chain messaging framework where the SGN monitors certain events on the source chain and posts a PoS consensus secured notarization on the destination chain.

We will be gradually opening up this underlying functionality to developers as an SDK to build use cases for not only on-chain bridging, but for other use cases like cross-chain NFT, cross-chain DeFi aggregation, and more.

Fungible Token Bridging Models

Celer cBridge supports two fungible token bridging models:

-

xAsset, the canonical mapping bridge: This model is intended for a token that needs to be bridged from its original source chain, chain A, to a new chain, chain B, when it has not yet been deployed on chain B. Celer cBridge will create a mapped version of the token on chain B via a lock-and-mint model.

When a user transfers the token from chain A to chain B, the original tokens will be locked on chain A and an equal number of tokens will be minted in a 1:1 pegged ratio and sent to the user on chain B. Reversely, when a user transfers tokens from chain B to chain A, the pegged tokens will be burned on chain B and an equal number of tokens will be sent back to the user on chain A.

Please Note: In xAsset v2, in addition to bridging between the original source chain and the specific canonically mapped destination chain, tokens can also be bridged between different canonical mapping chains in a mint-and-burn method without routing back to the original chain. This way there is only one copy of the canonically mapped token on all of the supported canonical mapping chains.\ -

xLiquidity, the pool-based bridge. This model is intended for a token that has been deployed on different chains and does not conform to the cBridge standard. Liquidity pools will be created on the various chains to support bridging. When users transfer between these chains they will be depositing their tokens into the pool on the source chain and withdrawing a matching number of tokens from the pool on the destination chain based on a bridge rate generated by the StableSwap pricing curve.

xAsset Architecture

Suppose token T has been deployed on chain A but not yet on chain B. If bridging is needed for the token T between chain A and chain B, then two contracts need to be deployed:

- TokenVault contract. This contract is deployed on chain A. The user can deposit token T into this vault and receive pegged tokens on chain B, or withdraw token T from the vault if pegged tokens are burned on chain B.

- PeggedToken contract which mints or burns the pegged tokens on chain B.

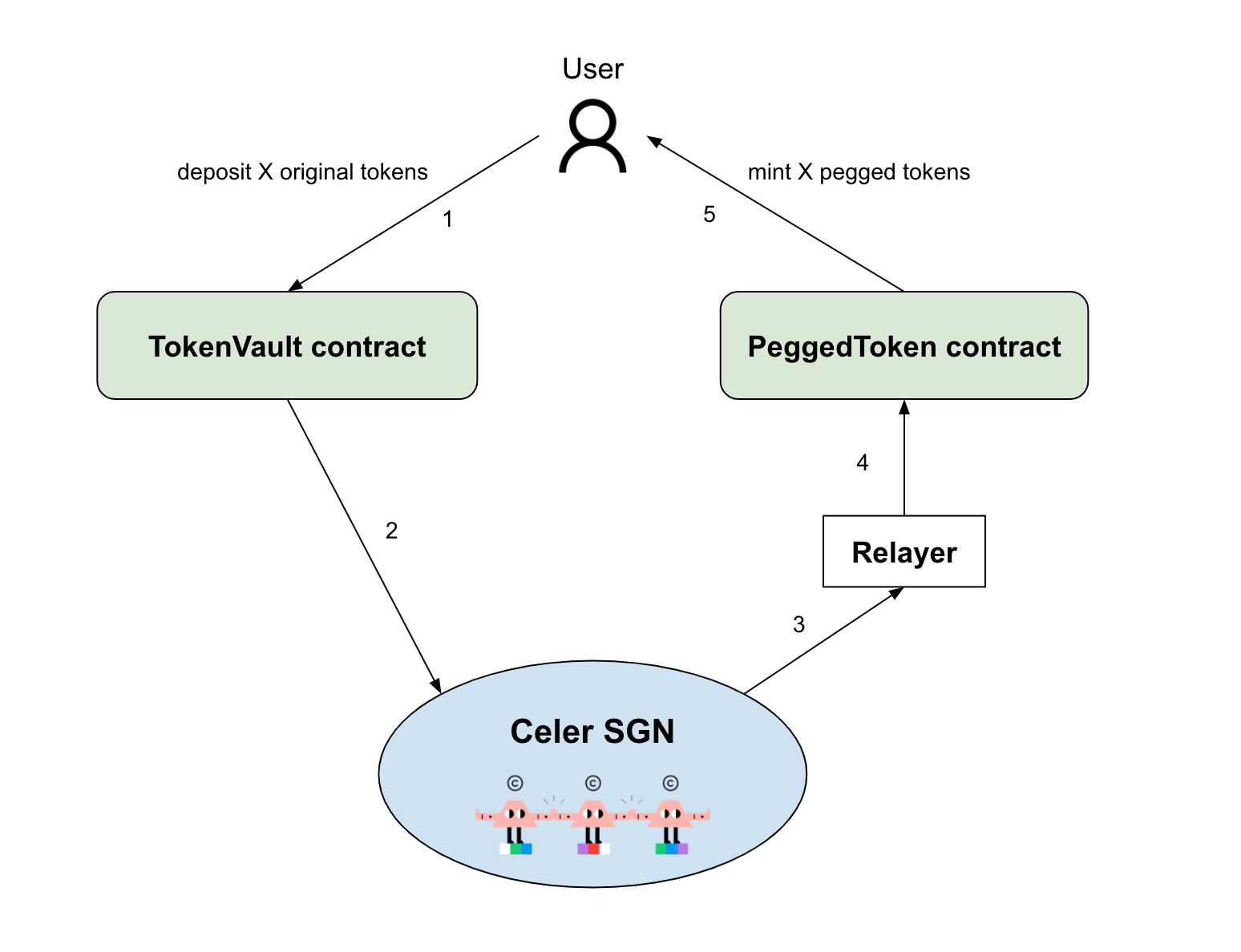

Transfer from chain A to chain B (Lock-and-Mint Flow)

The below figure illustrates the steps for bridging token T from chain A to chain B.

- User deposits X number of token T to the TokenVault contract on chain A.

- The Celer State Guardian Network (SGN) monitors the deposit event. Upon receiving the deposit event, the SGN generates a multisig that grants minting X pegged tokens on chain B.

- The relayer fetches the SGN’s multisig.

- On chain B, the relayer calls the PeggedToken contract with the multisig.

- The PeggedToken contract mints X tokens to the user on chain B.

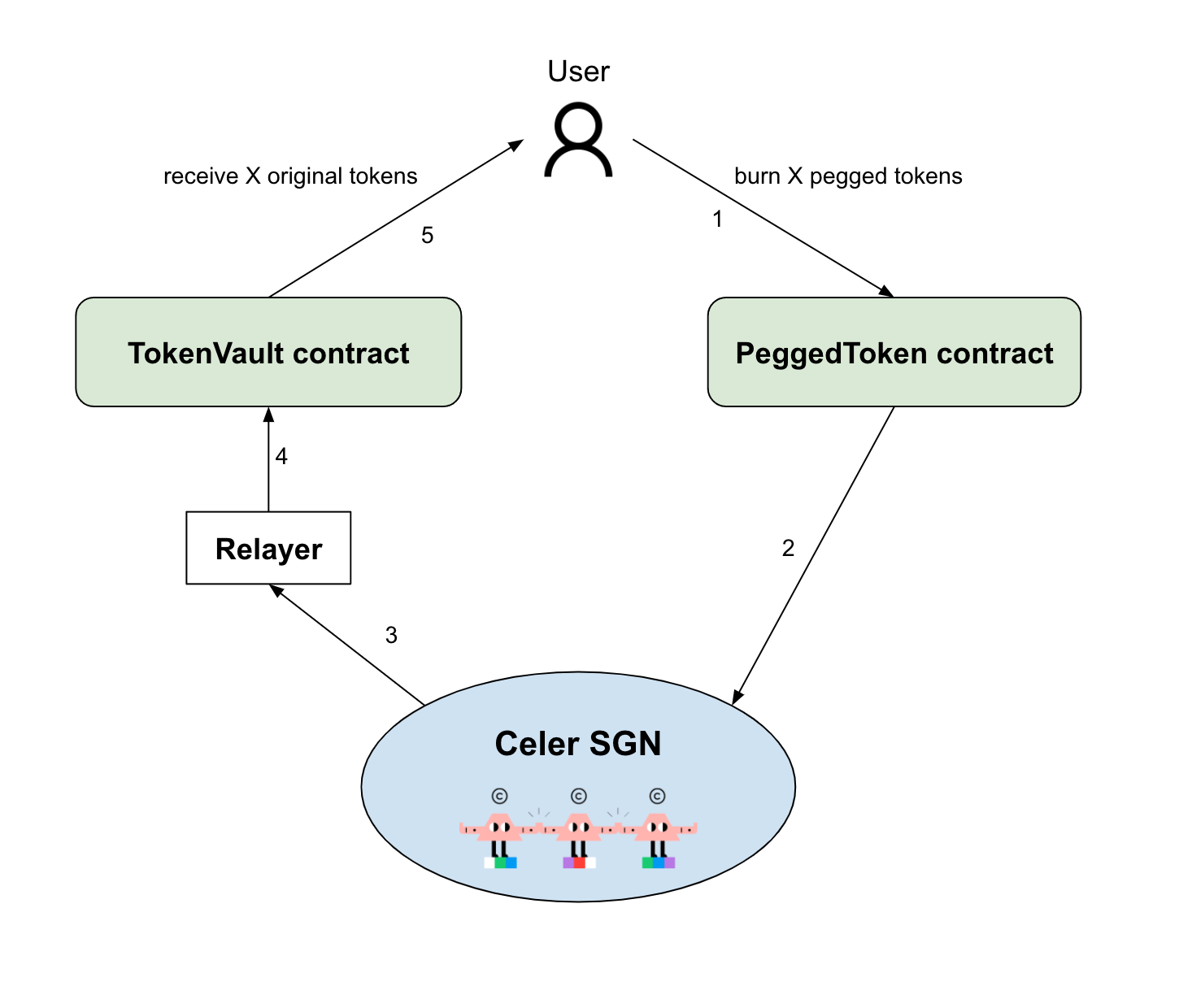

Transfer from chain B to chain A (Burn-and-Release Flow)

The below figure illustrates the steps for bridging the pegged tokens from chain B back to chain A.

- User calls PeggedToken contract to burn X pegged tokens on chain B.

- The Celer SGN monitors the burn event. Upon receiving the burn event, the SGN generates a multisig that grants the withdrawal from the TokenVault contract on chain A.

- The relayer fetches the SGN’s multisig.

- On chain A, the relayer calls the TokenVault contract with the multisig.

- The TokenVault contract sends back X number of token T to the user.

xAsset Fee Structure

The fee for a token bridged in the xAsset model is calculated as such:

Fee = Base Fee + Protocol Fee

The Base Fee is paid in the form of the tokens being transferred, and covers the destination-chain gas cost for sending the tokens to the user.

The Protocol Fee is proportional to the transfer amount, and is paid to State Guardian Network (SGN) validators and stakers in return for their services. The Protocol Fee ranges from 0% to 0.5% of the total transfer amount.

xLiquidity Fee Structure

The fee for a token bridged in the xLiquidity model is calculated as:

Fee = Base Fee + Protocol Fee

The Base Fee is paid in the form of the tokens being transferred, and covers the destination-chain gas cost for sending the tokens to the user.

The Protocol Fee is proportional to the transfer amount (after a bridge rate conversion), and is paid to cBridge liquidity providers and State Guardian Network (SGN) validators and stakers in return for their services. The Protocol Fee ranges from 0% to 0.5% of the total transfer amount.

cBridge Security

We’ve seen time and again news headlines about how different cross-chain bridges have been compromised and hacked, so it is important for our community, users, and developers to have a clear understanding of the security models of the Celer Inter-chain Message Framework (Celer IM). Different from existing interoperability solutions, Celer has two different security models, an optimistic-rollup inspired model and a L1-PoS-blockchain security model. Each of these comes with different delay and security assumptions tradeoffs that developers and users can freely choose from or set. The security model is highly flexible and even for a single application, developers can choose to build a hybrid model based on the “value” or “significance” of every cross-chain message.

In fact, Celer cBridge, an asset bridge built on top of Celer IM, supports a hybrid model so that the various tradeoffs can be dynamically chosen by the connecting chain based on the cross-chain transfer amount, token and source/destination chain.

Quick Recap of How Celer Inter-chain Message Works

Celer Network consists of smart contracts that are deployed on each chain. These contracts are all monitored and operated by the State Guardian Network (SGN), which serves as the “cross-chain message router”. The SGN is implemented as a Cosmos-based blockchain with $CELR PoS staking from a set of distributed validators. To send a message, bridge an asset, or invoke smart contract calls cross-chain, a user or a dApp will first send their intention as a message with a structured header and binary payload to a Message Bus smart contract on the source chain. Then the validators in the State Guardian Network blockchain, will monitor these events containing messages and first reach a consensus on the existence of such a message through the Cosmos consensus protocol and concurrently generate a stake-weighed multi-signature attestation. This attestation is then relayed to the destination via an Executor subscribing to the message. On the destination chain, the same Message Bus contract exists to check the validity of the message and triggers the corresponding logic associated with the message either immediately or after an Optimistic-rollup-style timeout. For a more detailed explanation with a step-by-step example walkthrough, please refer to this Celer IM documentation and the Celer IM introduction blog.

Blockchain-level Security Powered by Cosmos Consensus

By default, inter-chain dApps rely on the security of the State Guardian Network (a Cosmos Chain) to process messages routed from another chain without delay. The SGN offers L1-blockchain level security just like Cosmos or Polygon with it being a Proof-of-Stake (PoS) blockchain built on Tendermint with CELR as the staking asset. If one minority guardian acts maliciously, its staked CELR will be slashed by the consensus protocol and the offending guardian will be evicted from the validator group. There are also block rewards, to act as economic incentives, when the participating guardians follow the protocol.

This level of economic security grows with the staked CELR’s value and is simply not available in simple Multi-signature or MPC/PoA-based solutions. In MPC/PoA-based solutions, there is really no economic recourse or punishment built into the protocol for validators that act maliciously.

This security model is the most “lightweight” option, because it offers the best user experience with the lowest level of latency and cost to the users. There are numerous PoS blockchains using the exact same consensus protocol that the Celer SGN uses and are securing hundreds of billions in assets. Therefore, in most cases, this default security model is recommended.

Optimistic-rollup-style Security Model

So, what happens if more than two thirds (in staked value) of the validators behave maliciously in the State Guardian Network? Although this is highly unlikely given the economical security and distributed nature of the validators in Celer Network, Celer does have a second security model, inspired by the Optimistic Rollup design, that works securely even under this worst-case scenario.

Instead of instantly processing a message routed by the SGN, a two-phase commit-confirm pattern is used to process any inter-chain message. Before any application consumes the message, the message has to be “committed” to the blockchain by SGN into a “quarantine zone” for a period of time. Only after the delay has passed, can this message be “confirmed” and pushed to the final destination application.

During this delay buffer, a dApp can run an App Guardian service to double-validate the message on the source chain and check the authenticity of the message committed in the quarantine zone. If the App Guardian detects any inconsistency, it can prevent the message from being processed before the time buffer expires. For application developers who cannot run an App Guardian themselves, they can commission the SGN nodes to undertake the task of an App Guardian. In that case, the security model is strengthened to a trust-any model for the SGN. Therefore, even under the worst-case scenario of the SGN consensus failure, inter-chain dApps built on top of Celer’s construct will still maintain safety property without any concern.

Hybrid Model is Available

dApp developers and blockchains can choose to mix-match the above two models based on the “value” or “significance” of certain transactions. In fact, Celer cBridge, built on top of Celer IM, already has this hybrid model built-in based on the amount of transfer. We will also release sample applications where developers can trigger Celer IM in the optimistic-rollup-style security model based on different message types.

Other Considerations on Implementation

Except for the above architecture design to fundamentally enhance security, it is also very important to have implementation and operational best practices to ensure a safe operation of the asset bridge. These considerations includes 24*7 automated system invariant monitoring, rate limiting on bridging volume and more.

Smart contract audits

Celer cBridge has been extensively audited.

Open-source code: https://github.com/celer-network/sgn-v2-contracts/

CertiK reports: liquidity bridge

PeckShield Report: liquidity bridge, canonical bridge

SlowMist Report: liquidity bridge, canonical bridge

$2M Bug Bounty

In addition to the security audits, Celer cBridge has a standing $2M bug bounty in ImmuneFi

Cross-chain Transfer

In this tutorial, we will guide you through the process for making a cross-chain transfer.

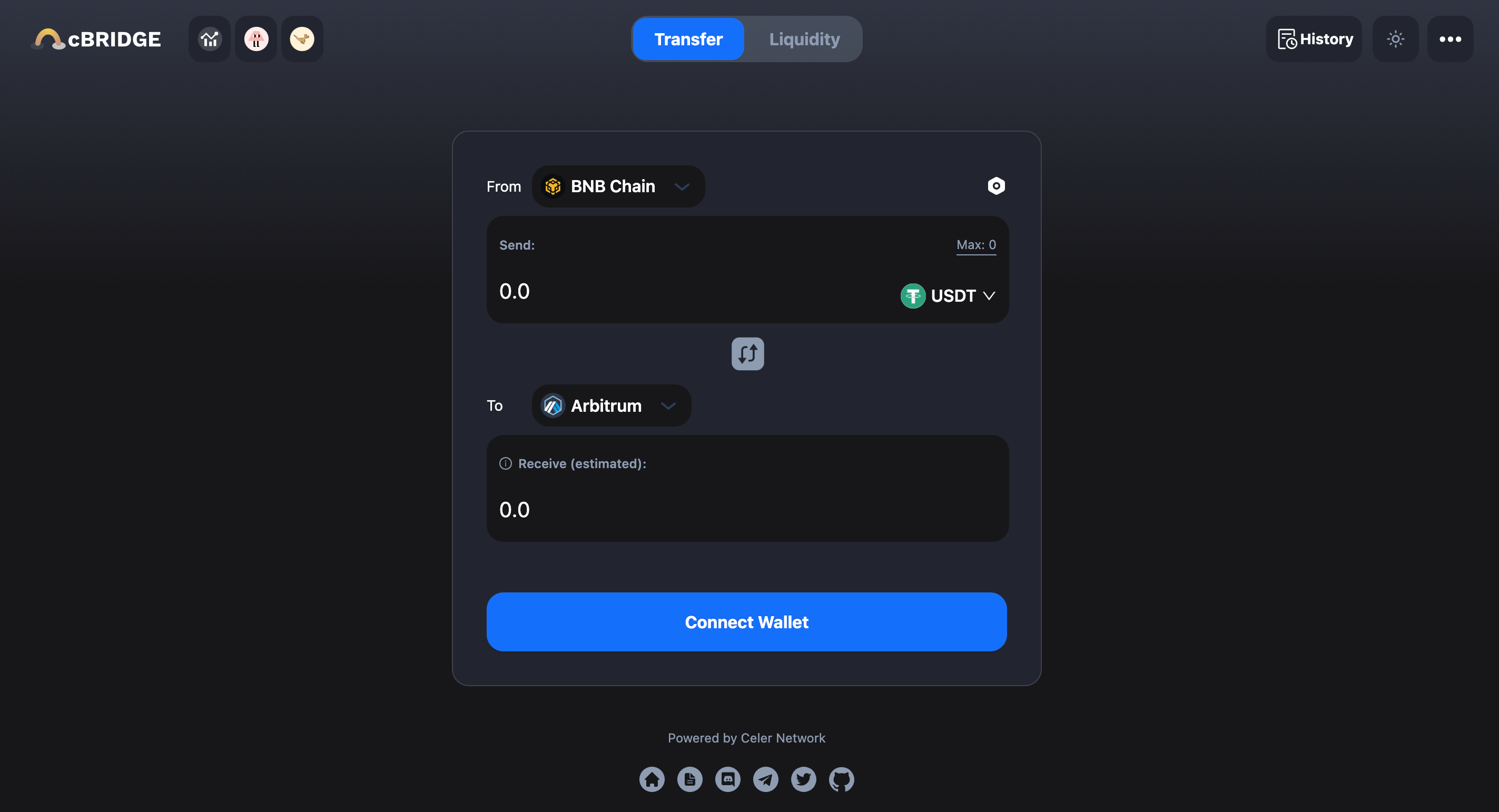

Connect Your Wallet

Before you explore the different features offered by cBridge, you will need to connect your wallet.

Click “Connect Wallet”, and you will be prompted to select a wallet. (This tutorial will take MetaMask as an example).

.png)

Select MetaMask, and you should now see your wallet address and your current chain in the top right corner of the page.

(1).png)

Transfer Tokens Across Chains

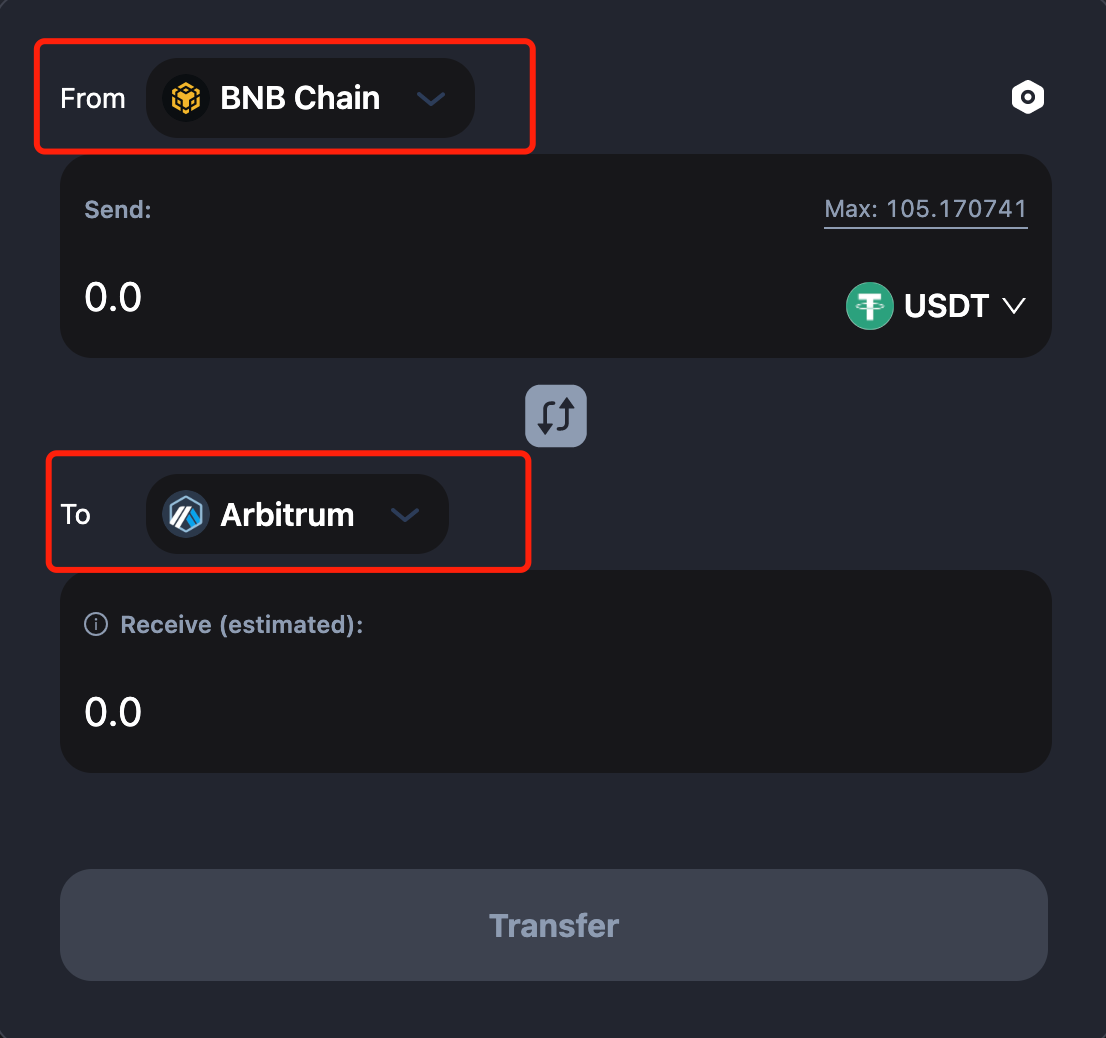

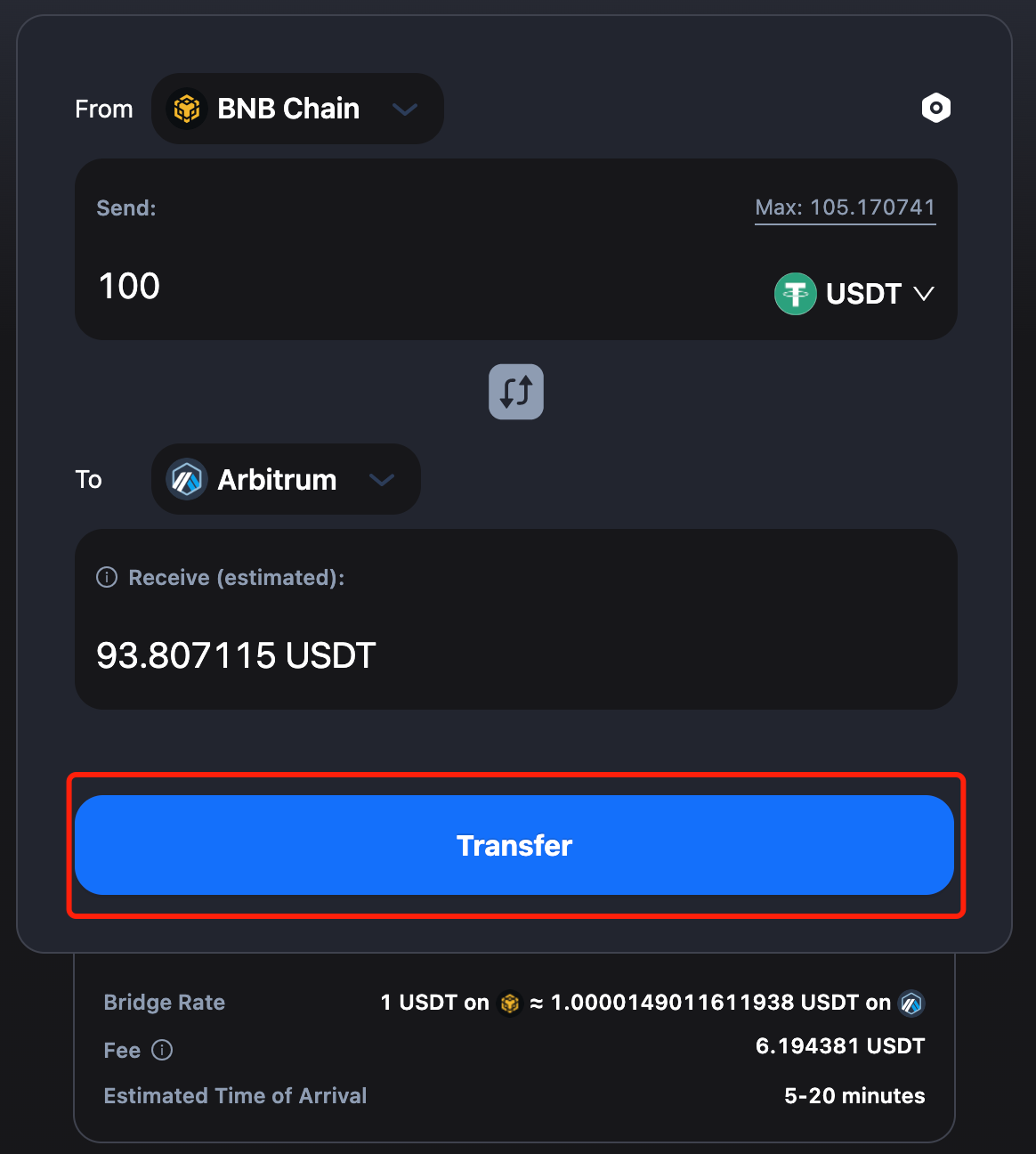

Let’s say, you want to transfer 100 USDT from the BNB Chain to Arbitrum. The steps are made simple in cBridge:

- Select “BNB Chain” in the dropbox next to “From” and “Arbitrum” in the dropbox next to “To”.

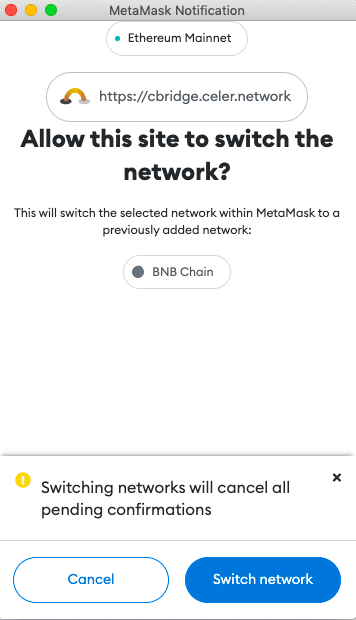

You will be prompted to switch your wallet to BNB Chain if it’s not already connected.

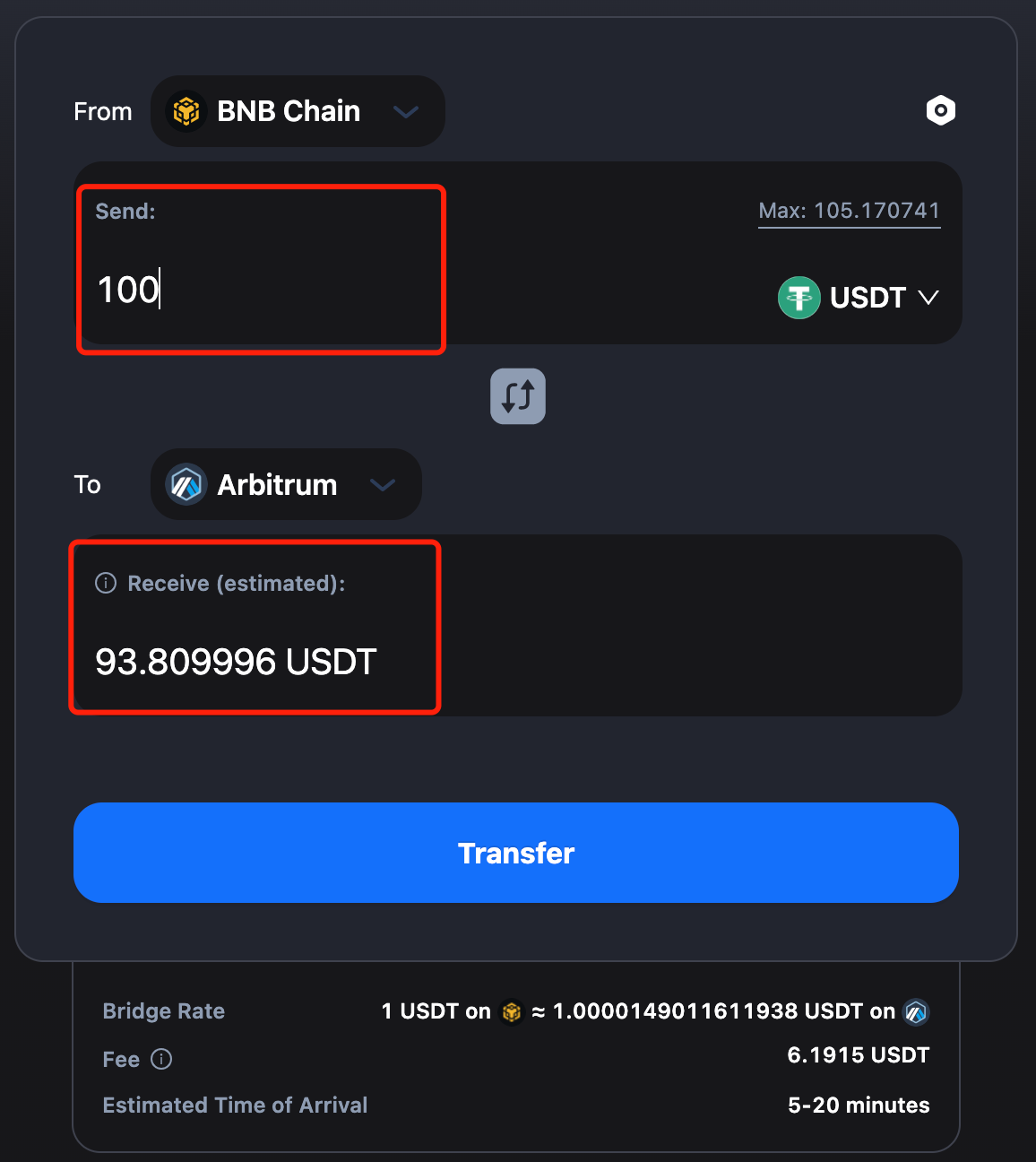

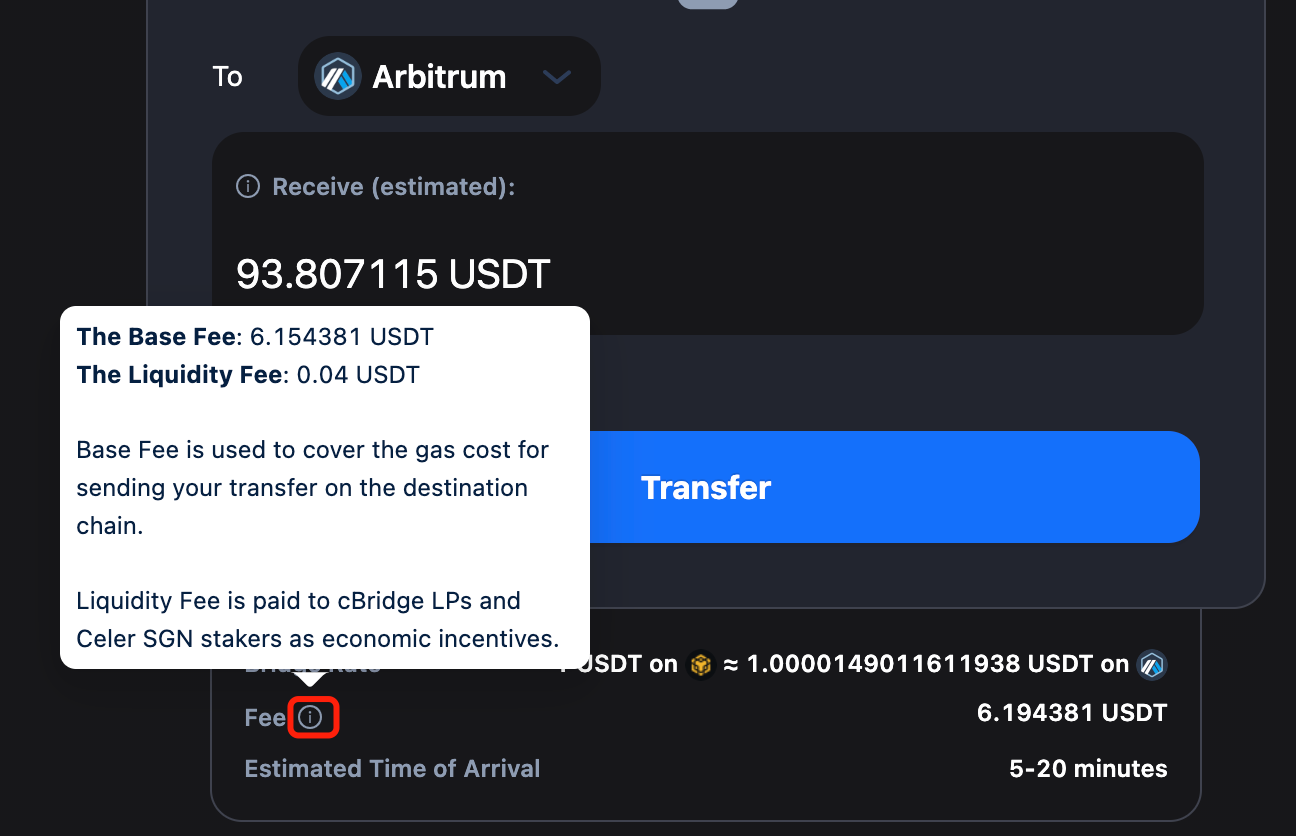

2. Enter the amount you want to send under “Send”. You should see the estimated amount you will receive under “Receive(estimated)”.

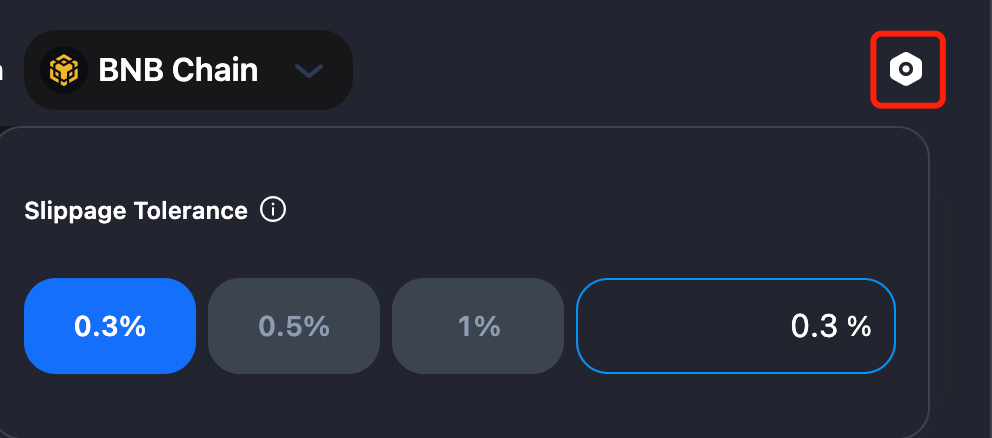

3. You can adjust the Slippage Tolerance of the transfer. Your transfer may fail with a very low Slippage Tolerance. It’s usually between 0.1% and 0.5%.

Note that there will be a difference between the amount you send and the amount you receive, which is determined by the Bridge Rate and fees. For the exact definition of each item in the transaction, check the tooltips next to each of the terms.

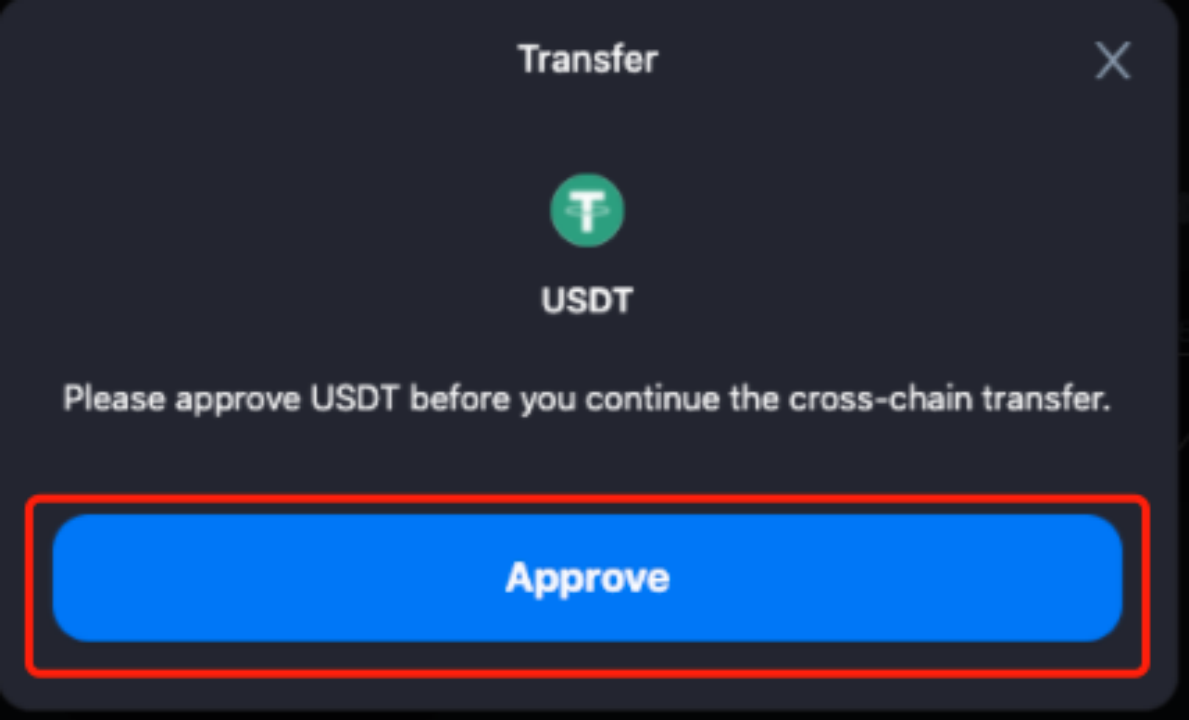

4. Review your transfer details and click “Transfer” You will receive a popup for USDT approval.

Click “Approve” and you will be prompted with a USDT spend confirmation on MetaMask. Click “Confirm”, and your “Approve” transaction will be finalized in a few minutes.

.png)

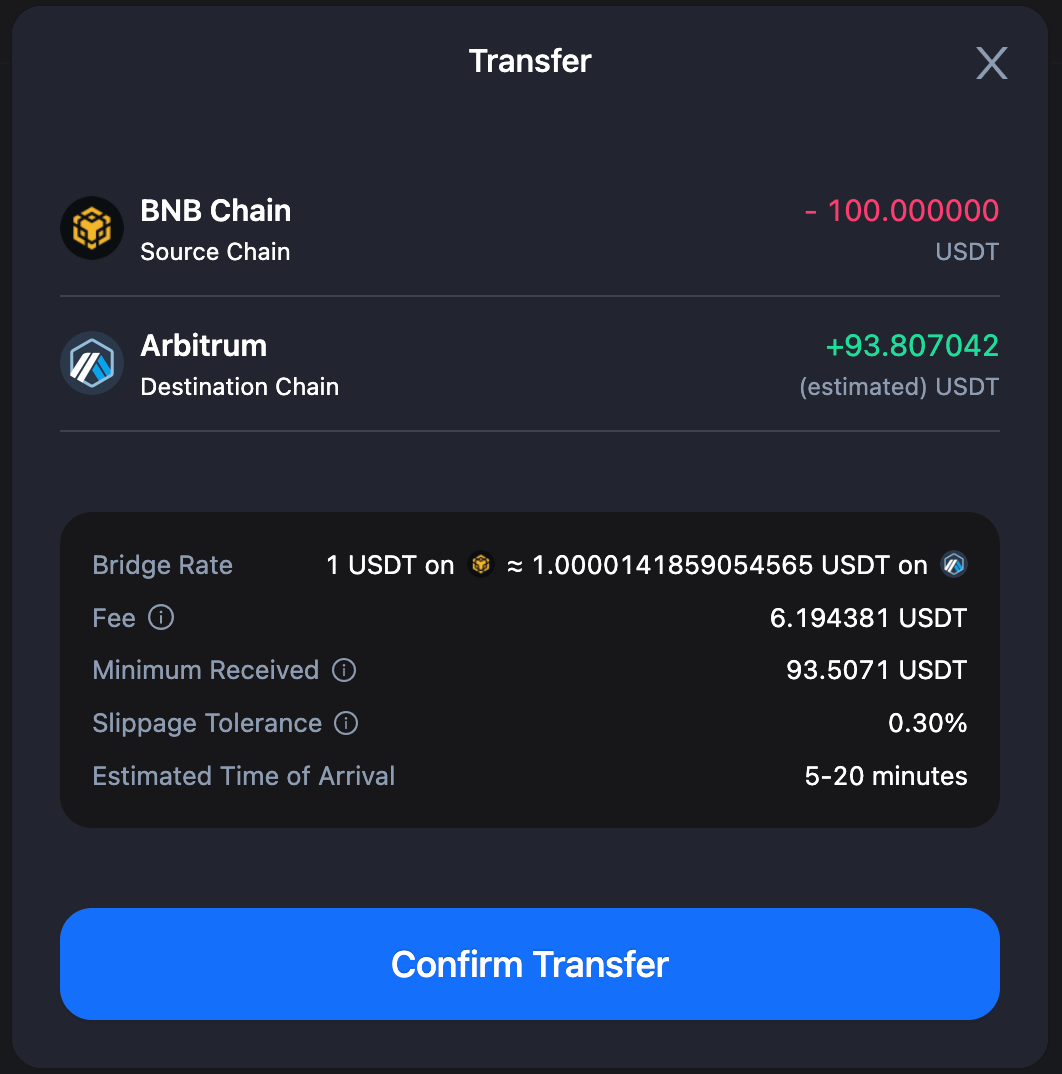

5. After USDT is approved, you will be prompted on cBridge to confirm the cross-chain transfer. Review the transfer details and click “Confirm Transfer”. You will be prompted to confirm the transaction on MetaMask. Click “Confirm”.

.png)

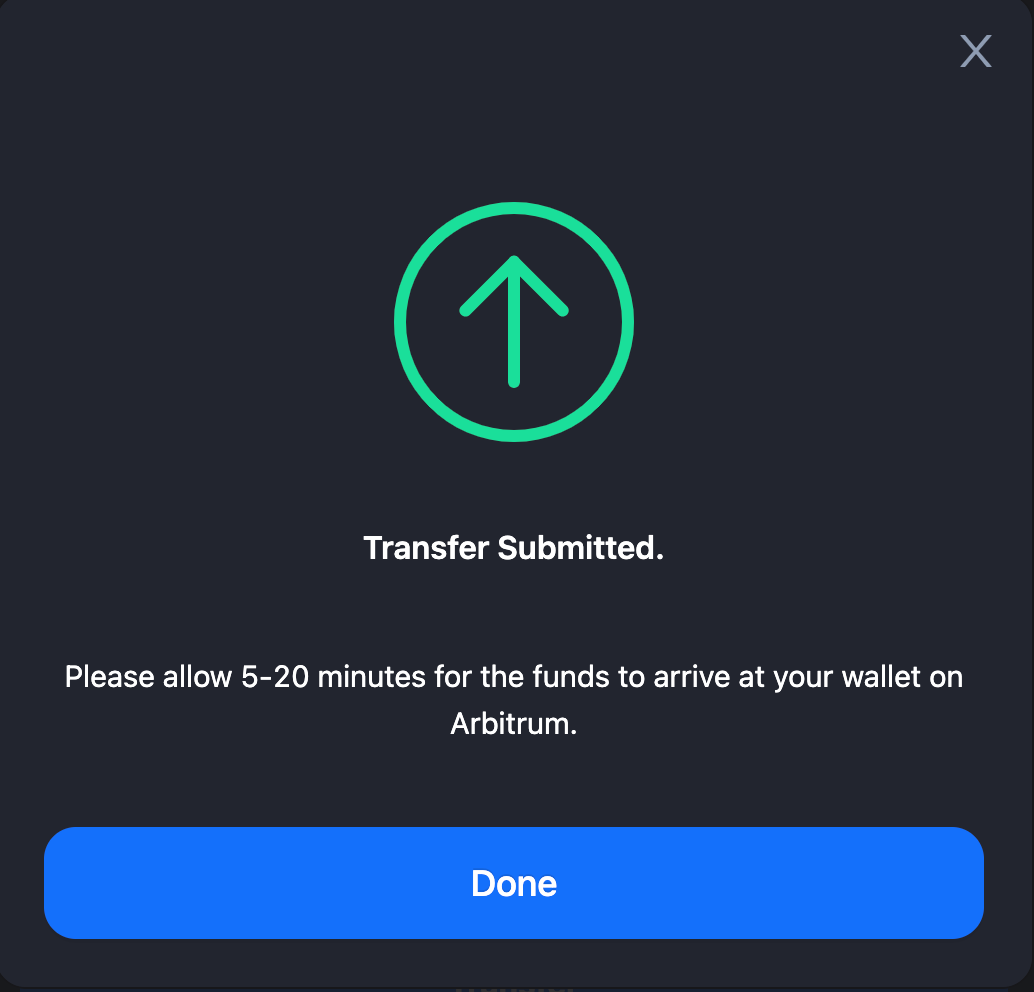

6. After confirming on MetaMask, you will receive a Transfer Submitted popup.

You can also check the transaction status in “Pending” in the top right corner of the page.

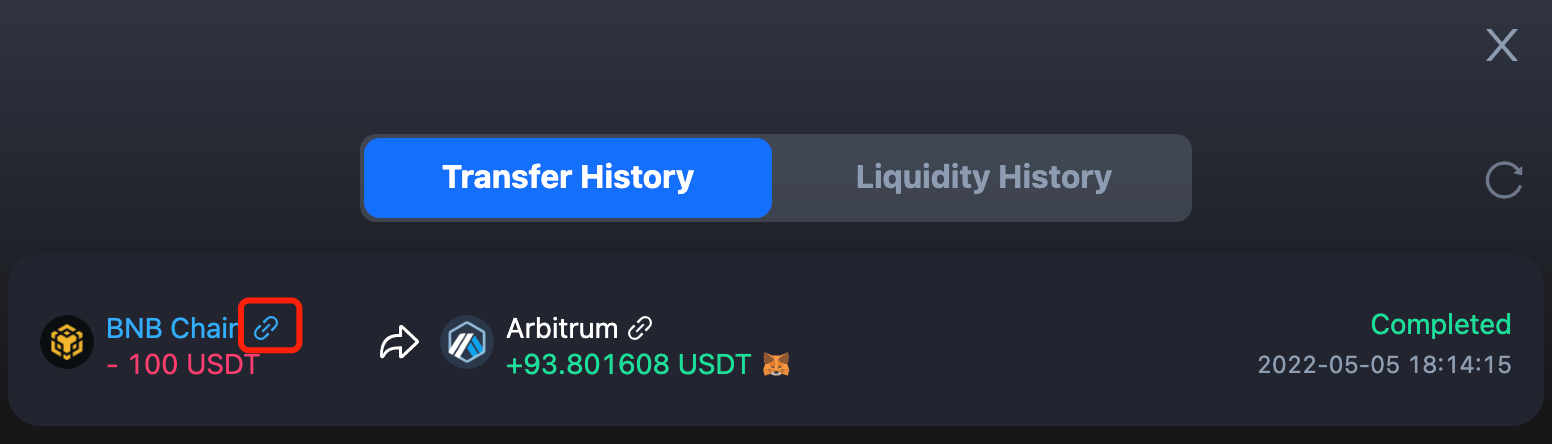

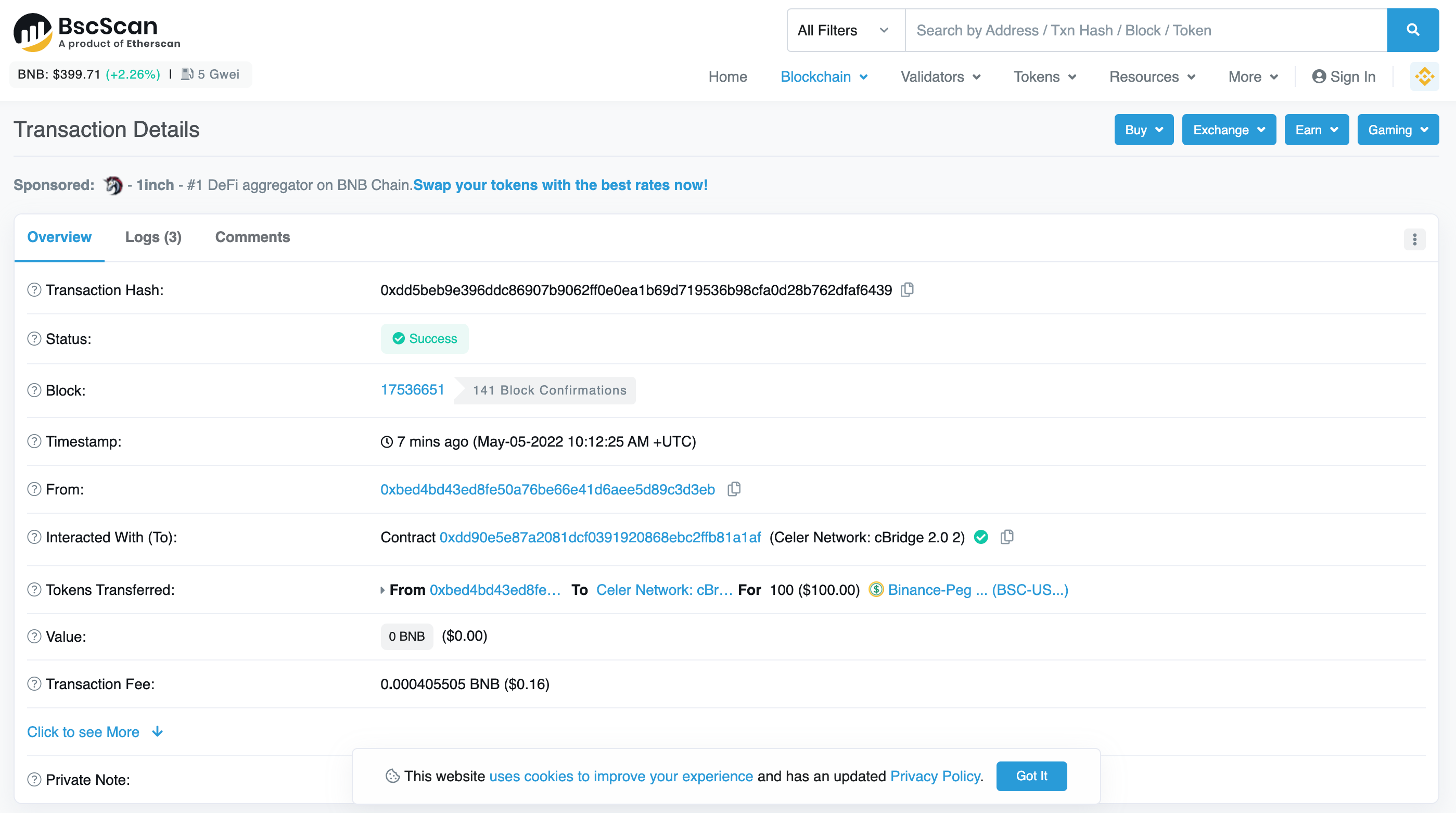

7. It takes some extra time for the funds to arrive at your wallet on the destination chain. On MetaMask, you can switch to the destination chain, which in our case is Arbitrum, to check if you have received the funds.

Alternatively, you can also view your transaction status via the BNB Smart Chain Explorer, which can be accessed via a link in your transaction history.

8. In cases where your transfer fails due to insufficient liquidity on the destination chain or an unfavorable slippage tolerance, you will receive a popup explaining the reason for the failure. You can click “Request Refund” in the transfer history.

And voila! Congratulations on completing your first cross-chain transfer on cBridge !

LP Guide

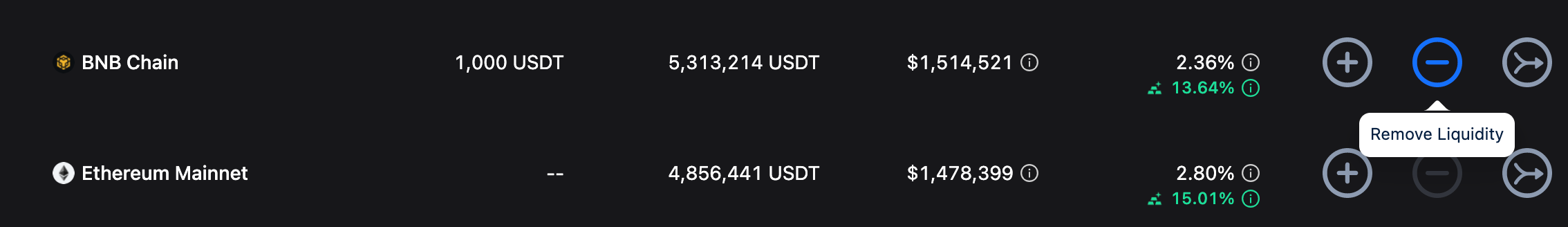

In this LP Guide part, we will walk you through 2 main features: Provide Liquidity and remove Liquidity.

Note: In the current version, using a smart contract to remove liquidity is not supported on the frontend UI. Unless you are an expert, PLEASE DON’T USE smart contract wallet to provide liquidity. For expert, please refer to this section.

Provide Liquidity

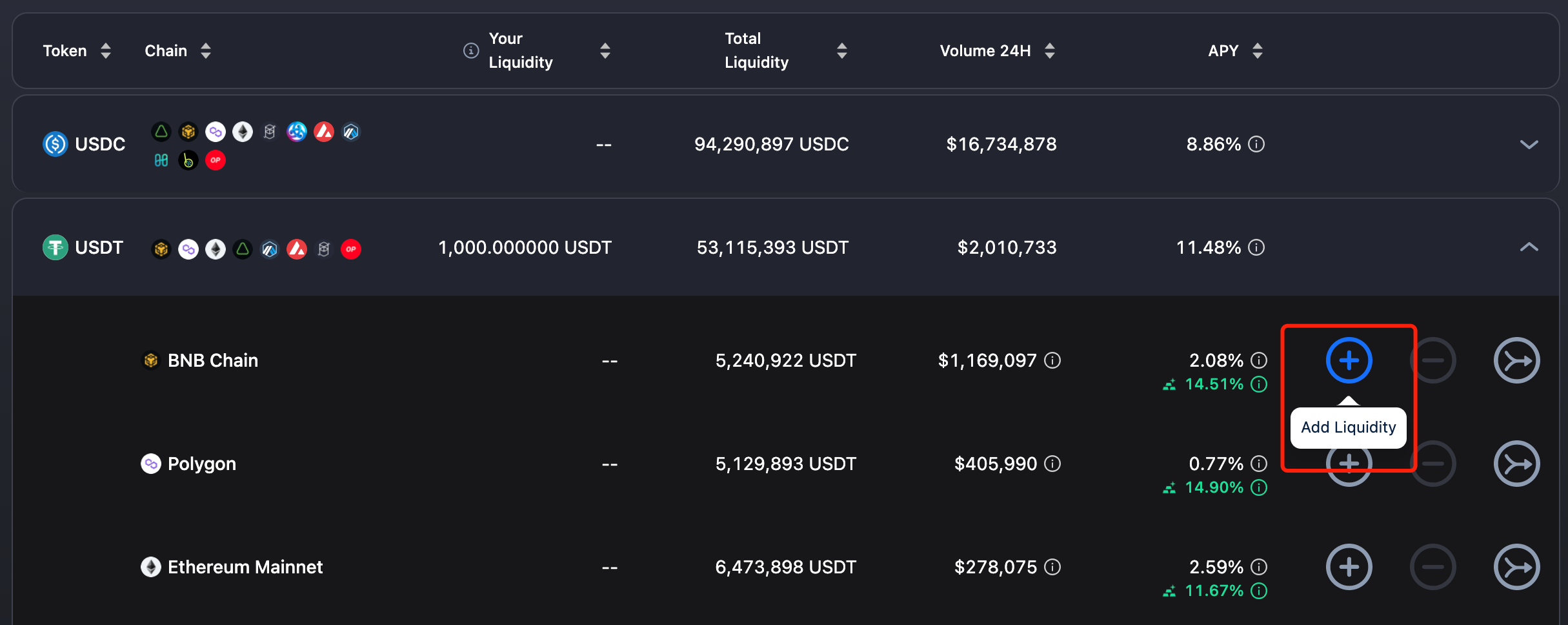

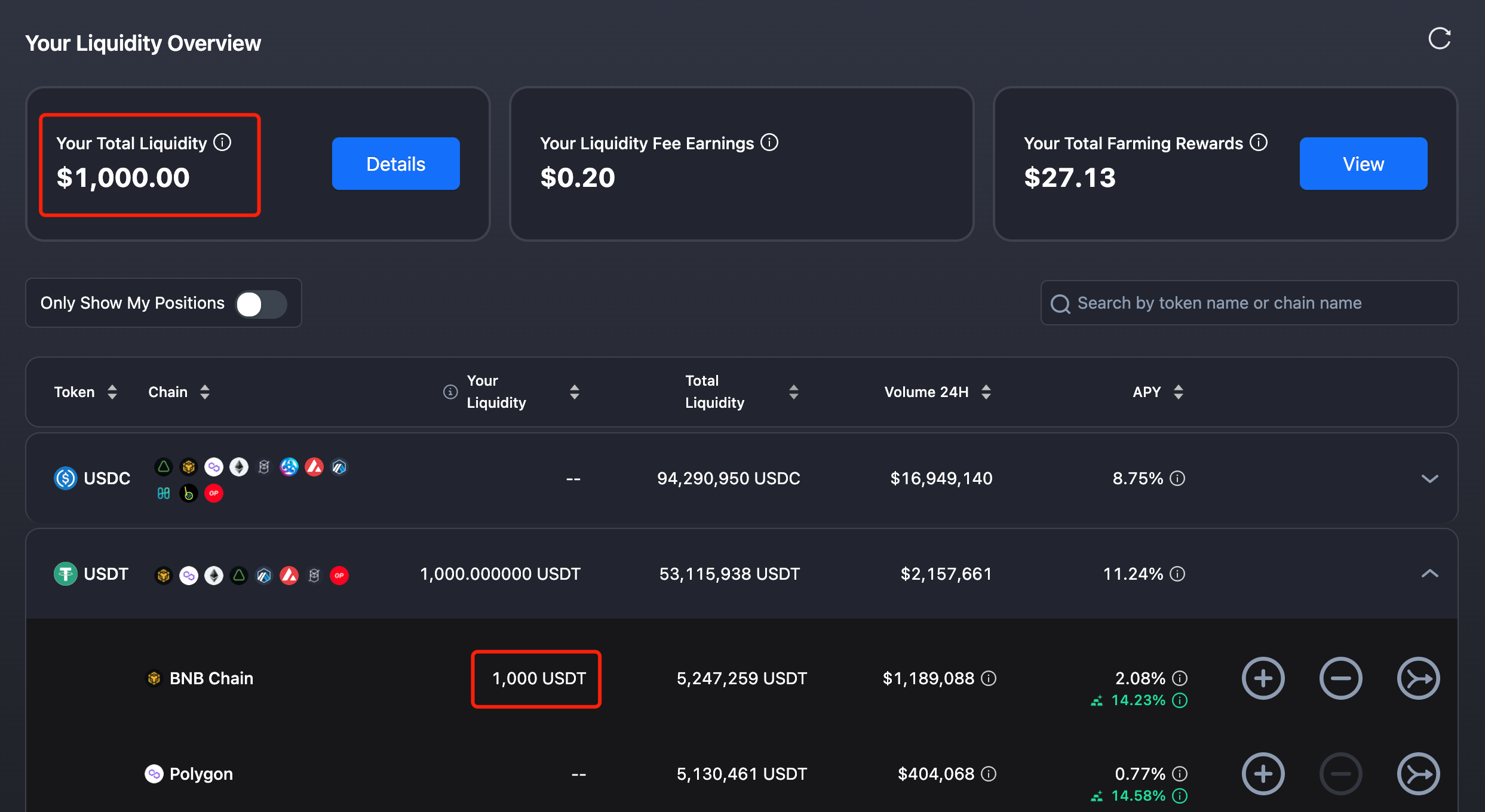

Let’s say, you want to supply liquidity for USDT on BNB Chain to earn transaction fees and farming rewards. The steps are simple.

1. First, click the “+” button on the liquidity pool of your interest. Switch your wallet to the network you want to provide liquidity for.

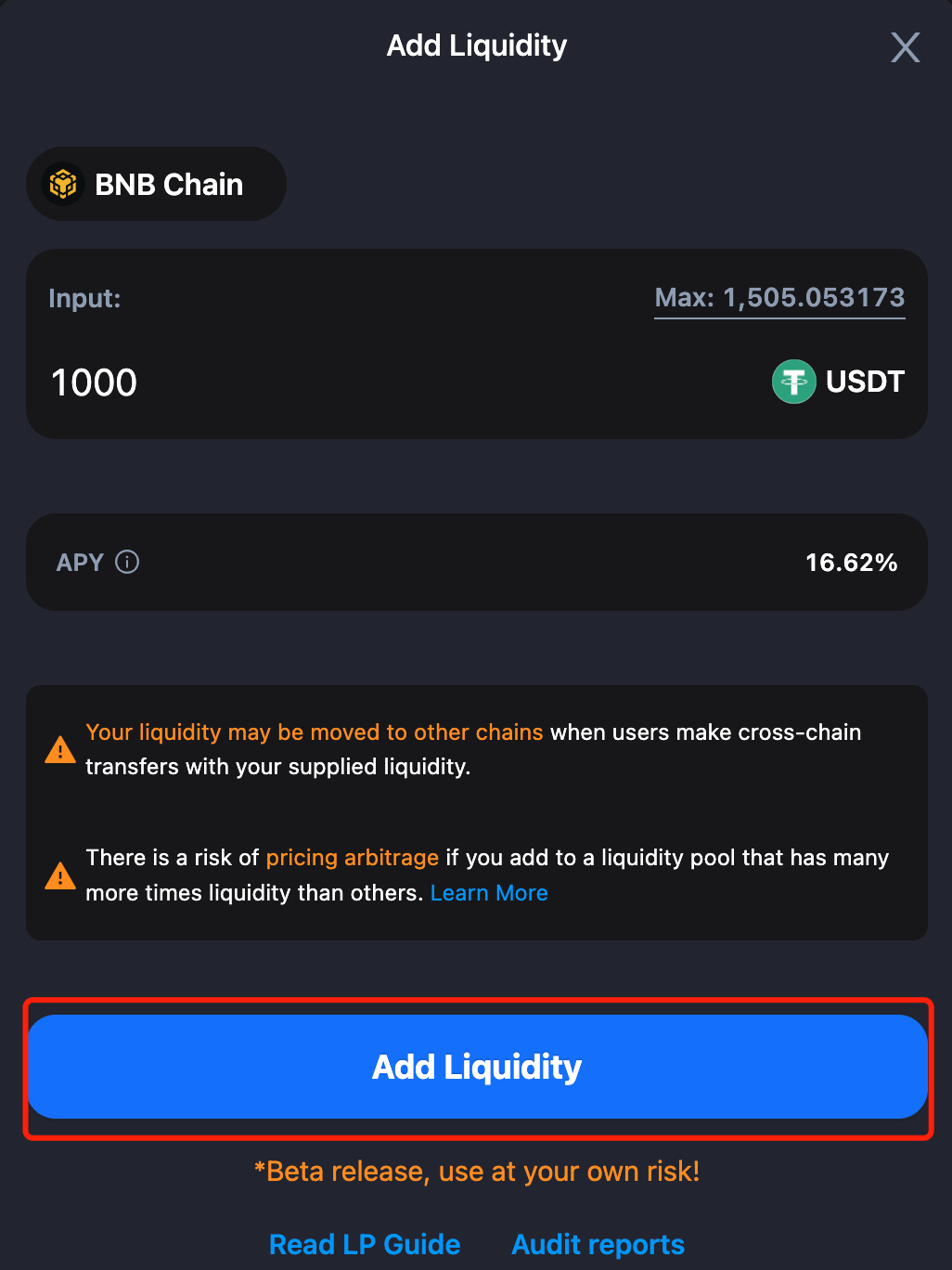

2. On the popup prompted, enter the amount you want to supply to the pool. Click “Add Liquidity”.

Note that your liquidity may be moved to other chains as users make cross-chain transfers with your supplied liquidity. There might also be Impermanent Loss if there is a significant liquidity imbalance between chains. We always recommend adding liquidity to balance out multiple pools while you earn fees and rewards.

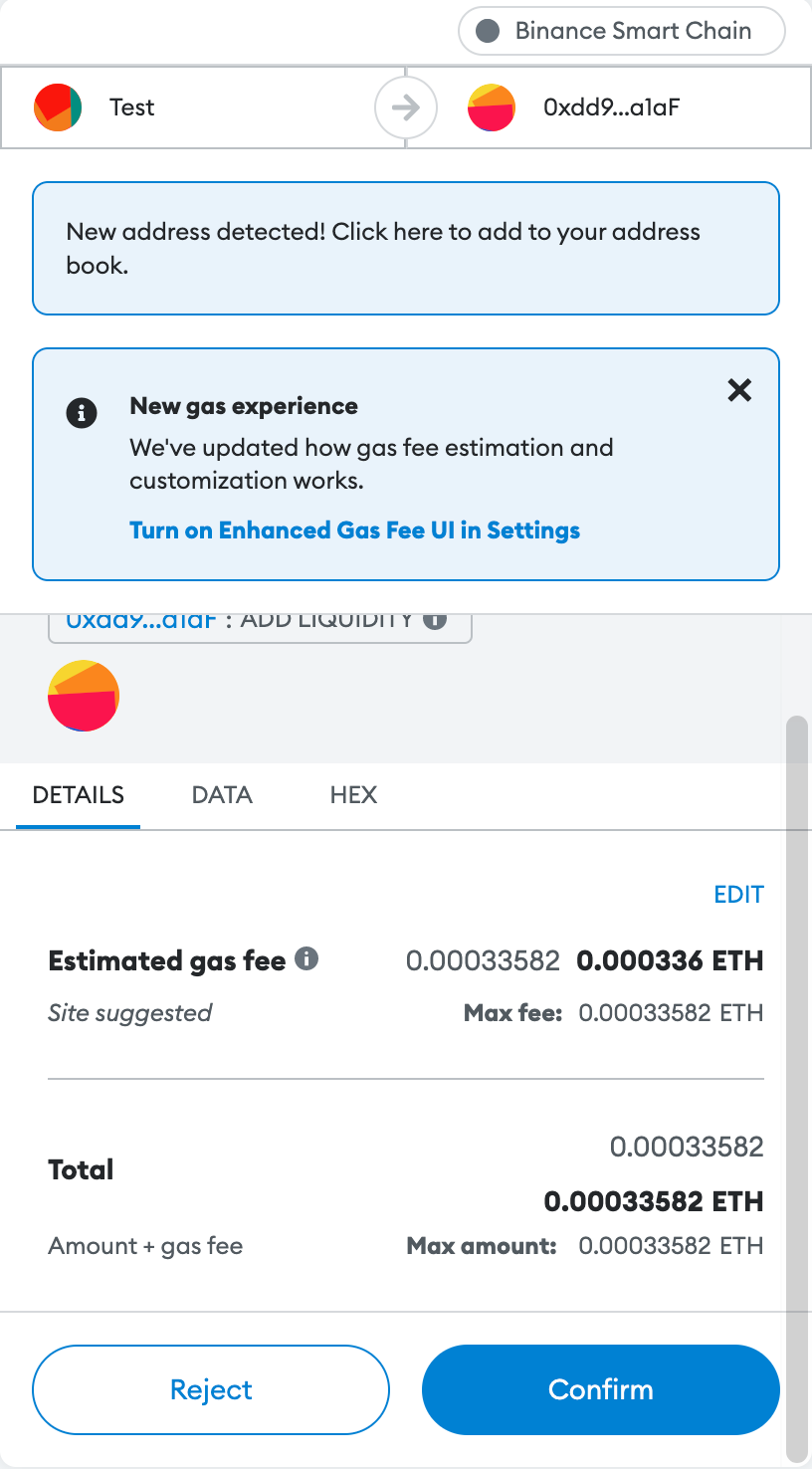

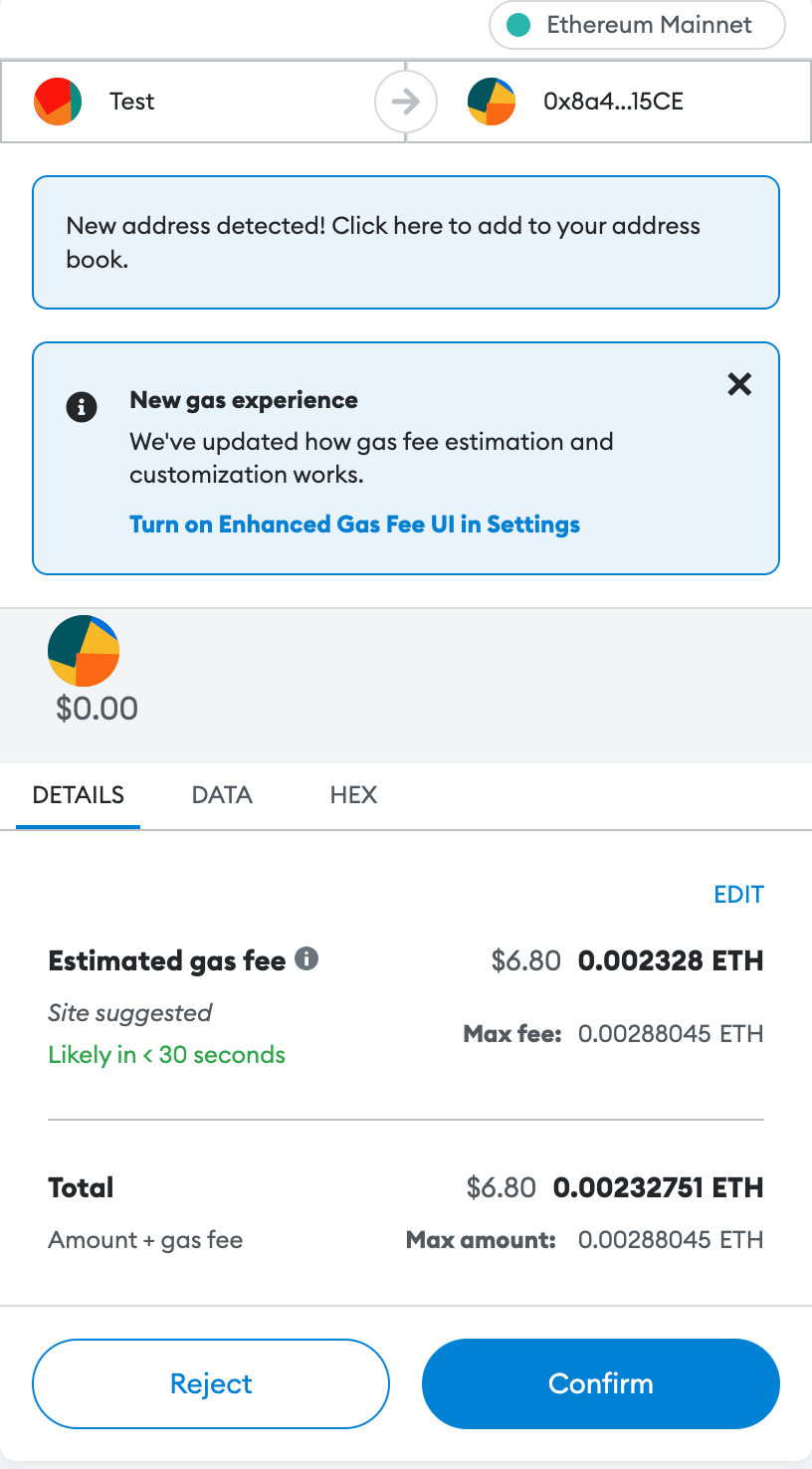

3. You will then be prompted to confirm the transaction on MetaMask. Click “Confirm”.

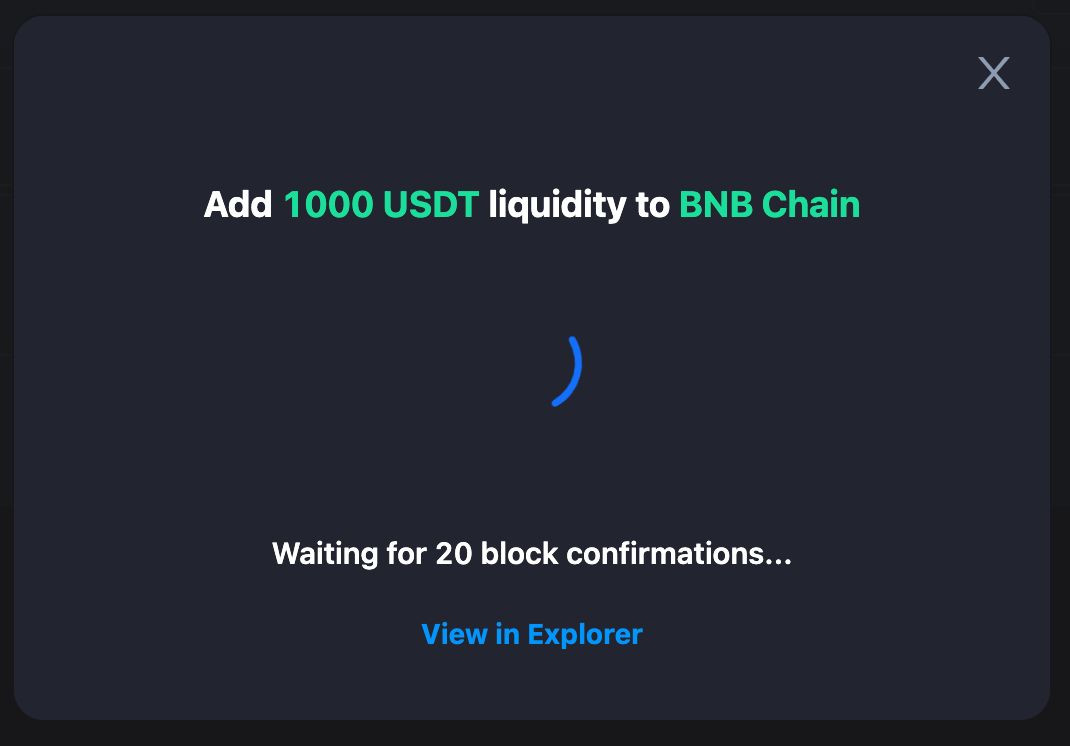

4. After confirming on MetaMask, the transaction status will update on cBridge and show you the progress of the transaction. The transaction will first be validated on the blockchain, and then by the Celer SGN (State Guardian Network).

5. While the transaction is being confirmed, you can close the popup. You can check the transaction status in “Pending” on the top right corner of the page.

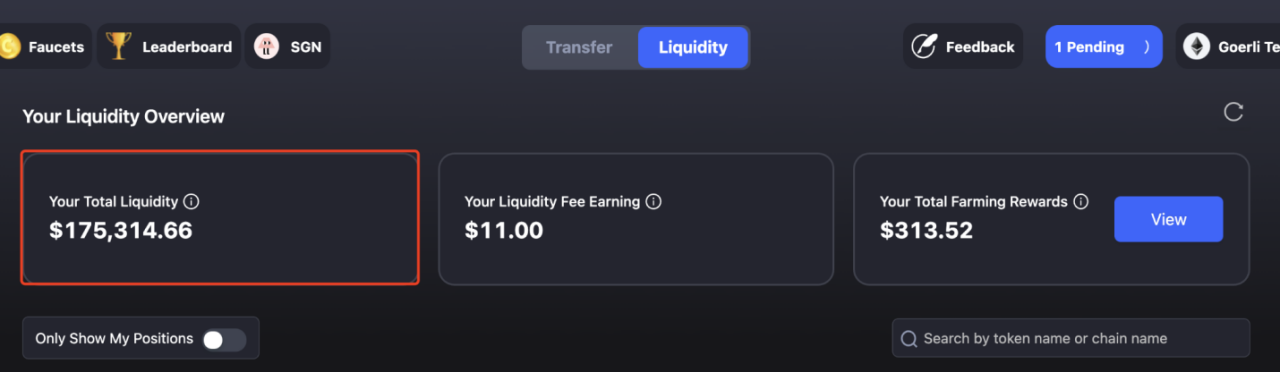

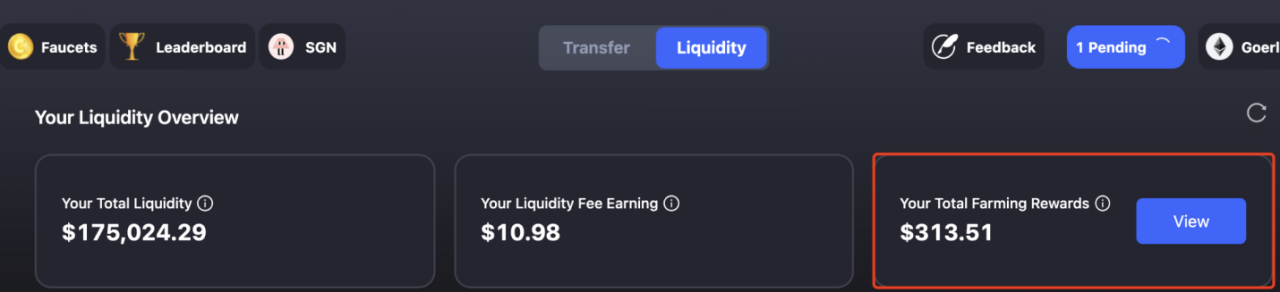

6. When the transaction is complete, you can check your liquidity summary, positions, earnings and rewards in “Your Liquidity Overview”.

Earn Transaction Fees & Farming Rewards

Note: Screenshots used in this tutorial are from cBridge testnet.

Supplying liquidity in cBridge comes with the benefits of liquidity fee earnings and farming rewards.

When you supply liquidity, you earn a percentage of the transaction fees from people who use your liquidity to bridge funds across chains, and your liquidity fee earnings are automatically added to your total liquidity.

Some liquidity pools may have active farming sessions, where you gain additional farming rewards in CELR along with your liquidity fee earnings. Farming rewards need to be claimed manually.

1. To claim farming rewards, click “View”, and then “Unlock to claim”.

2. You will then see a popup showing the unlocking progress.

3. Once rewards are unlocked, you will see a popup update asking if you want to claim farming rewards at the moment. Clicking “Claim Farming Rewards” will prompt you to confirm the transaction on MetaMask.

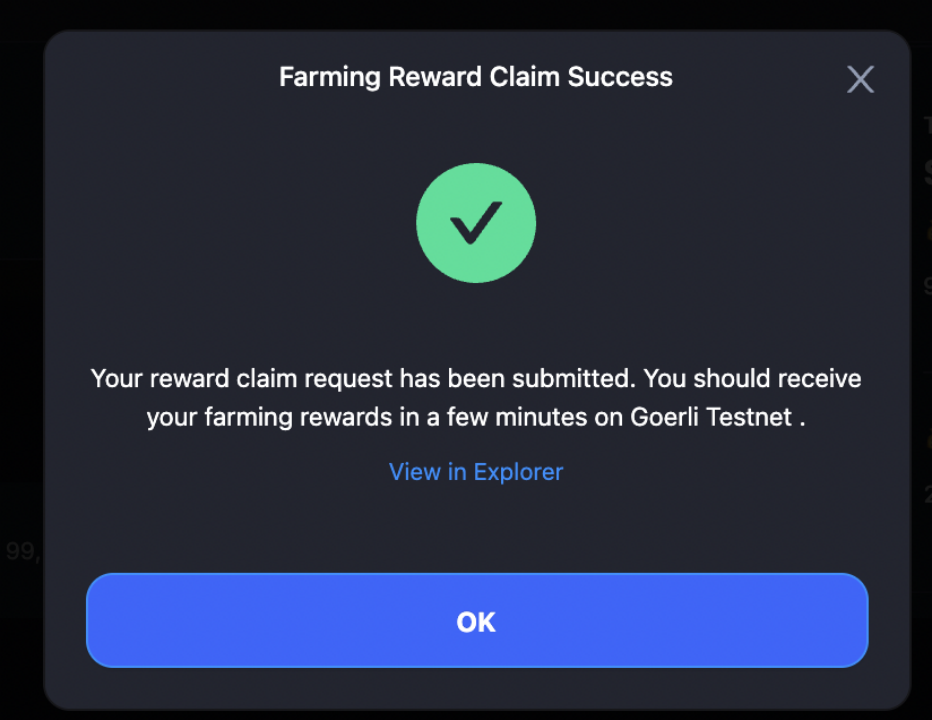

4. When the transaction is complete, a “Success” popup update will show up on cBridge.

5. Alternatively, you can choose to wait for your farming rewards to accumulate and claim them later. You can always go to “Your Total Farming Rewards” to check your reward positions and claim rewards.

6. All your farming rewards are accumulated in one single pool, so there is no need to switch between multiple chains to claim your rewards.

Remove Liquidity

You can easily remove your liquidity from the SGN at any time.

- To remove your liquidity, click the “-” button on the Liquidity interface.

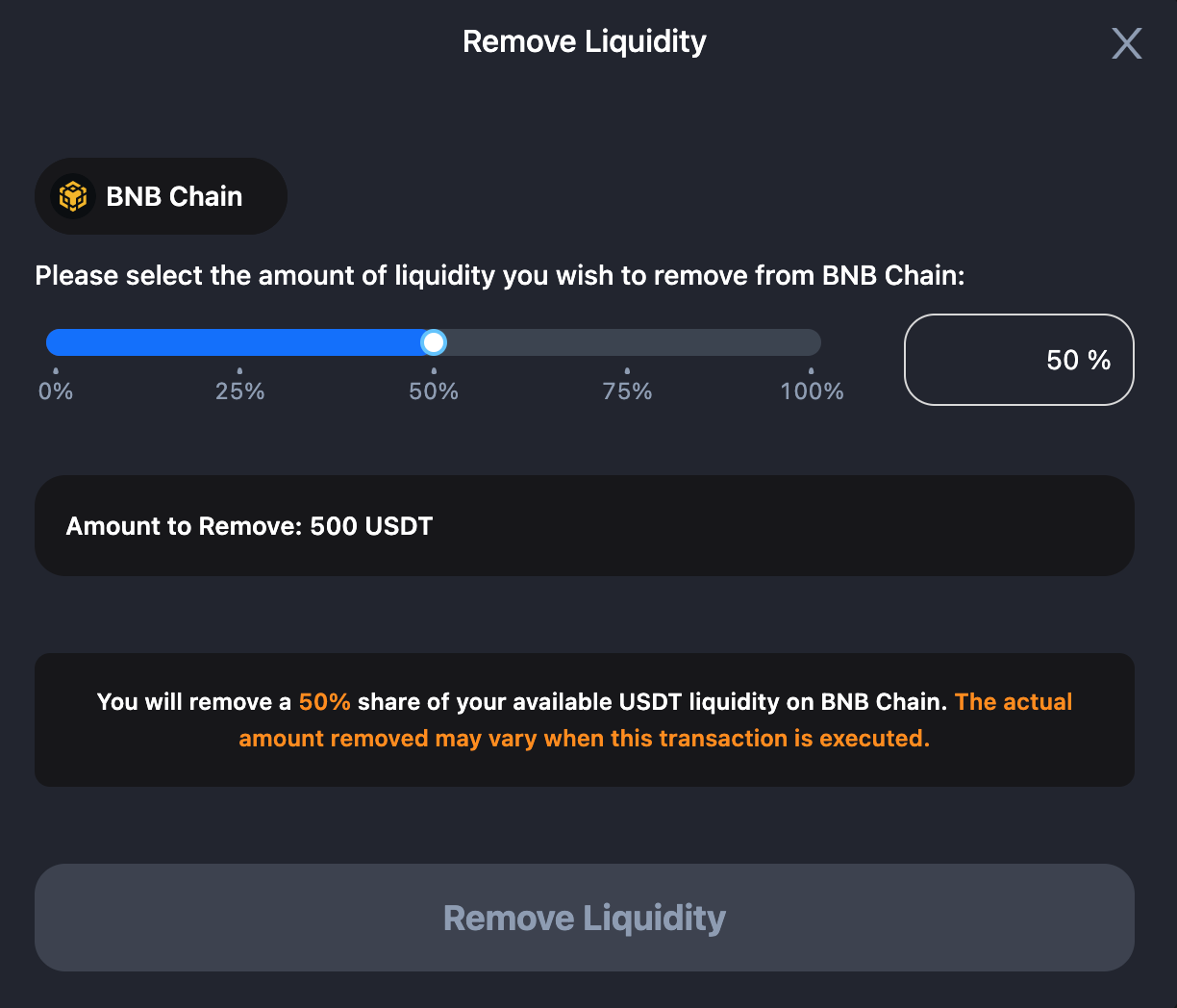

2. Choose the percentage of liquidity you wish to remove with the slider bar, or enter a specific percentage.

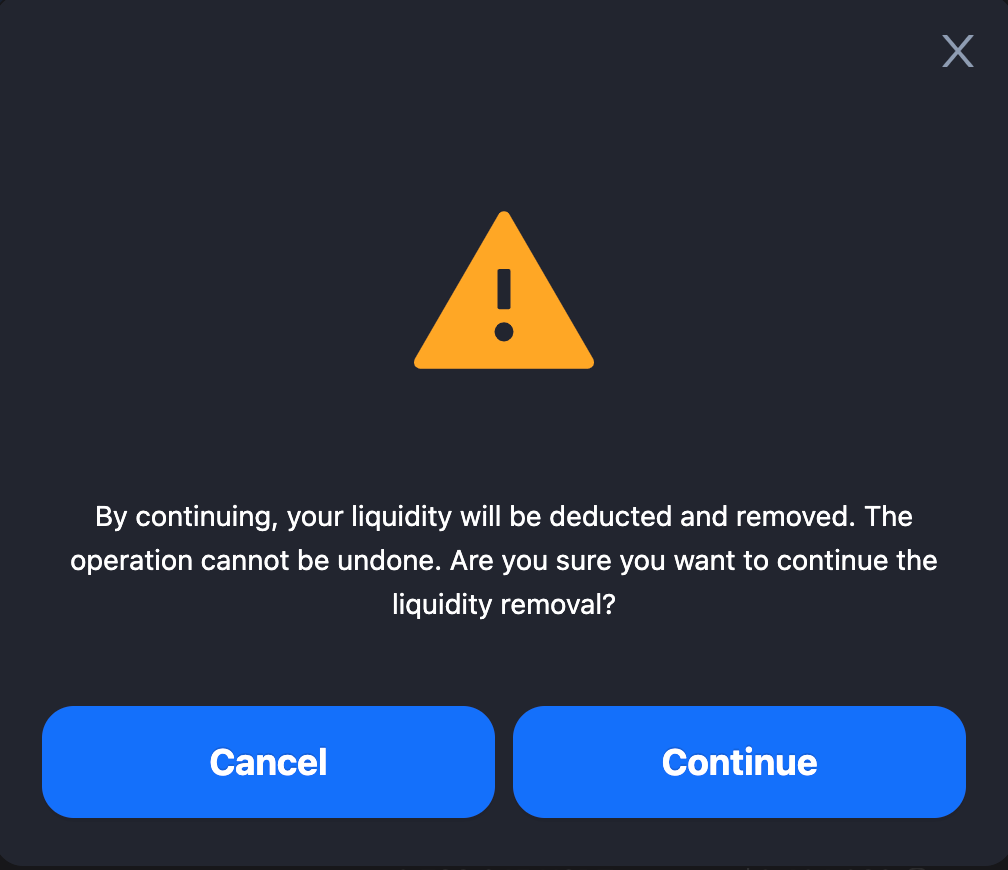

3. Review your liquidity removal details, such as “Amount to Remove”. Click “Remove Liquidity”, and you will be prompted with a confirmation popup. Click “Continue”.

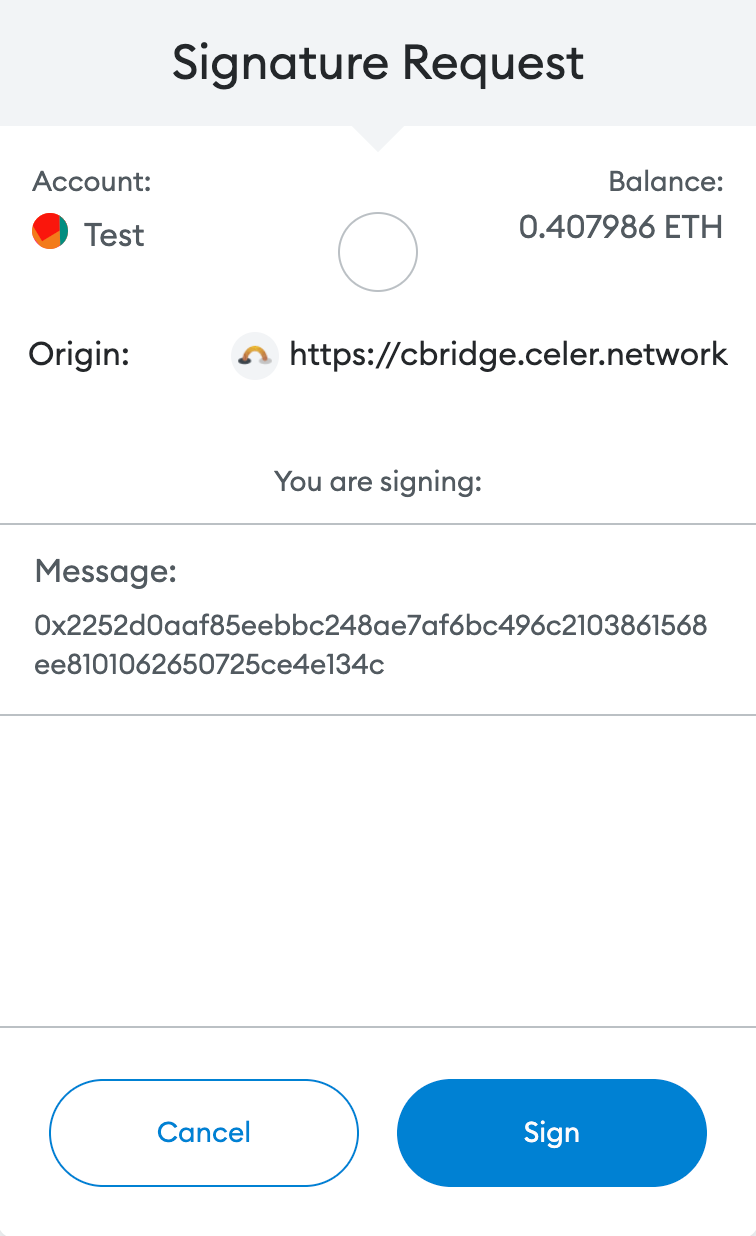

4. You will be prompted to sign the transaction on MetaMask. Click “Sign”.

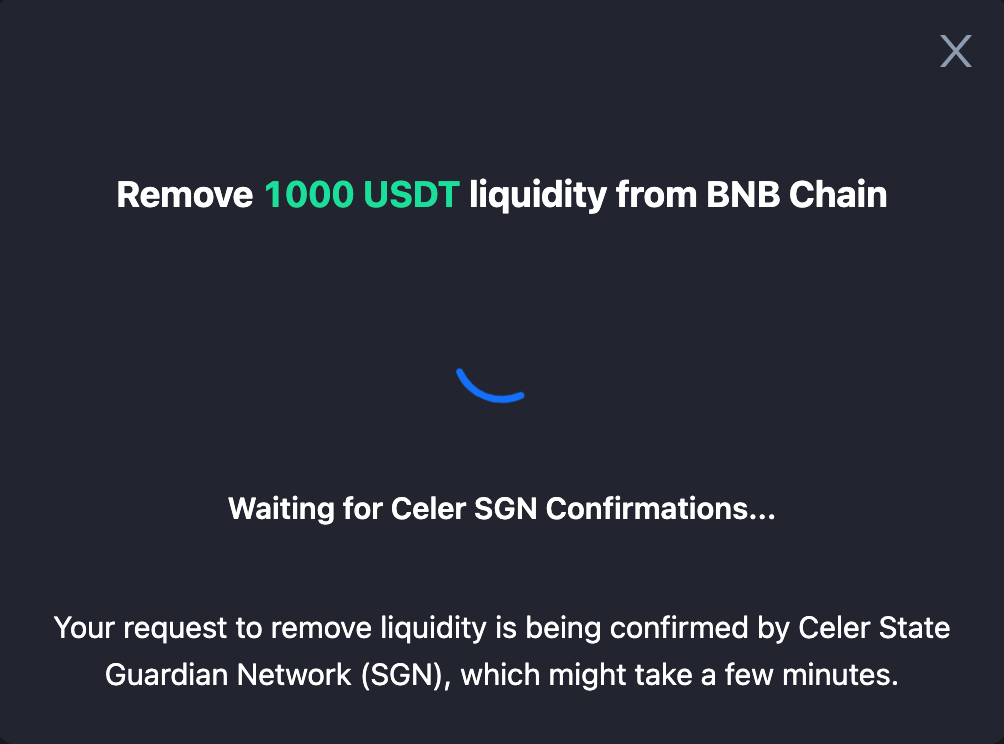

5. You will then receive a popup update on cBridge, showing you the status of the removal.

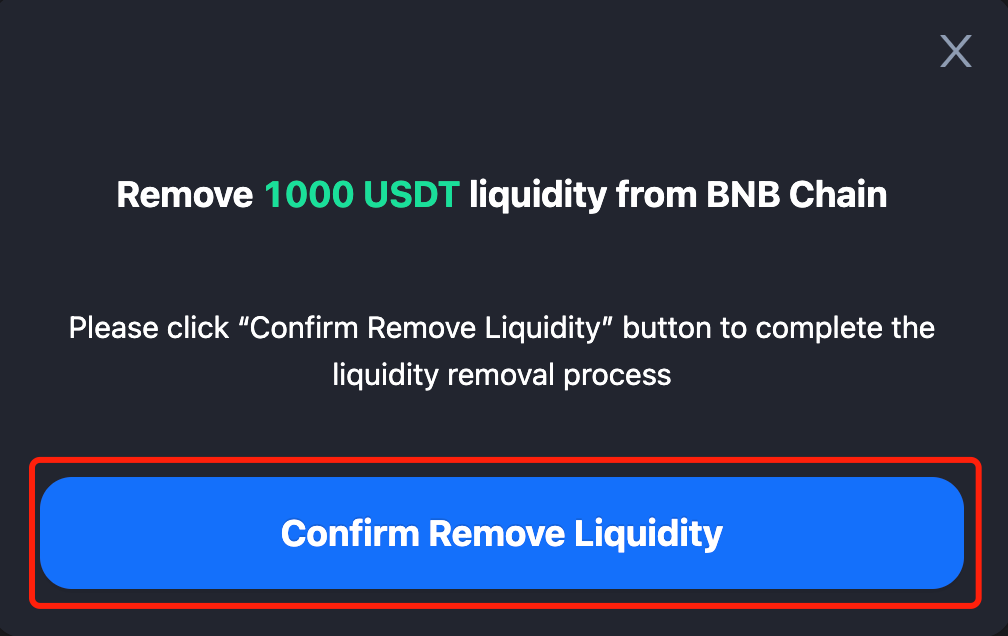

6. Once the removal is confirmed by the Celer SGN, you will be prompted to confirm the removal. Click “Confirm Remove Liquidity”.

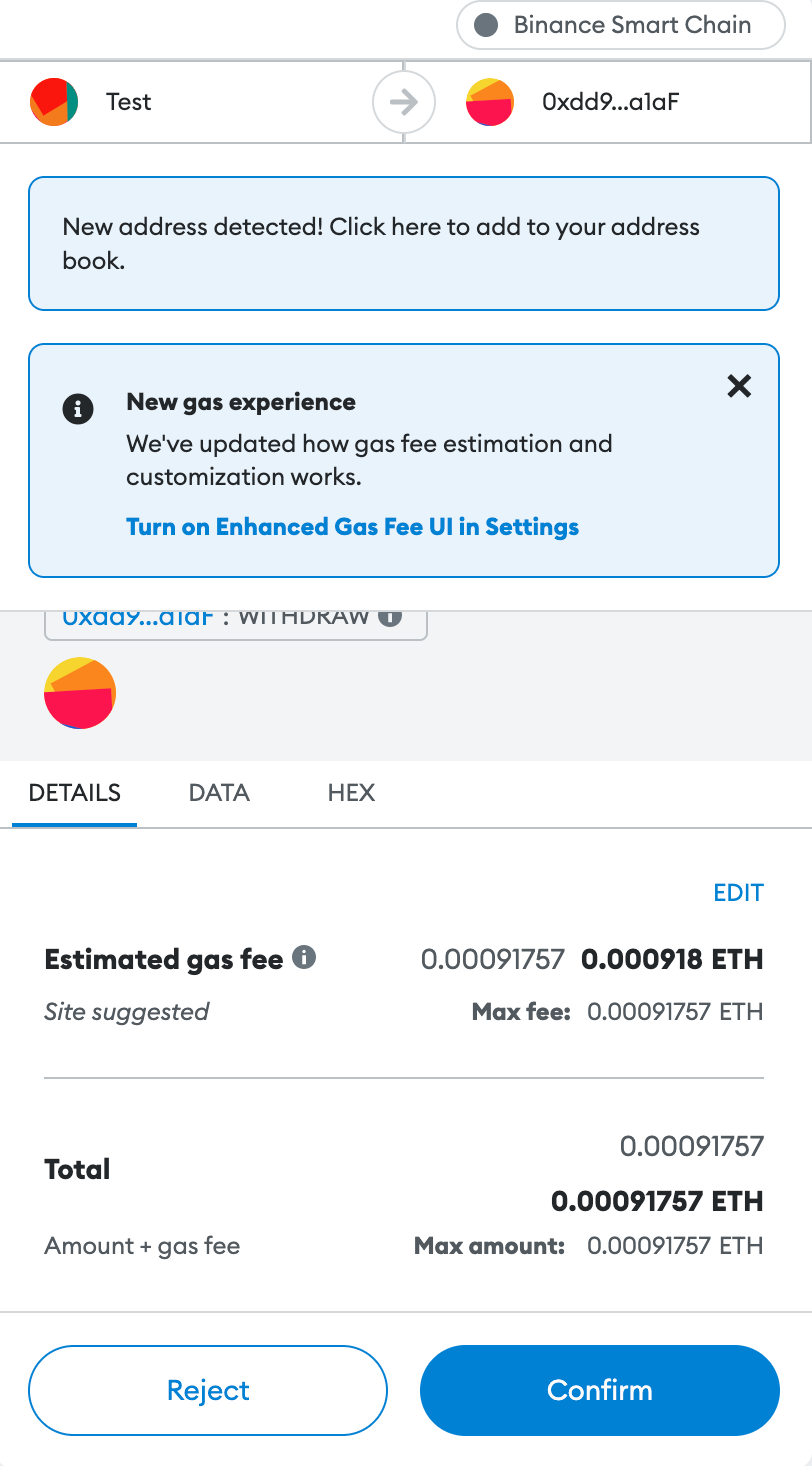

7. You will be prompted to confirm the transaction on MetaMask. Click “Confirm”.

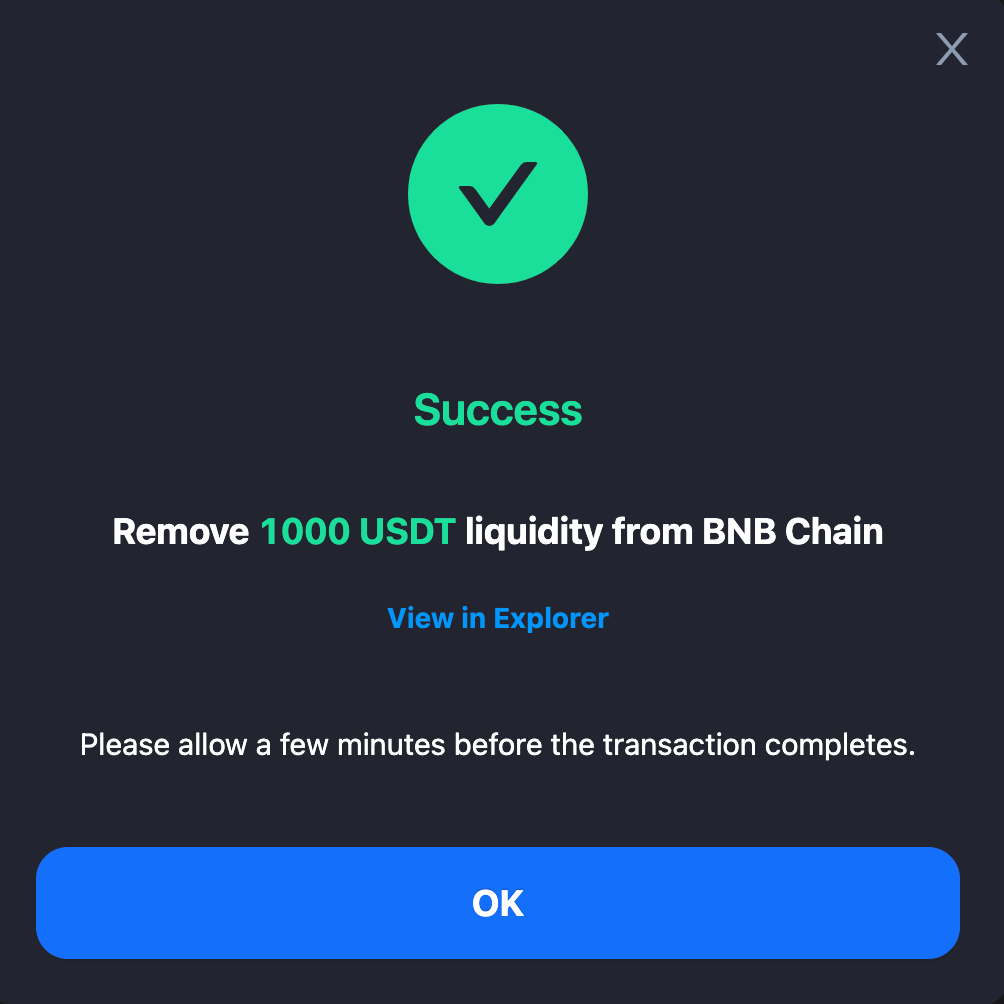

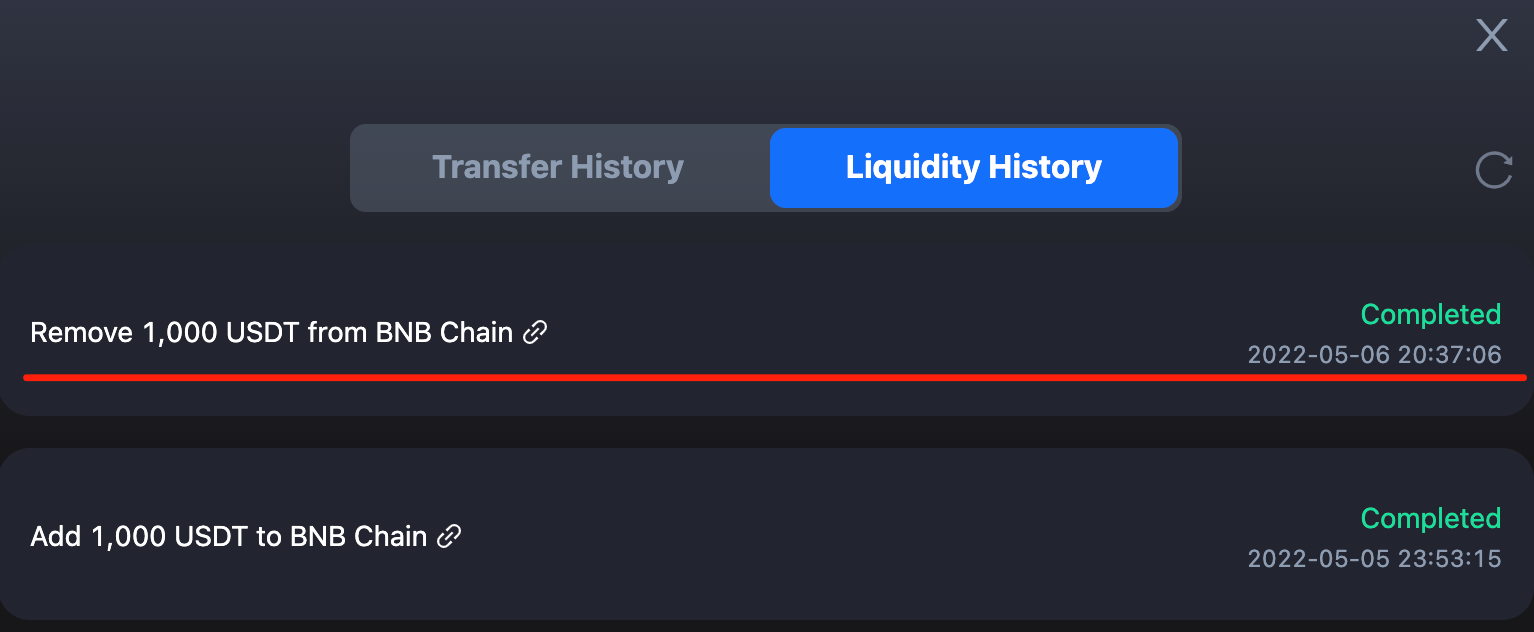

8. You will receive a “Success” popup on cBridge.

9. Note that it may take a few minutes for the transaction to complete. You can go to “History” -> “Liquidity History” to check the status of the transaction.

SGN V2 Staking Guide

Staking your CELR with the Celer SGN allows you to gain transaction fee earnings and staking rewards. In this part, we will guide you through the process of delegating stakes to validators, withdrawing your stakes from the SGN, and managing your SGN rewards.

Delegate Stakes to Validators

- First, connect your wallet to the Celer SGN and then switch to Ethereum Mainnet.

.png)

2. Click the “Delegate” button to choose a validator of your interest to delegate your CELR stakes to.

.png)

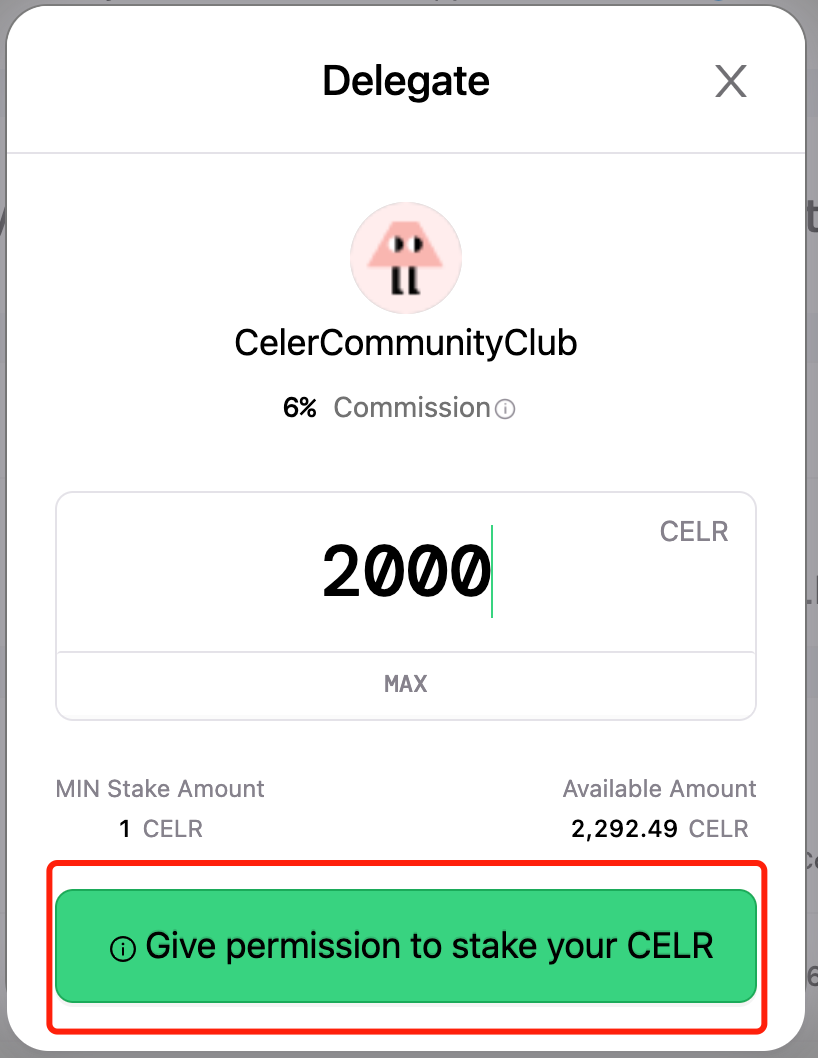

3. Enter the amount of CELR you want to stake and click “Give permission to stake your CELR”. You will be prompted to confirm the transaction on MetaMask and click “Confirm”.

4. After granting permission, click “Delegate” to approve.

.png)

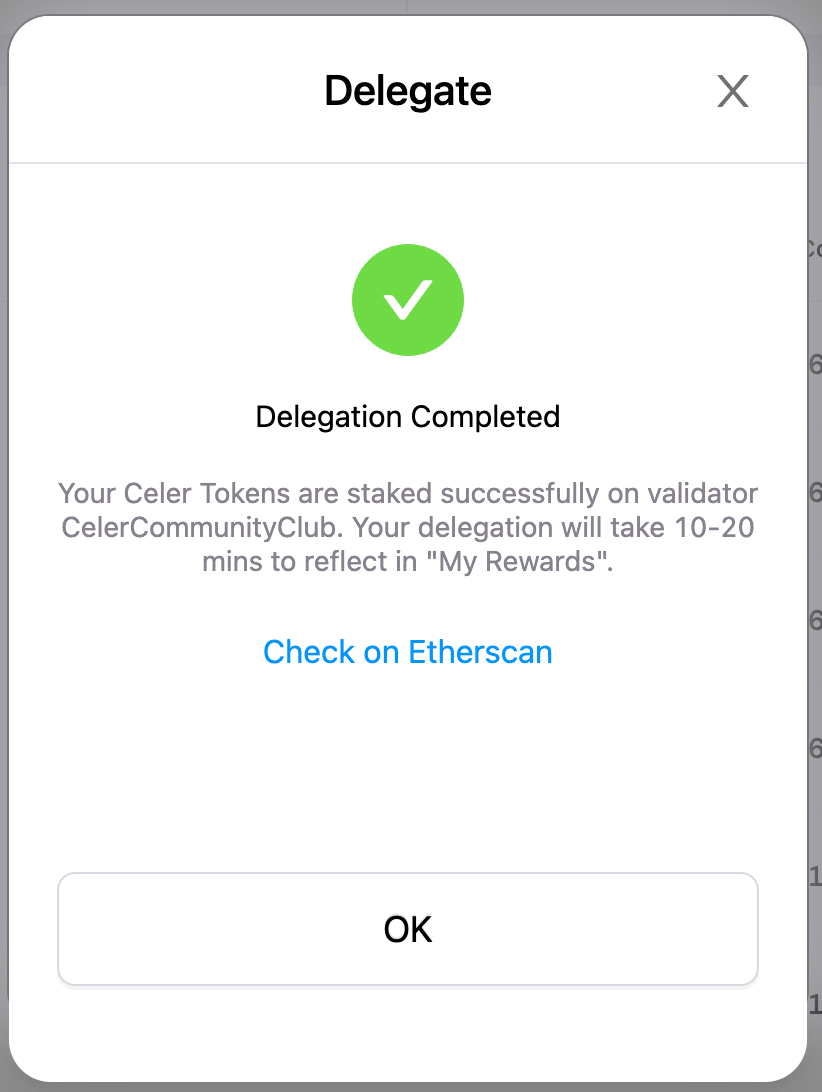

5. You will then receive a “Delegation Completed” popup. Congratulations, you have completed the staking. Note that it may take some time for your staking rewards to show in “My Rewards”.

6.You can check the delegation details by clicking the expand button next to “Details”.

.png)

Manage SGN Rewards

On the “My Rewards” page, you will see two benefits that come with staking: Staking Rewards and cBridge Transaction Fee Earnings.

Claim Staking Rewards

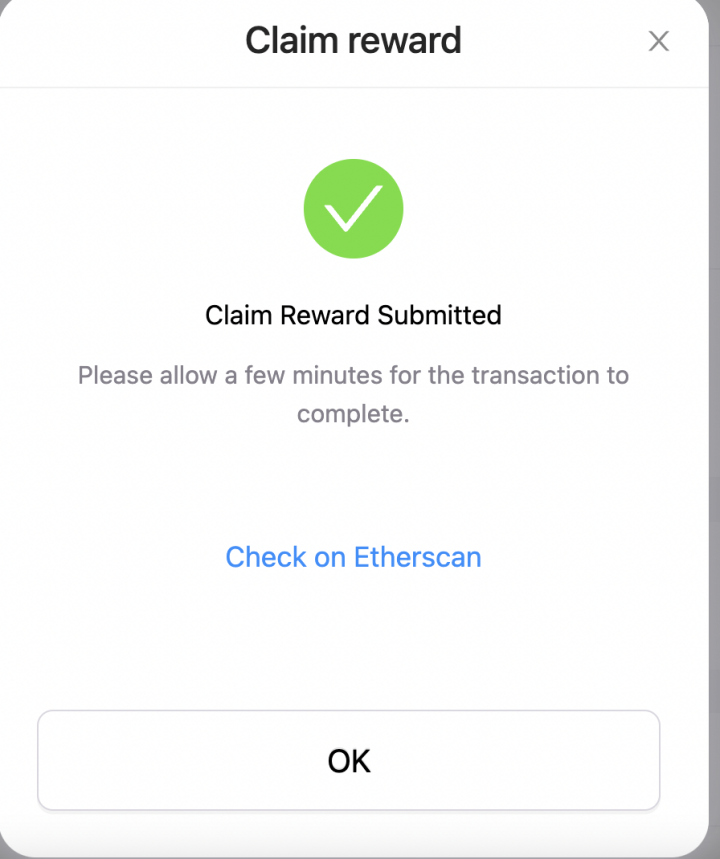

- You need to first unlock your staking rewards to claim them. Click “Unlock to claim.”

.png)

2. You will see a popup showing the unlocking progress.

3. Once rewards are unlocked, you will see a popup update asking if you want to claim rewards at the moment. Click “Claim” will prompt you to confirm the transaction on MetaMask.

4. Or you can click “claim” in “My Rewards” later and claim your rewards after confirmation by MetaMask.

5. Click the “Claim” button, and a confirmation popup will show up. Click “Claim” on the popup. You will be prompted to confirm the transaction on MetaMask. Confirm in Metamask.

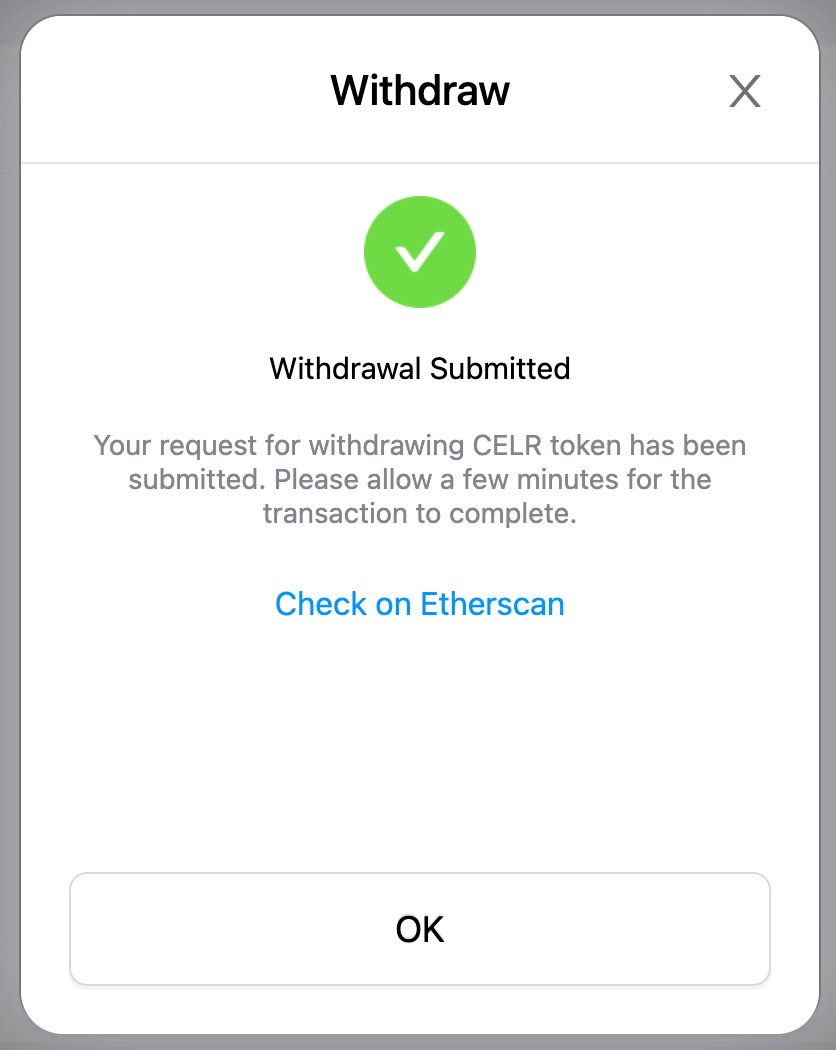

6. You can view status updates on SGN. It takes a few minutes for the transaction to complete on Ethereum, and you can always go to Etherscan to check the status of the transaction.

Claim Transaction Fees from cBridge

When you stake CELR on SGN, in addition to staking rewards, you can also get cross-chain transaction fee earnings from cBridge.

Celer cBridge cross-chain transaction fee earnings come from three sources, the Celer Inter-chain Messaging framework, the open canonical token bridge standard and the pool-based bridge model.

.png)

1. To claim your transaction fee earnings, go to the “My Rewards” page, click “Claim Fee Rewards pool-based bridge” next to “cBridge Transaction Fee”, and a popup will appear to show you the rewards you can claim on different chains.

2.To claim fee rewards on a single chain, click “Claim” next to a single chain.

Withdraw Your Stakes From SGN

To withdraw your stakes, you need to first unbond your stakes from the delegator, and wait for a 7-day unbonding process. Once stakes are unbonded, they can be withdrawn.

Unbond Your Stakes

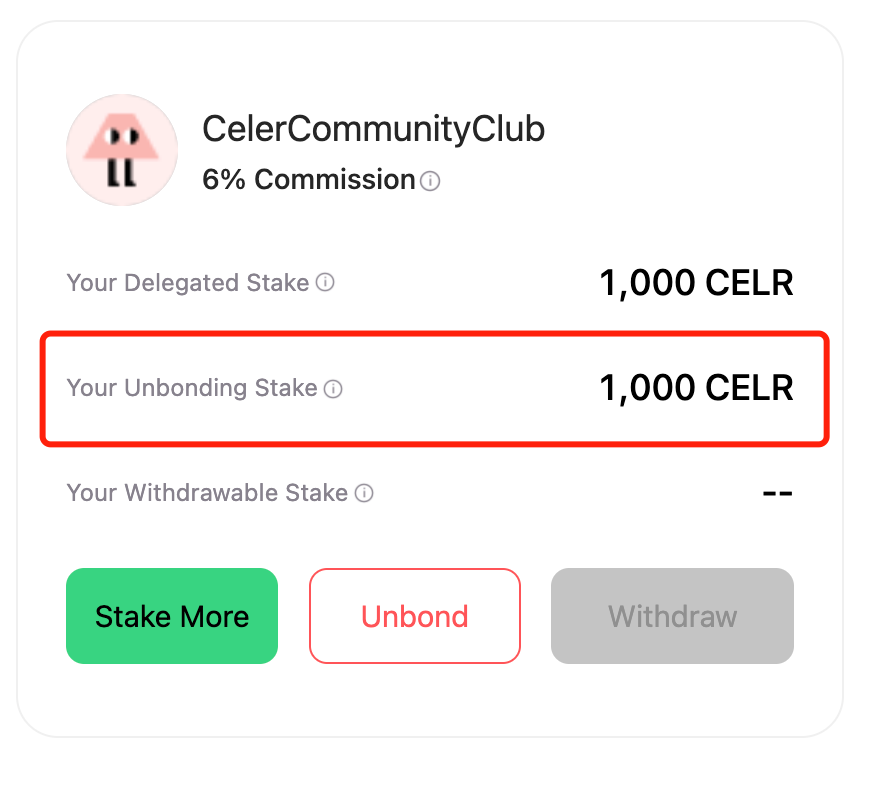

- To unbond your stakes from a validator, go to “My Rewards” -> “My Delegations”, and click the “unbond” button.

.png)

Alternatively, you can go to “All Validators”, and expand on the validator to find the “unbond” button.

.png)

2. On the popup that shows up, enter the amount you want to withdraw. You will be prompted to confirm the transaction on MetaMask. Click “Confirm”.

.png)

3. After confirming, you will then receive an “Unbond in Progress” popup, which tells you when your stakes will become withdrawable.

.png)

4. Now you can see the amount of the stake being released in My Delegations.

5. The unbonding process takes 7 days, after which your stakes will be moved to “Your Withdrawable Stakes”.

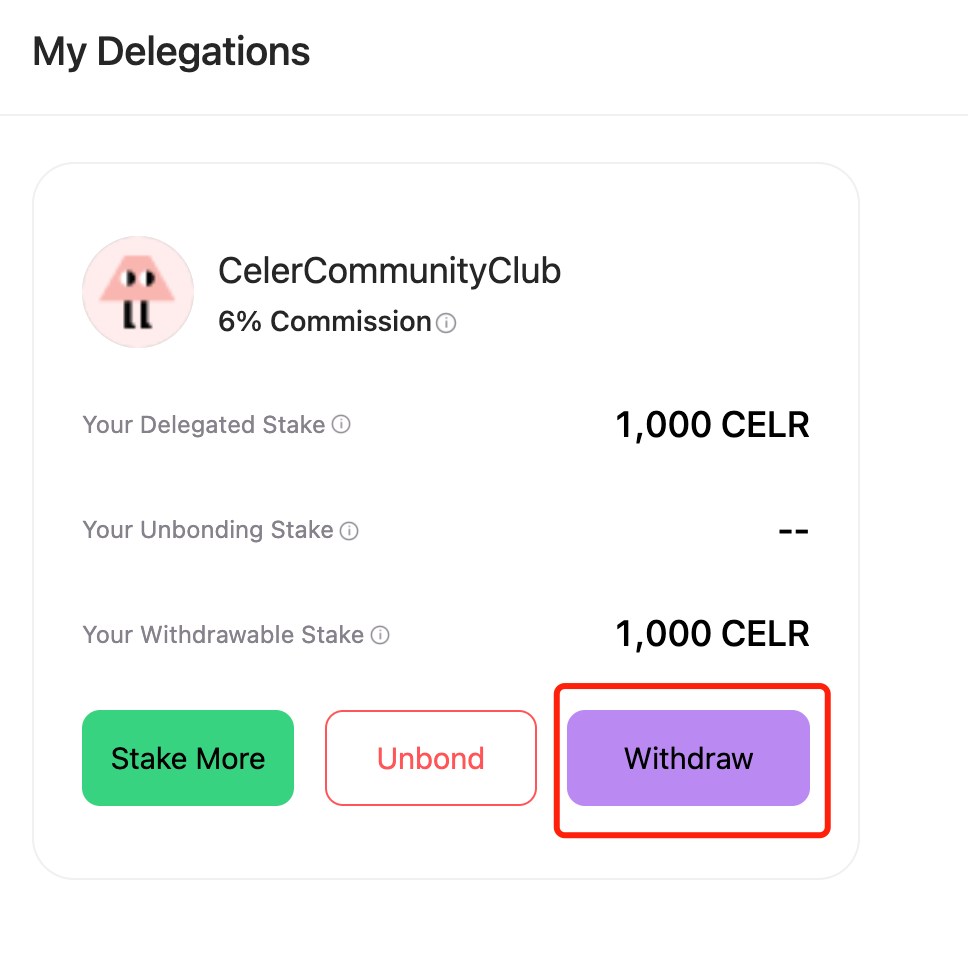

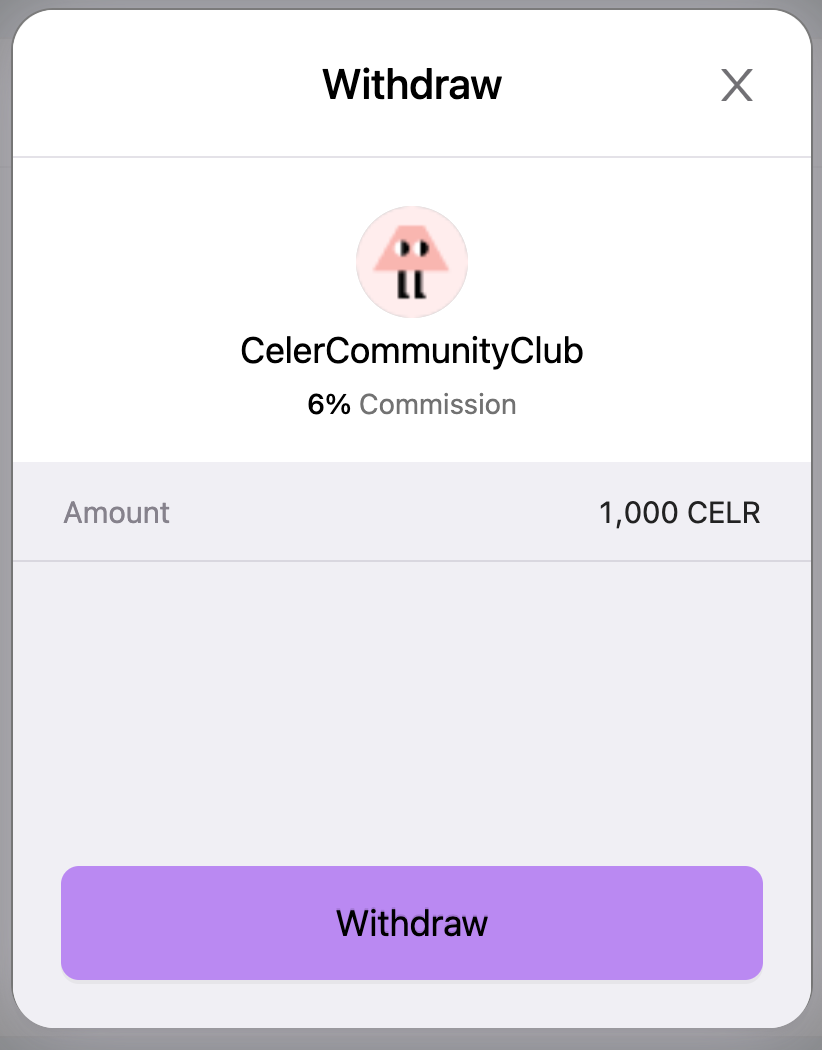

Withdraw Your Stakes

- Click “Withdraw”.

2. You will be prompted to confirm the transaction on MetaMask. Click “Confirm”.

3. It may take a few minutes for the transaction to complete. Once completed, you can check in Metamask if you have received the fund.

SGN V1 Unbonding Guide

Withdraw Your Stakes From SGN V1

To withdraw your stakes, you need to first unbond your stakes from the delegator. The unbonding confirmation takes no time. Once stakes are unbonded, they can be withdrawn.

Unbond Your Stakes

- To unbond your stakes from a validator, go to “Validators”, find the address you delegated to and click on it.

2. On the delegator page, click on the top right “Initialize Withdraw” button.\

3. On the pop-up, enter the amount you want to withdraw. For v1->v2 migration, make sure you enter the full amount you staked into this delegator. Review the amount and click OK.\

4. On the MetaMask popup, click “Confirm”.

Withdraw Your Stakes

- Once the transaction is confirmed on MetaMask, go back to the validator page and click the top-right “Confirm Withdraw” button.\

2. On the MetaMask popup, click “Confirm”. It may take a few minutes for the transaction to complete. Once completed, you can check in Metamask if you have received the fund.

Withdraw Your Rewards From SGN V1

Claim Staking Rewards

To claim your staking rewards, go to “Reward”, and click the “Initialize Redeem” button.\

Redeem Staking Rewards

- After SGN completes collecting signature, click “Redeem Reward”.\

2. On the Metamask popup, click on “Confirm”, and your rewards should be sent to your address in a few minutes.

Smart Contract as LP

The liquidity pool mode of cBridge supports using a smart contract (eg. a multi-sig wallet) to provide liquidity, with the caveat of having to follow a special process to withdraw liquidity. This tutorial describes the process of adding and withdrawing liquidity using smart contracts.

Note: This feature has only been released on a limited number of chains.

Note: Before adding any liquidity to cBridge from a smart contract, make sure you have read this tutorial and are comfortable with following the technical instructions.

Prerequisite: Check LP address

Currently, we have only released support for contract LPs on a limited number of chains on which we have deployed WithdrawInbox contracts to facilitate withdrawing liquidity:

- Ethereum: 0xD20fc42E293734f58316E2106933B8D9FB14F5b2

- BSC: 0xf0FF9888A70f44eb12223A6a55C65976BA7bf854

- Optimism: 0x1b6a49B01176020b153d0cD5Bc90Ef2b75676F00

- Polygon: 0x0E6847e732c0dfE40cc15216AC95E558960e522e

- Avalanche: 0x03ab38cF52173CC71be33B0D2779568f412Be828

- Arbitrum: 0xfe0401bFFBeECE5d9FaE7f1b9a8f1e03FA1c3184

- Conflux: 0x78a21c1d3ed53a82d4247b9ee5bf001f4620ceec

- Kava: 0x0D90AC8466C3aEF6821f9116B96aa2255Ca2DA20

- zkSync Era: 0x80Bd61013F1ca7908b75d88AD08f8dBdEab4e779

- Moonbeam: 0x9B36f165baB9ebe611d491180418d8De4b8f3a1f

- Manta Pacific: 0xF9eBA2FE3F8d03d098a439fab2038c737D3DBB94

- Base: 0xAeC3b47eda9040b9C12F2Ac8d6980d2D2Bcc99F5

Make sure the chain you are going to interact with is supported. Take a note of the WithdrawInbox address and cBridge address.

In cBridge, all LPs are identified by their address regardless of the chain they use. Technically, it is possible for two different entities to occupy the same address but on different chains. For security purposes, a contract LP is only allowed to submit withdraw requests to the WithdrawInbox on the first chain on which they added liquidity. Note that this only restricts on which chain you can submit the withdraw request and it does not affect where the withdrawn liquidity comes from. For example, if you first added liquidity on Ethereum, then you need to submit the withdraw request to the WithdrawInbox on Ethereum. Within the request, you are still free to withdraw liquidity from BSC to Optimism.

To make sure your intended LP address is not occupied by someone else and to check which chain you can submit the withdraw request on, execute the following command:

curl -X GET 'https://cbridge-prod2.celer.app/v1/getLPOrigin?usr_addr=<your contract address>'

A response with a chain_idof 0 means that no LP with the given address has added liquidity. Since the address is not registered with the system, there is also no chain where you can submit a withdraw request yet, and you can proceed to Add Liquidity with confidence. A non-zero chain-id requires you to confirm that you have control of the address on the returned chain_id. If not, it means the address has been occupied by someone else and you need to use a different address.

NOTE: If you added liquidity via a smart contract / multi-sig wallet before we added support for withdrawal on a particular chain and receive a 0 response from the command above, please add liquidity again with a small value from the same contract to register it with the system. Only then will you be able to withdraw your previously added liquidity.

Contract Preparation

Skip this step if you are using generic multi-sig wallets such as Gnosis Safe.

For custom contracts, you need to make sure they can interact with the liquidity Pool and the WithdrawInbox contracts. Specifically, it needs to interact with the required Pool and WithdrawInbox interfaces.

Here is an example of a smart contract LP.

Add Liquidity

Adding liquidity from contracts is relatively simple. Just call addLiquidity on the cBridge contract.

Query Liquidity

You can query the liquidity by:

curl -X GET 'https://cbridge-prod2.celer.app/v1/getLPInfoList?addr=<your contract address>'

Look for the liquidity_amt fields.

Send Withdrawal Request

From your contract, call the withdraw function of WithdrawInbox.

Some explanations of the parameters:

_wdSeqis a unique identifier for each withdrawal._receiveris the receiver address on_toChain._toChainis the chain ID to receive the tokens withdrawn._fromChainsare a list of chain IDs to withdraw the tokens from. We support cross-chain withdrawals, that is to withdraw the liquidity from multiple chains to a single chain._tokensare the token addresses on each chain. Make sure they refer to the same token symbol and they are supported by cBridge on all the chains involved._ratiosare the percentages of liquidity to be withdrawn from each chain. They should be all positive. The max ratio is 100000000, which means 100%._slippagesare the maximal allowed slippages for cross-chain withdrawals. Usually a small number such as 5000, which means 0.5%, should suffice. The max slippage is 1000000, which means 100%.

Query Withdrawal Request

After the transaction has been confirmed for some period of time. Use the command below to query your withdrawal request, replace <_wdSeq>, <_receiver> and <_toChain> with the input parameters when you submitted the withdrawal request to WithdrawInbox. Leave type as 2 and tx_hash empty.

curl -X GET 'https://cbridge-prod2.celer.app/v1/queryLiquidityStatus?seq_num=<_wdSeq>&lp_addr=<_receiver>&chain_id=<_toChain>&type=2&tx_hash='

Here is an example response:

{

"err": null,

"status": 2,

"wd_onchain": "CGEQzN8EGhS1u4t/bxiD4MAf+4aXAkUy5vMjjCIUfUOqvFFcNWFFBJInzuVLYINCwK0qBDWfasA=",

"sorted_sigs": [

"RWOqYnYjJ7RicK+10sUJQw2N8RqD8okx7Fm0CVAxsGQCjvQzECG/5RuEvVj2DuMABqeqNutwNzQi/507NLTgchw=",

"gT7QzODxY2jPvw1CJ01NxUsd6wGgnjEiBorjlXovpId5qgCiIddpYAlMWQobvsvOeTFwrQeTeIZt0c2UtXEryhw=",

"EwUS55eqLuzV8VzJv49yLvuzfmLlMNWvjMHZ/0fhFoJqUZt40YjZ+wHrgOFiNjxoIcmCca6eK0RVk/afbvOn/Rs=",

"13elR2IulcfpWsWoaSyllFxSIn4QhizBYhm3ws9XBBVSx9wkLGxWj1bZsGnL35jfuycyNfcIkTDJpqNIESVKcRw="

],

"signers": [

"afcdW46iJXHU2+JxPDGns9yk0jQ=",

"pQACNVE4h2O3IICMCwzfAKdStp8=",

"pSItCOb+GXa1jDYzZA/xxl87xcE=",

"pTM822LmU58+waekF8LVXMoYHgA="

],

"powers": [

"aZYG7SZ3X4CQpYA=",

"eDiO17/7OhWy5oA=",

"fo+fSaavop8afu8=",

"W2+85IicuUj4AAA="

],

"block_tx_link": "",

"block_delay": 8

}

A little explanation about the status field in the response:

0 means no withdrawal request found. Check your query command first. If the fields were set correctly, it is possible that your withdrawal request has not been reflected in the cBridge / SGN system yet so please retry after a little while. If it keeps being 0 after quite a while, your request is likely rejected due to bad arguments. Check the instructions and try again. If you are sure the arguments are correct, it is possible that the withdraw amount is too large that it hit certain rate limits. Please contact us before you make another try.

1 means the withdrawal request has been accepted, but not yet co-signed by validators. Please query again after a little while.

2 means the withdrawal request is ready to be submitted on-chain. In this case, you will see a hex string in wd_onchain along with a number of strings in sorted_sigs, signers, powers.

3 means the withdrawal request is being submitted on-chain.

4 means the withdrawal request is completed, and tokens have been sent to the given address on the given chain if the request is not delayed due to large amount.

5 means the withdrawal request has failed. Probably due to slippage being too small, but could be caused by other reasons such as insufficient liquidity or token transfer being disabled. Contact us for details before you make another try.

6 means the withdrawal request has been delayed due to the amount being too large. It should usually turn into a 4 after about 30 minutes.

If you see a 2, copy and save the wd_onchain, sorted_sigs, signers and powers fields for later use.

Submit Withdrawal On-Chain

Once you have received a response with status 2, prepare the input parameters for the on-chain withdrawal transaction. As described in the withdraw function, you need to supply _wdmsg, _sigs, _signers and _powers. You can use an explorer like Etherscan to send the transaction.

The wd_onchain you saved corresponds to _wdmsg. Go to base64-to-hex, paste wd_onchain on the left, switch GROUP BY to NONE on the right, add a hex prefix 0x to the result on the right, and you will get _wdmsg.

Note: For

sorted_sigs,signersandpowers, do not change the order of parameters within the arrays.

sorted_sigs corresponds to _sigs. Convert the signature strings in sorted_sigsone by one using the same way as with wd_onchain, and put all 0x prefixed strings in an array [] to get _sigs.

signers corresponds to _signers. Prepare them the same way as sorted_sigs.

powers corresponds to _powers. First, convert the strings the same way as with wd_onchain but this time without adding 0x prefixes. Second, go to hex-binary, switch CONVERT TO to Decimal(10) in the middle and convert the result from the first step to decimal number. Put all the numbers you get in an array [] to get _powers.

With all the prepared parameters. Open Etherscan or whatever explorer you use, search for the cBridge address and connect to your wallet. Input the parameters to the withdraw function and send the transaction.

Note that large withdrawals might be subject to delays.

Aptos Bridging Guide

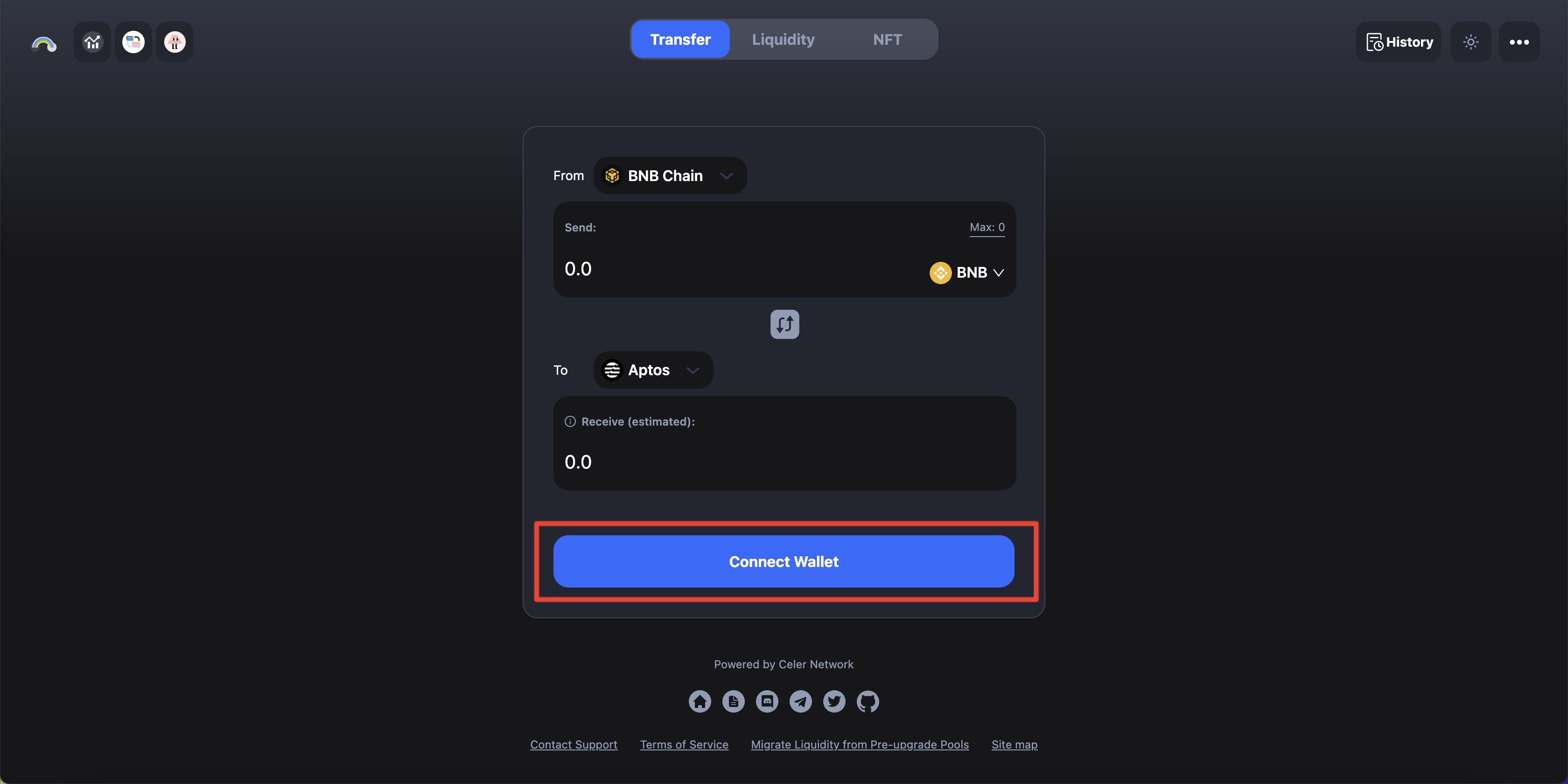

We’ll use the BNB Chain, the $BNB token, and the MetaMask and Petra Wallets in this tutorial as an example.

Connect Your Wallet

Before you start transferring assets via cBridge, you need to connect wallet first.

1. Click “Connect Wallet”, and you will be prompted to select a wallet. (cBridge currently supports MetaMask, TokenPocket, Coinbase Wallet, WalletConnect, and Clover on desktop browsers).

2. Select “MetaMask”.

.png)

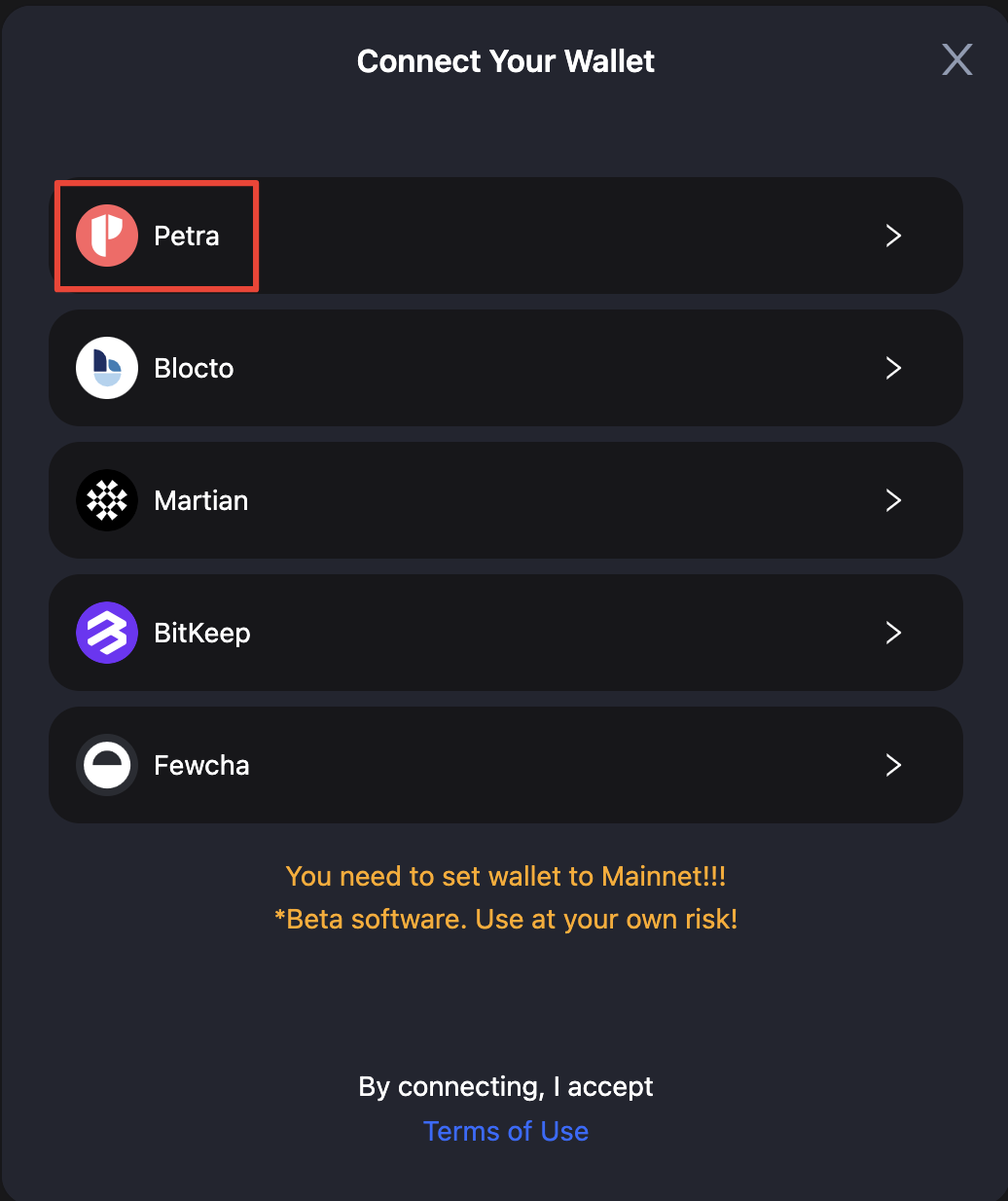

3. Click “Connect your Aptos wallet to receive the funds”, and you will be prompted to select a wallet. (cBridge currently supports Petra, Blocto, Martian, BitKeep, and Fewcha wallets for Aptos).

.png)

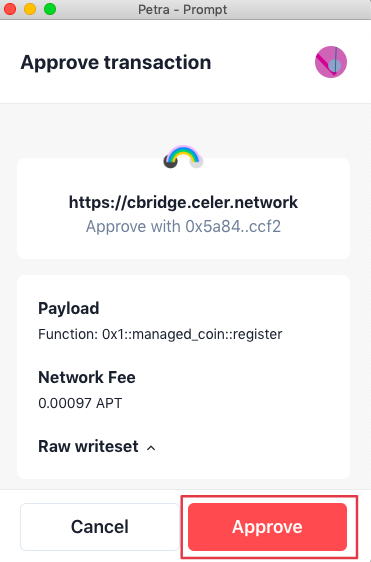

4. Select “Petra” and you will be prompted with a confirmation on Petra. Click “Approve” and your wallet will be connected successfully.

.png)

Now you can see your recipient address on Aptos.

Transfer Assets to Aptos

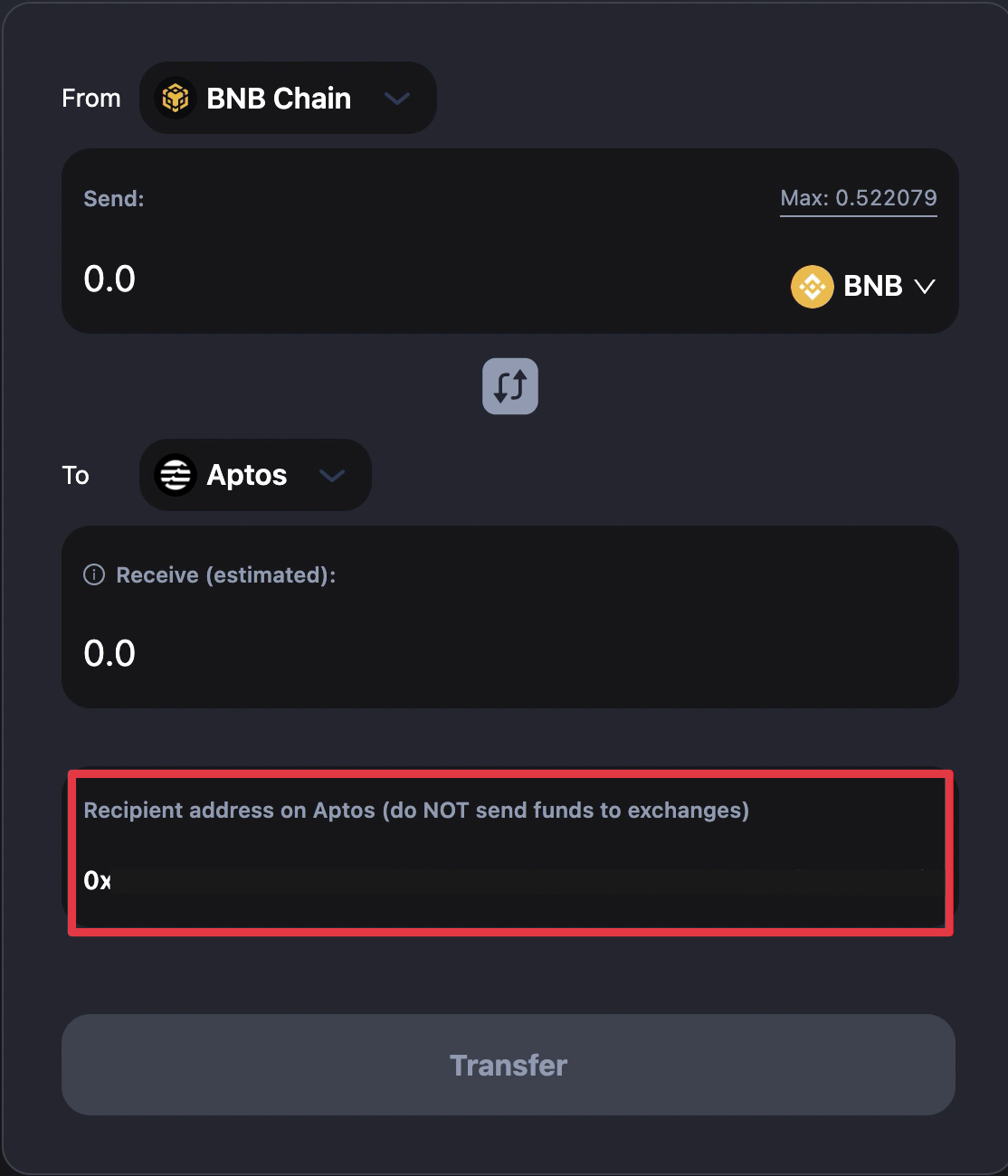

Let’s say, you want to transfer 0.1 $BNB from BNB Chain to Aptos:

1. Select “BNB Chain” as the “From” chain and “Aptos” as the “To” chain.

.png)

2. You may be prompted to switch your wallet to BNB Chain first. Enter the amount you want to bridge under “Send”. You should see the estimated amount you will receive under “Receive (estimated)”.

.png)

Note that there will be a difference between the amount you send and the amount you receive, which is determined by the bridge rate and fees. For the exact definition of each item in the transaction, check the tooltips next to each of the terms.

.png)

3. Review your transfer details and click “Transfer”. You will receive a popup to submit the transfer.

.png)

4. After clicking “Transfer”:

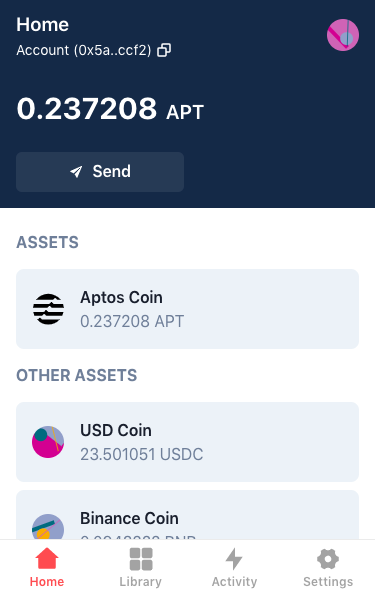

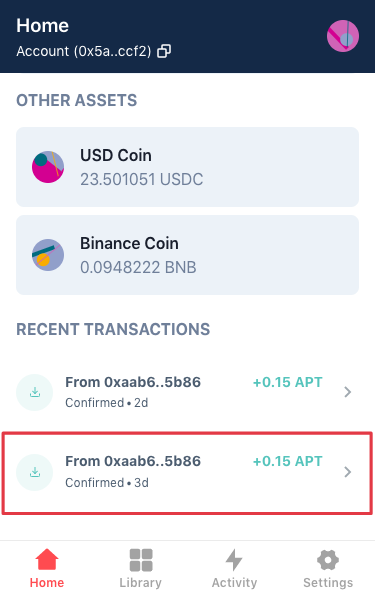

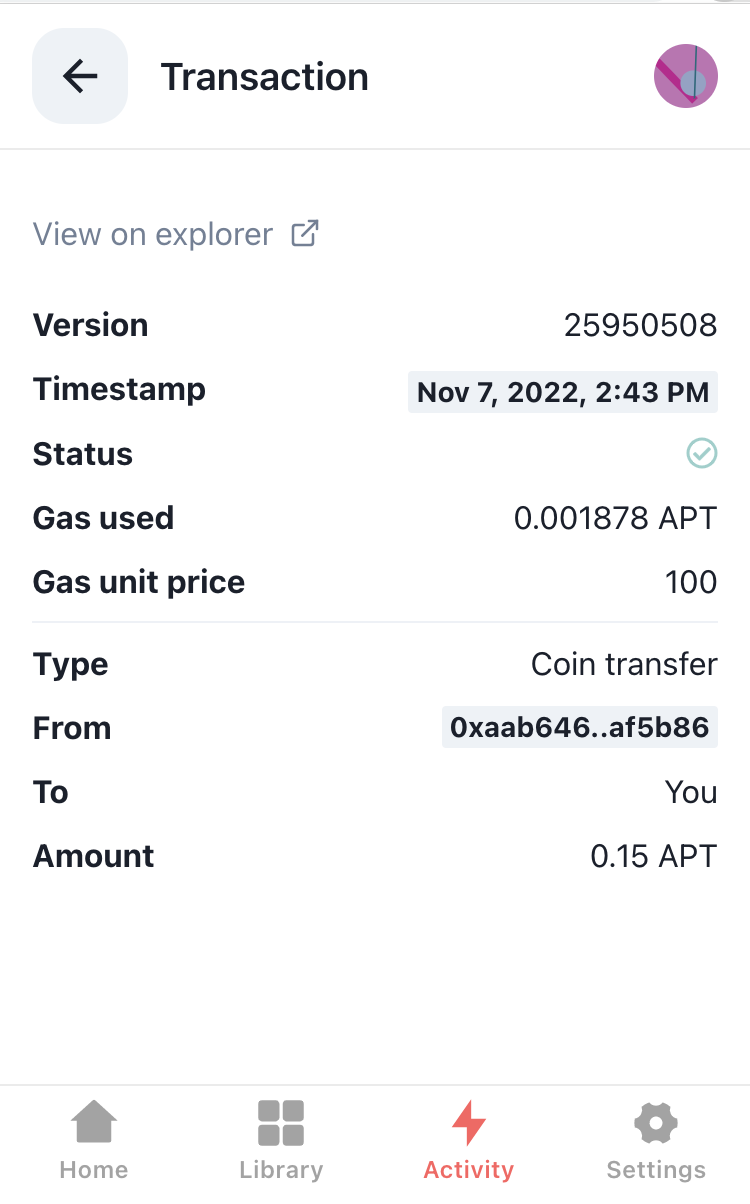

4.1 If it is a newly created Aptos account with 0 $APT in it, you will also receive 0.15 $APTOS to pay the gas fee on Aptos. Click “Confirm Transfer” and you will be prompted with a confirmation on MetaMask.

.png)

.png)

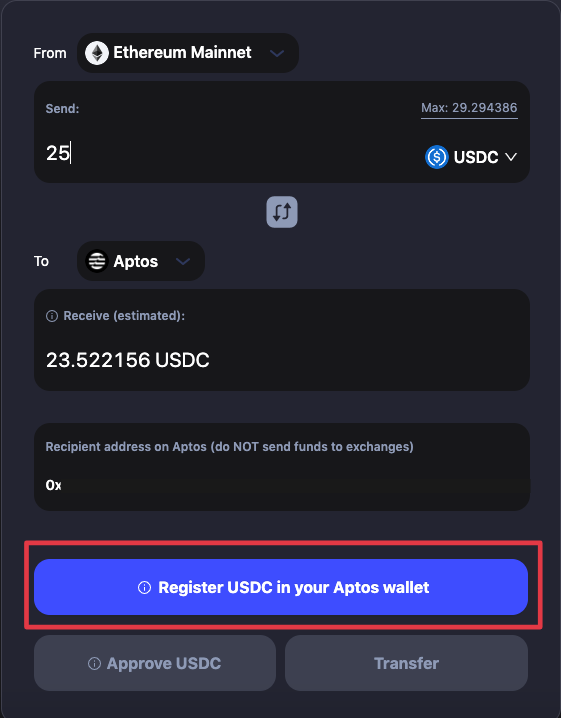

4.2 If there is some $APT balance in the Aptos account and it is the first time to receive this token on Aptos, it is mandatory to Register the token in the Aptos wallet first before claiming/receiving in Step 7. Please refer to this section to find out how to register token. You only need to register once per token.

4.3 If there is some $APT balance in the Aptos account and it is NOT the first time to receive this token on Aptos, you will see “Transfer” button only and after clicking “Confirm Transfer” you will be prompted with a confirmation on MetaMask. In this case you do not need to Register the token anymore and still receive 0.15 APTOS to pay the gas fee on Aptos.

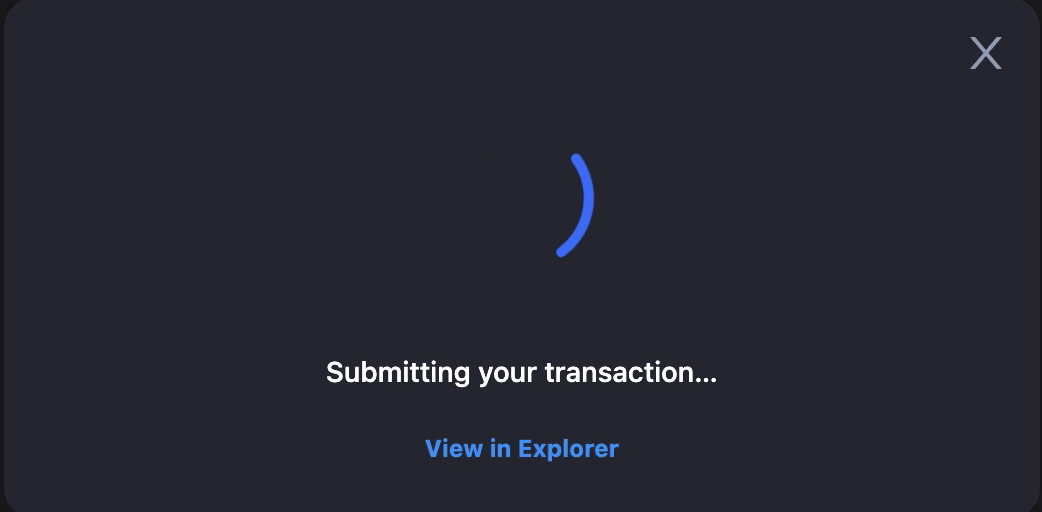

5. After “Confirm Transfer”, your transaction will be submitted. Please wait a few minutes.

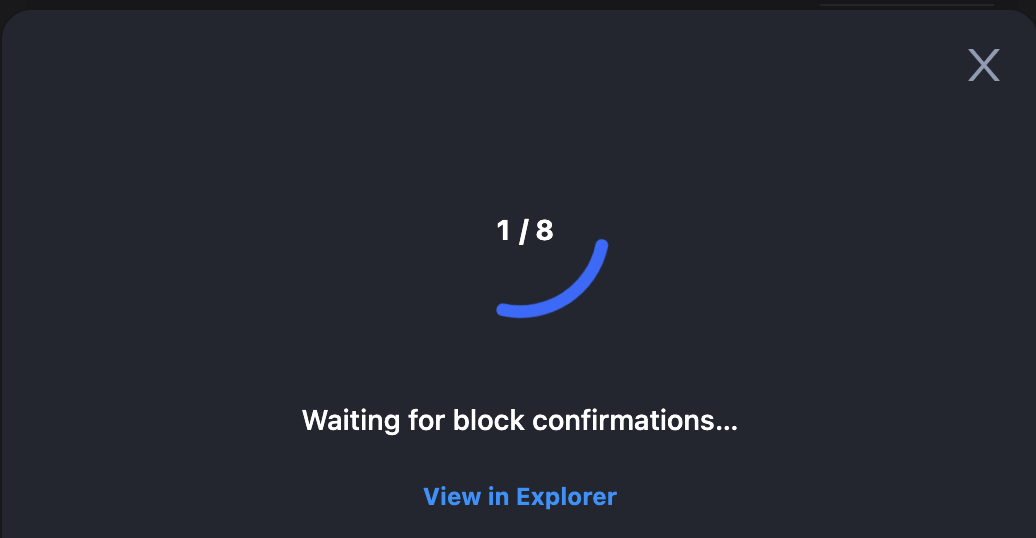

6. The page will show you the real-time progress of the transaction.

.png)

7. When block confirmations and SGN confirmations are completed, you will see a popup to “Claim BNB”.

Note: You need to claim first to receive the token on Aptos. You only need to claim once per token.

.png)

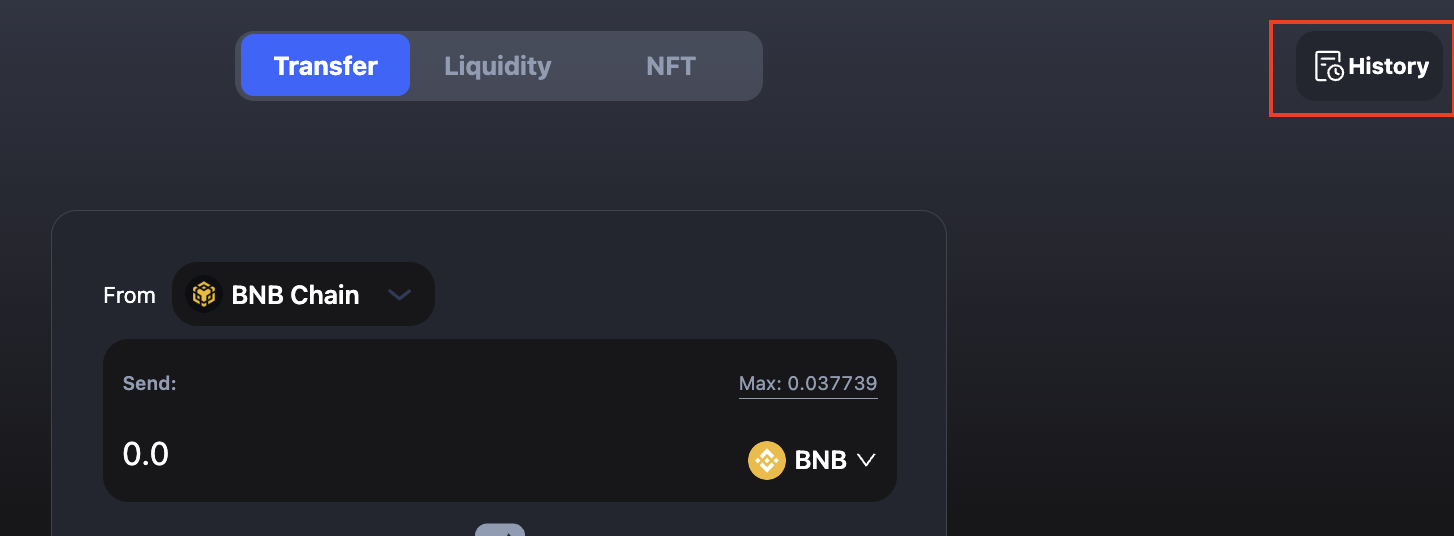

If you close this window without claiming $BNB, you can also Claim in cBridge History section.

.png)

8. Click “Approve” and you will see the Transfer Completed popup.

.png)

.png)

9. Click “Petra” at the extension in the top right corner of the browser, you can see all the assets in your wallet, including $APT and the bridged assets.

10. You can also click “Recent Transactions” to view your transaction history and details.

Register Token in Aptos Wallet (If Need)

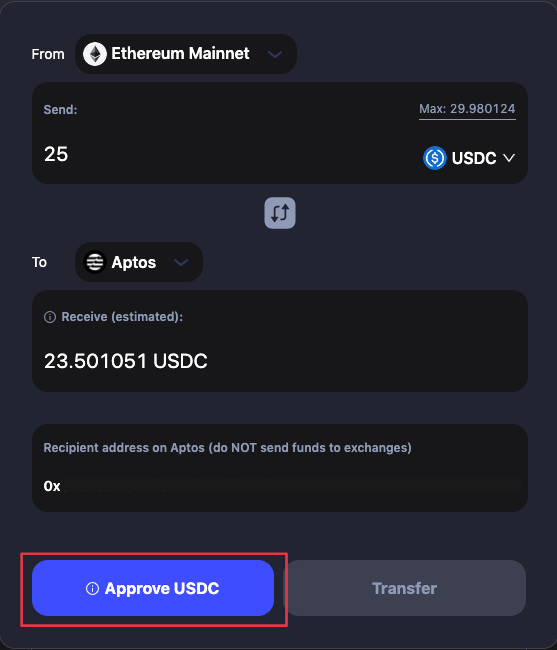

If you transfer a token to Aptos for the first time, you will need to Register the token in your Aptos wallet first. Here take $USDC as the example and go through the steps as follows:

You will see “Register $USDC in your Aptos wallet” button first.

Then click “Approve” on Petra.

Then click “Approve USDC”, and you will be prompted to confirm on Metamask.

.png)

Click “Confirm” and you will complete the token registration and can continue transferring your assets.

.png)

Ape Chain Bridging Guide

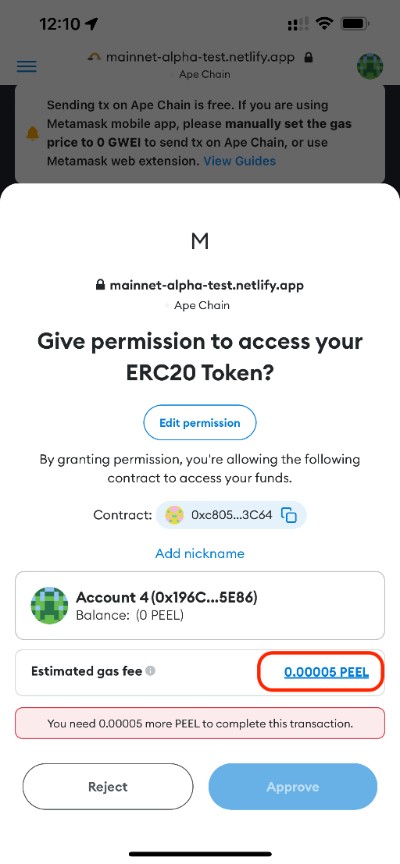

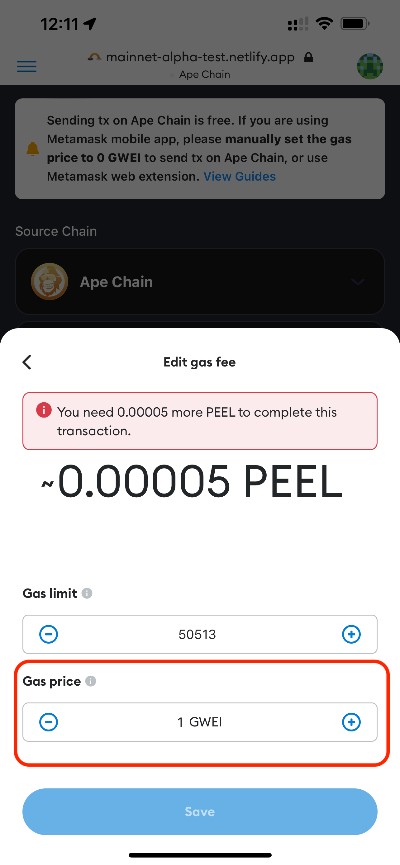

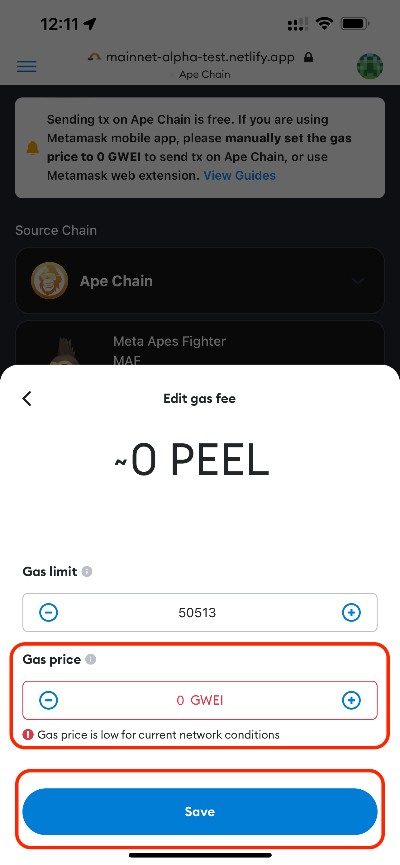

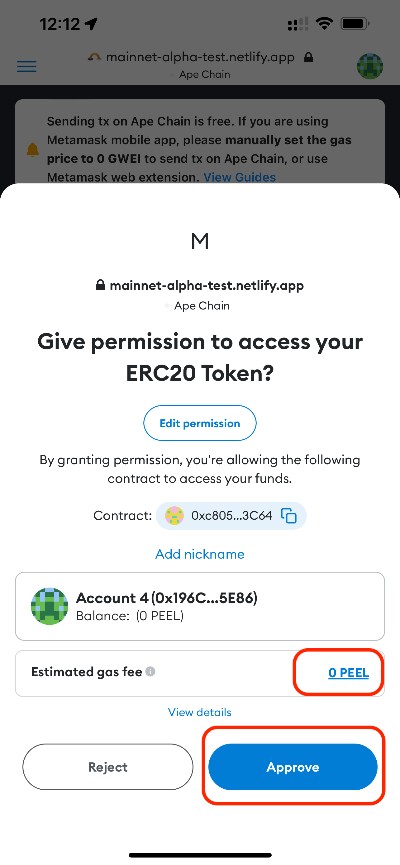

Sending bridge transactions on Ape Chain is currently free. However, if you are using mobile wallets (e.g., Metamask mobile, imToken), you may be asked to pay gas fees (in $PEEL) when submitting tx on Ape Chain. In this case, please follow the below guides to solve the issues.

Metamask Mobile App

If you are using Metamask mobile app, you may be asked to pay gas fees when approving NFTs or SHELL tokens on Ape Chain.

In this case, click on the gas fee link as highlighted above, and you will see the popup to adjust the gas price.

Change the gas price from 1 GWEI to 0 GWEI (just ignore the warning that the gas price is too low).

Click the “Save” button and you will see the gas fee becomes 0 PEEL.

Other Mobile Wallets

If you are using other mobile wallets, you try similar steps to adjust the gas price to 0 GWEI on Ape Chain. However, some mobile wallets may not allow 0 GWEI gas price (e.g., imToken). In this case, please use Metamask mobile or Metamask web extension to send bridge transactions on Ape Chain.

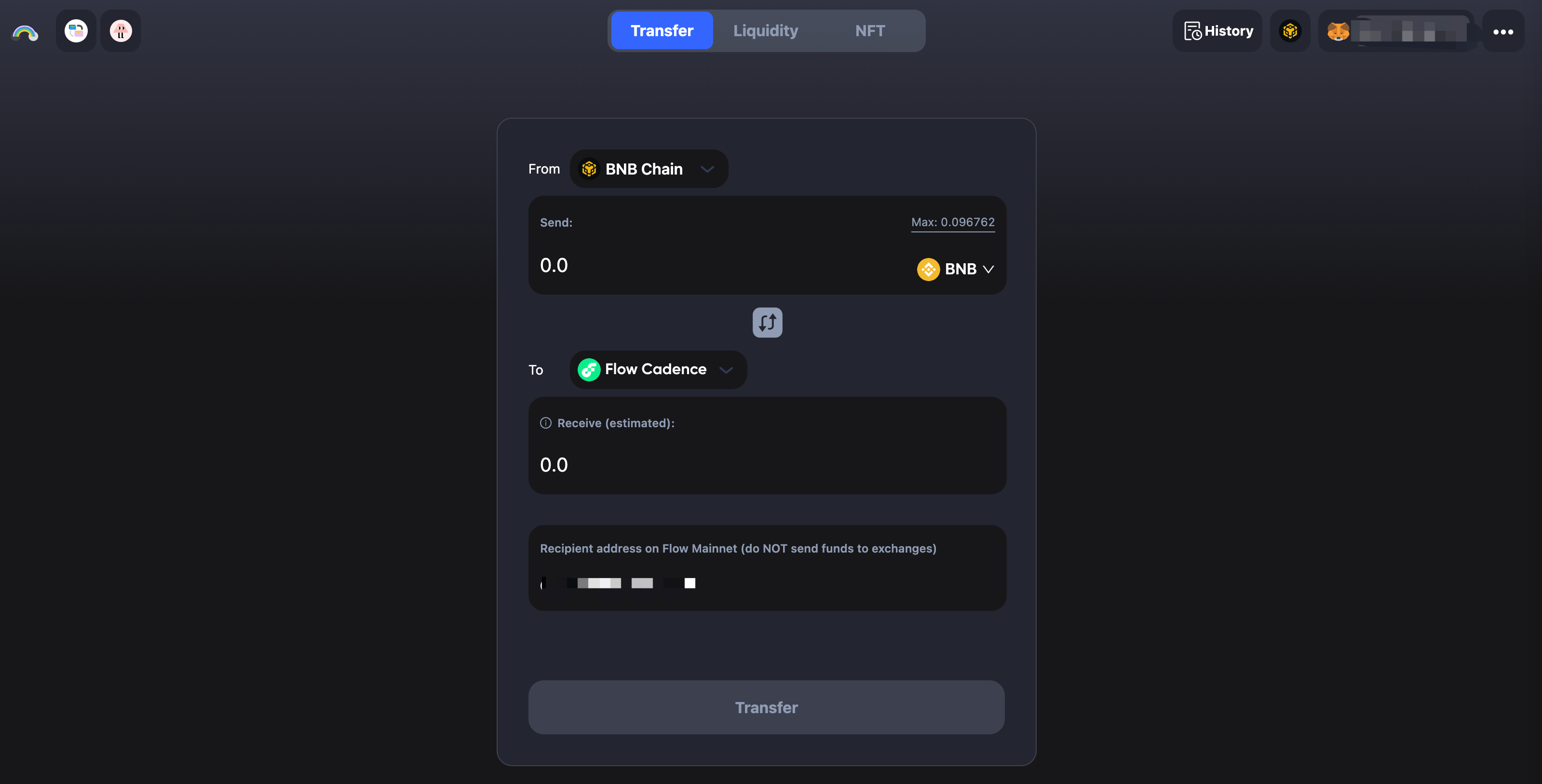

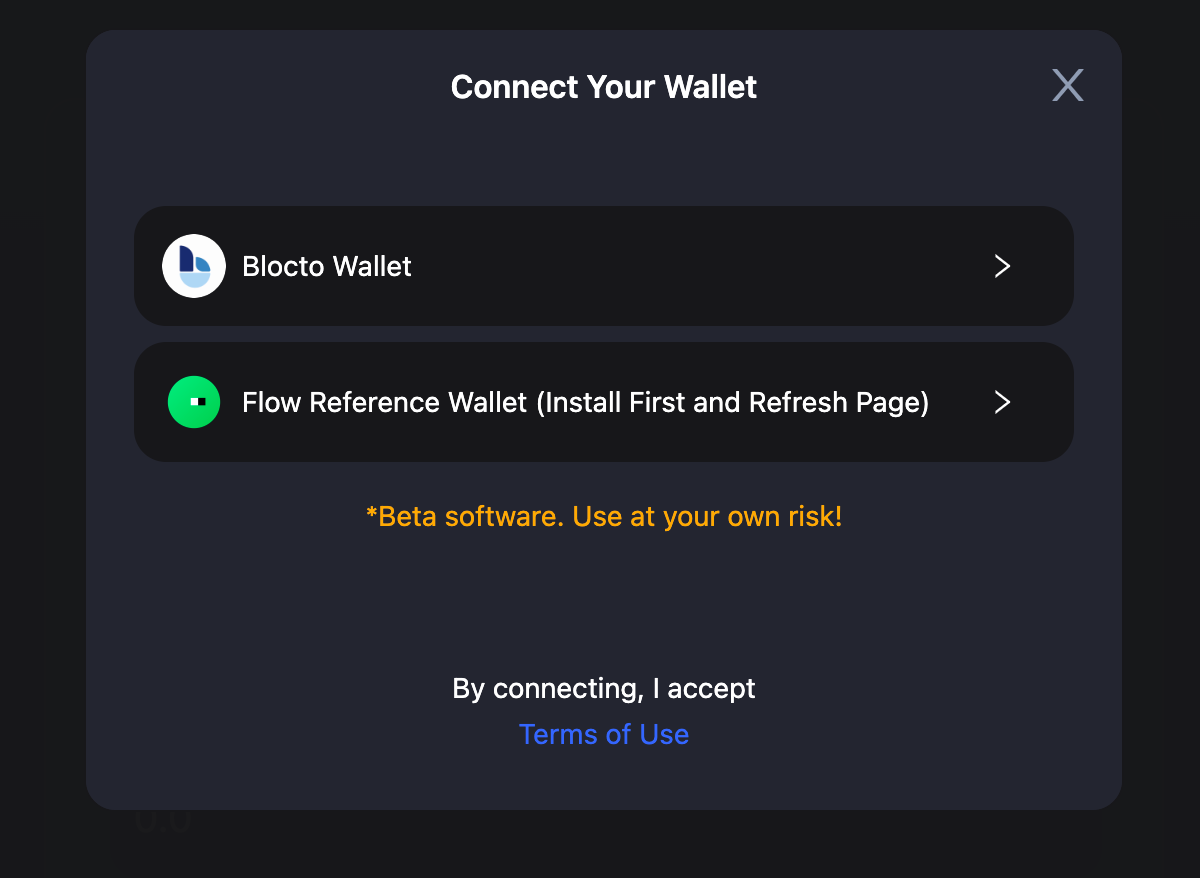

Flow Cadence Bridging Guide

Connect Your Wallet

Before you start transferring assets via cBridge, you will need to connect your wallet first.

1. Click “Connect Wallet”, and you will be prompted to select a wallet. (cBridge now supports MetaMask, TokenPocket, Coinbase Wallet, WalletConnect, and Clover on desktop browsers).

.png)

2. Select “MetaMask”.

.png)

- Click “Connect your Flow wallet to receive the funds”, and you will be prompted to select a wallet. (cBridge now supports Blocto and Flow Reference wallets for Flow Cadence).

.png)

.png)

- Connect a wallet you would like to use for transfer.

4.1 Connect Blocto Wallet. By entering your email address, you can Sign in/ Register to your Blocto Account. After entering passcode given by Blocto, you can click confirm button to connect your Blocto wallet to cBridge.

.png)

.png)

.png)

.png)

4.2 Connect Flow Reference Wallet. cBridge website will detect whether you have installed Flow Reference Wallet. If not, you will need to install the chrome extension firstly according to the guideline and Refresh cBridge website. If Flow Reference Wallet has been installed in chrome, you will see a prompt after selecting Flow Reference Wallet. By clicking Connect button, your Flow reference wallet is connected for cBridge transfer.

.png)

.png)

Transfer Assets Across Chains

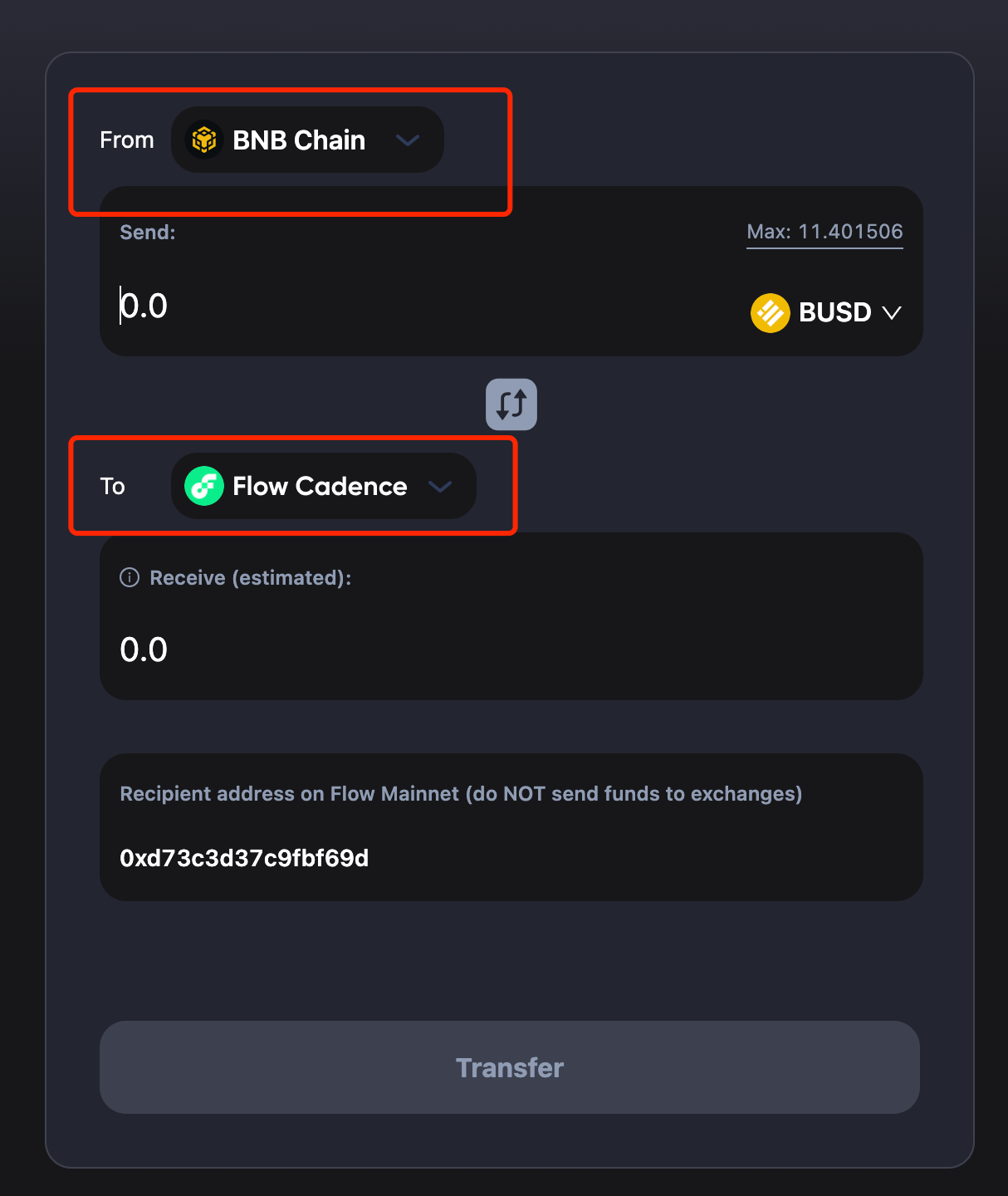

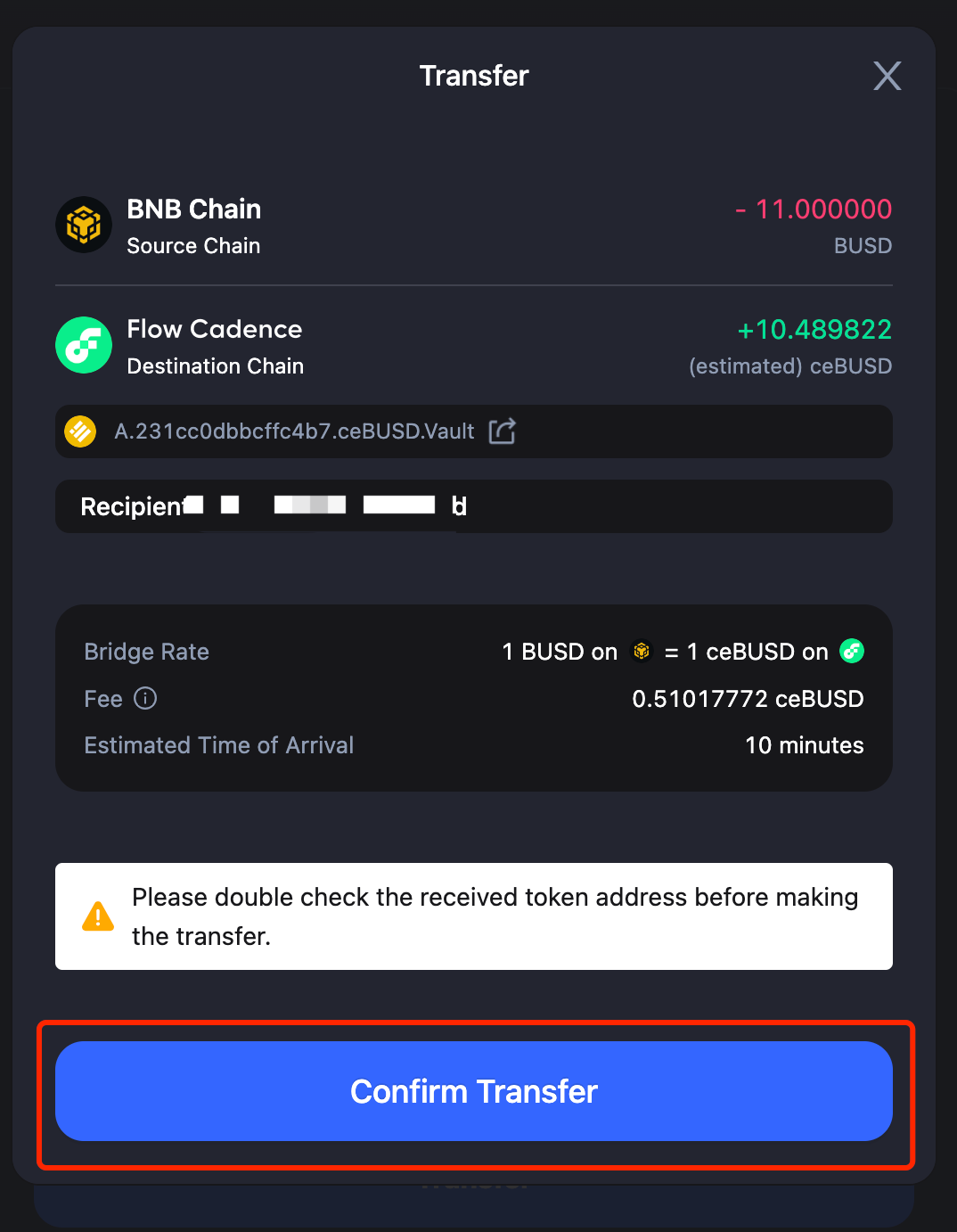

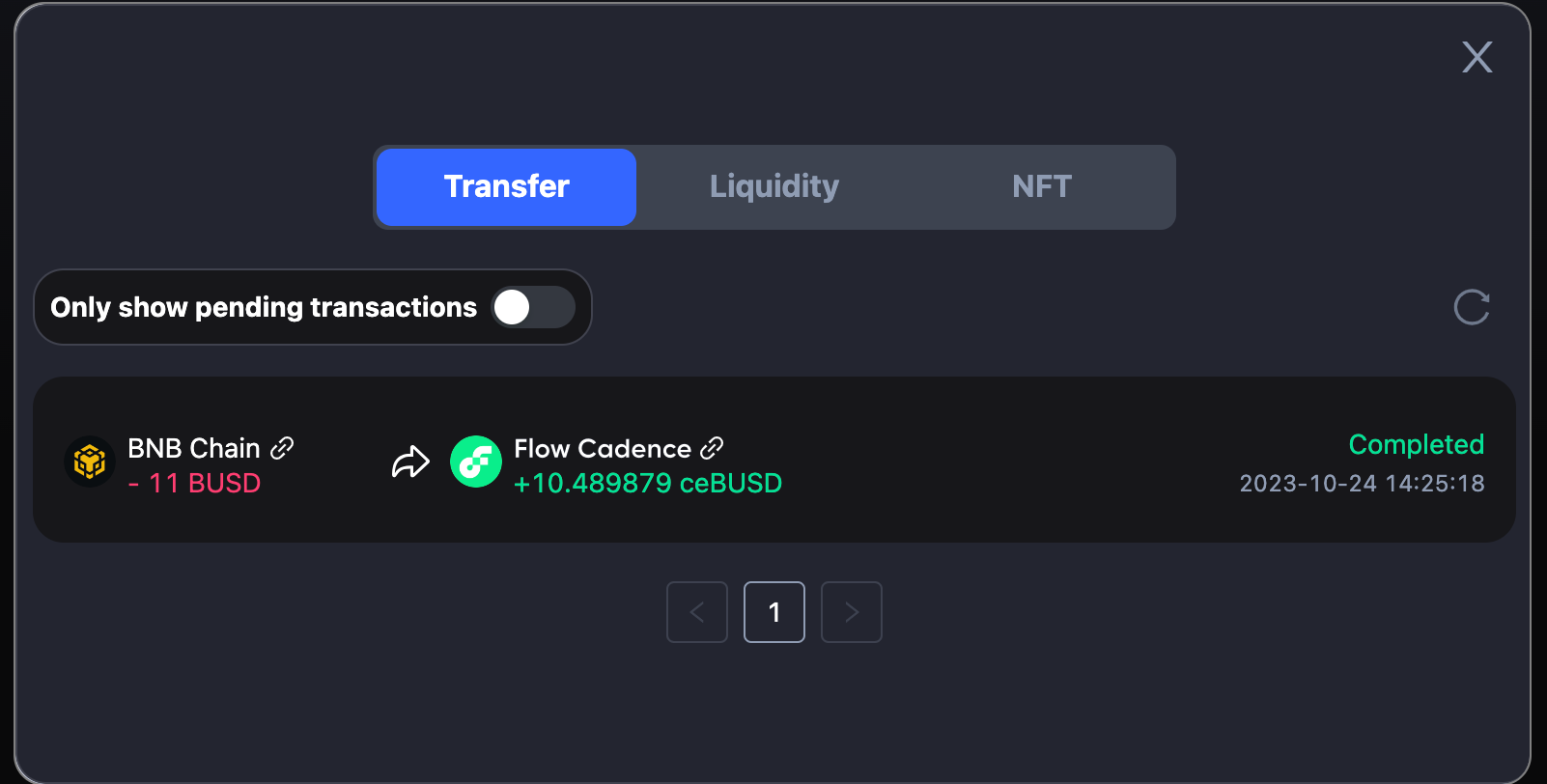

Let’s say, you want to transfer 11 BUSD from BNB Chain to Flow Cadence. The steps are made simple in cBridge:

- Select “BNB Chain” in the dropbox next to “From” and “Flow Cadence” in the dropbox next to “To”.

- You will be prompted to switch your wallet to BNB Chain if it’s not yet connected. Enter the amount you want to send under “Send”. You should see the estimated amount you will receive under “Receive (estimated)”.

.png)

Note that there will be a difference between the amount you send and the amount you receive, which is determined by the bridge rate and fees. For the exact definition of each item in the transaction, check the tooltips next to each of the terms.

.png)

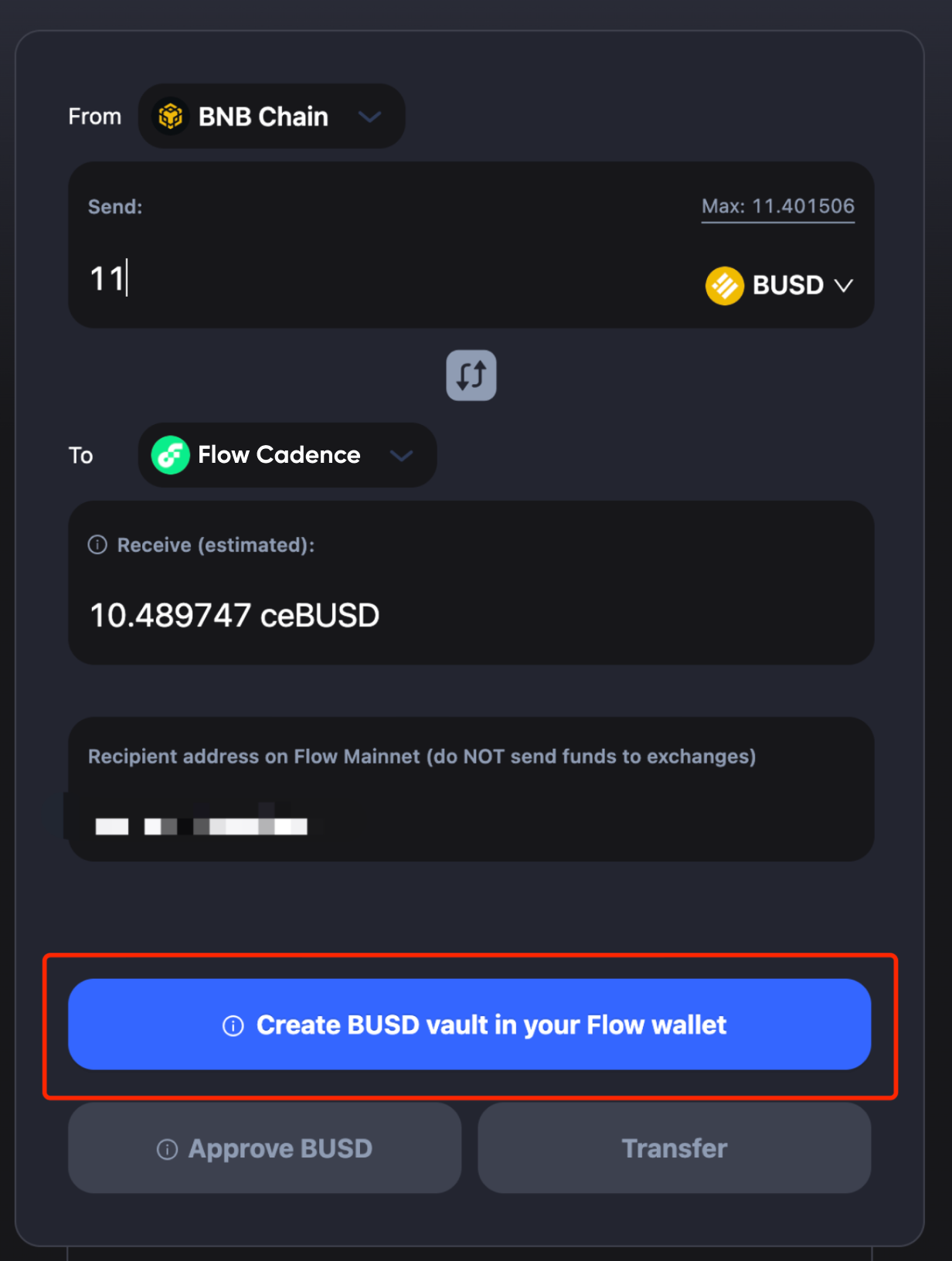

- Note that If you transfer BUSD to Flow Cadence for the first time, you will be prompted to “Create BUSD vault in your Follow wallet” first.

- Then click “Approve” on Flow Wallet.

.png)

- Then you need to “Approve BUSD”, and will be prompted to confirm on Metamask.

.png)

.png)

.png)

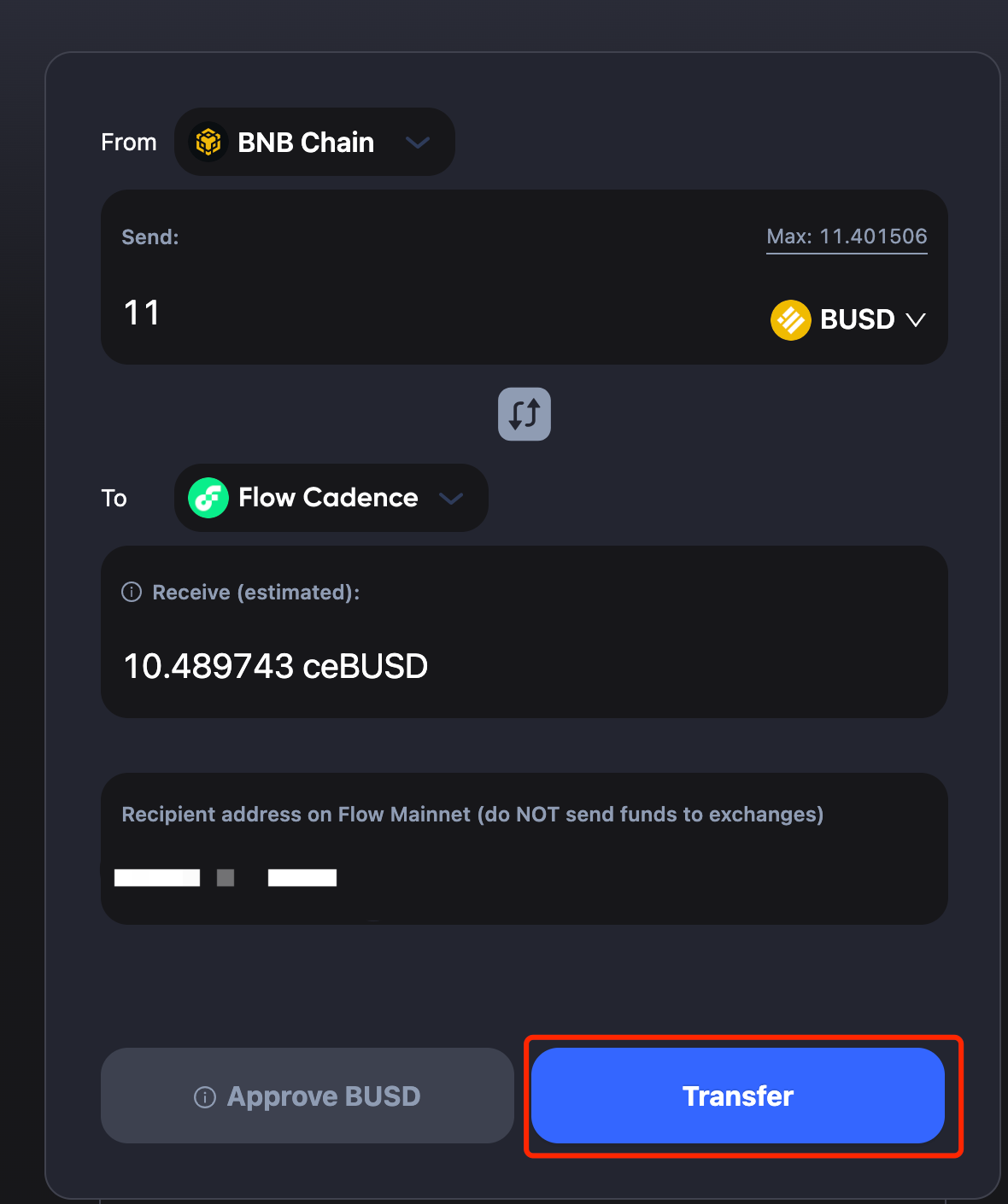

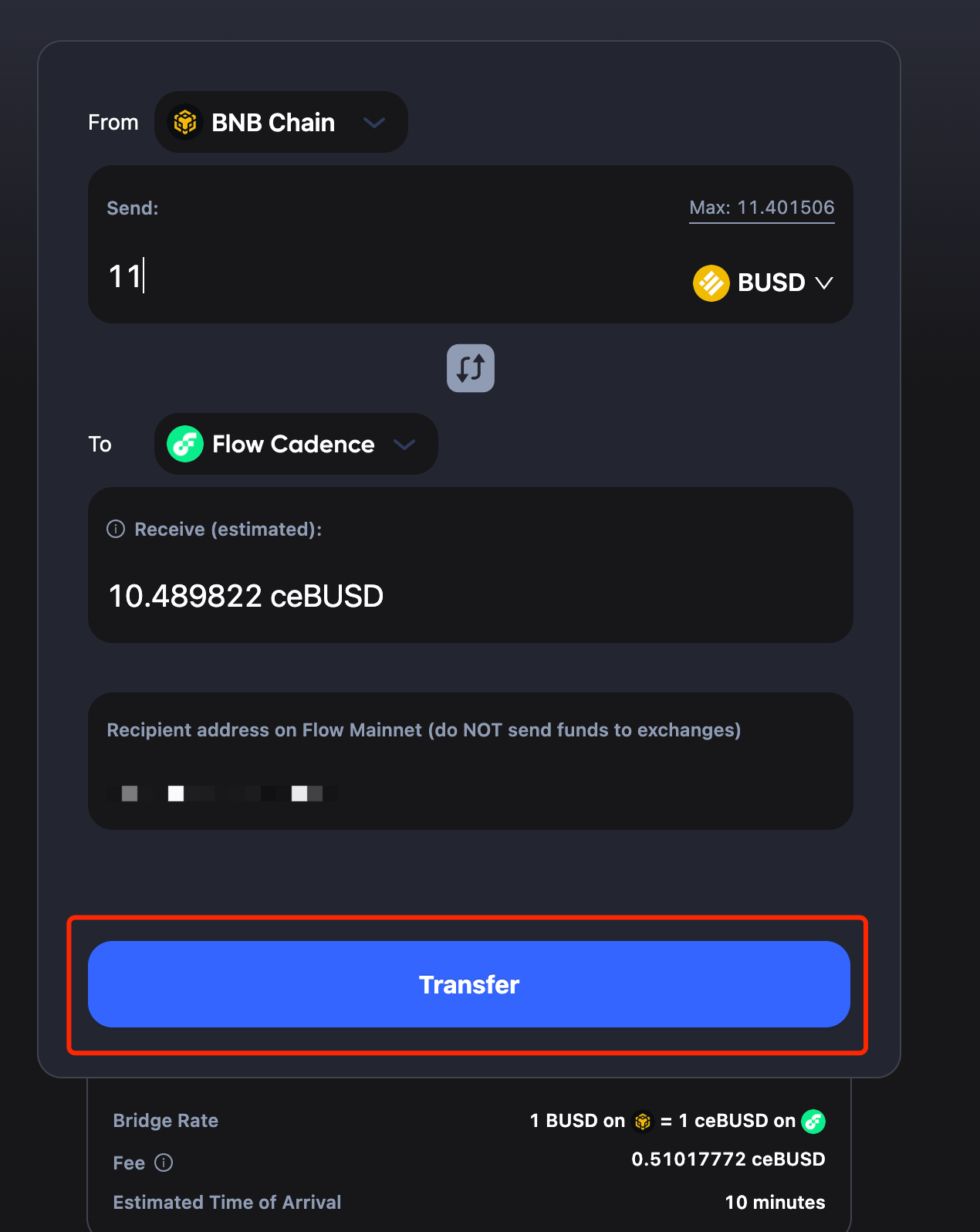

- Click “Next” and “Approve” in each prompt and you can transfer your assets. Then, review your transfer details and click “Transfer”. You will receive a popup to confirm the transfer.

Note if you have approved BUSD before, you will skip step 5 and see the below Transfer page.

- Make a final review and click Confirm Transfer button. Then you will be prompted with a confirmation on MetaMask.

.png)

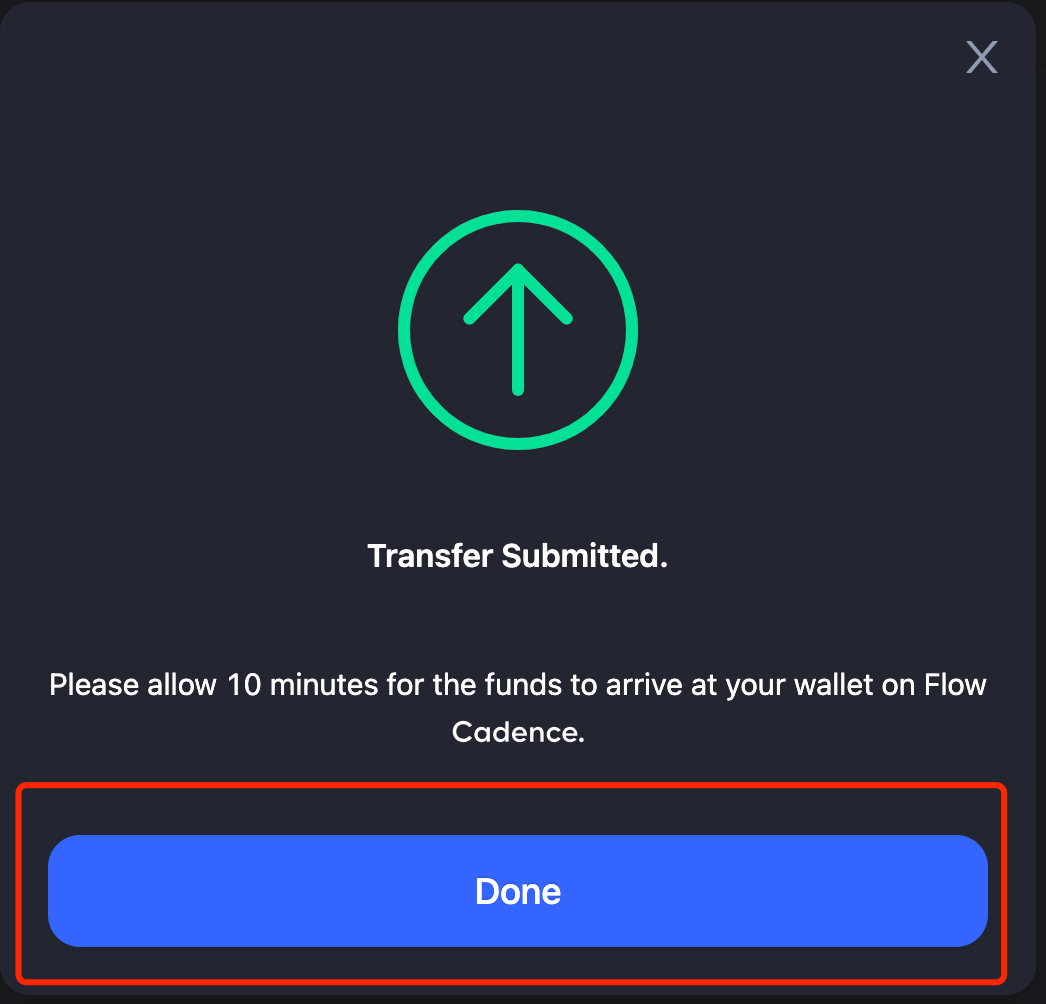

- Click “Confirm”, and your transaction will be submitted. Please wait for a few minutes as the bridging is in progress.

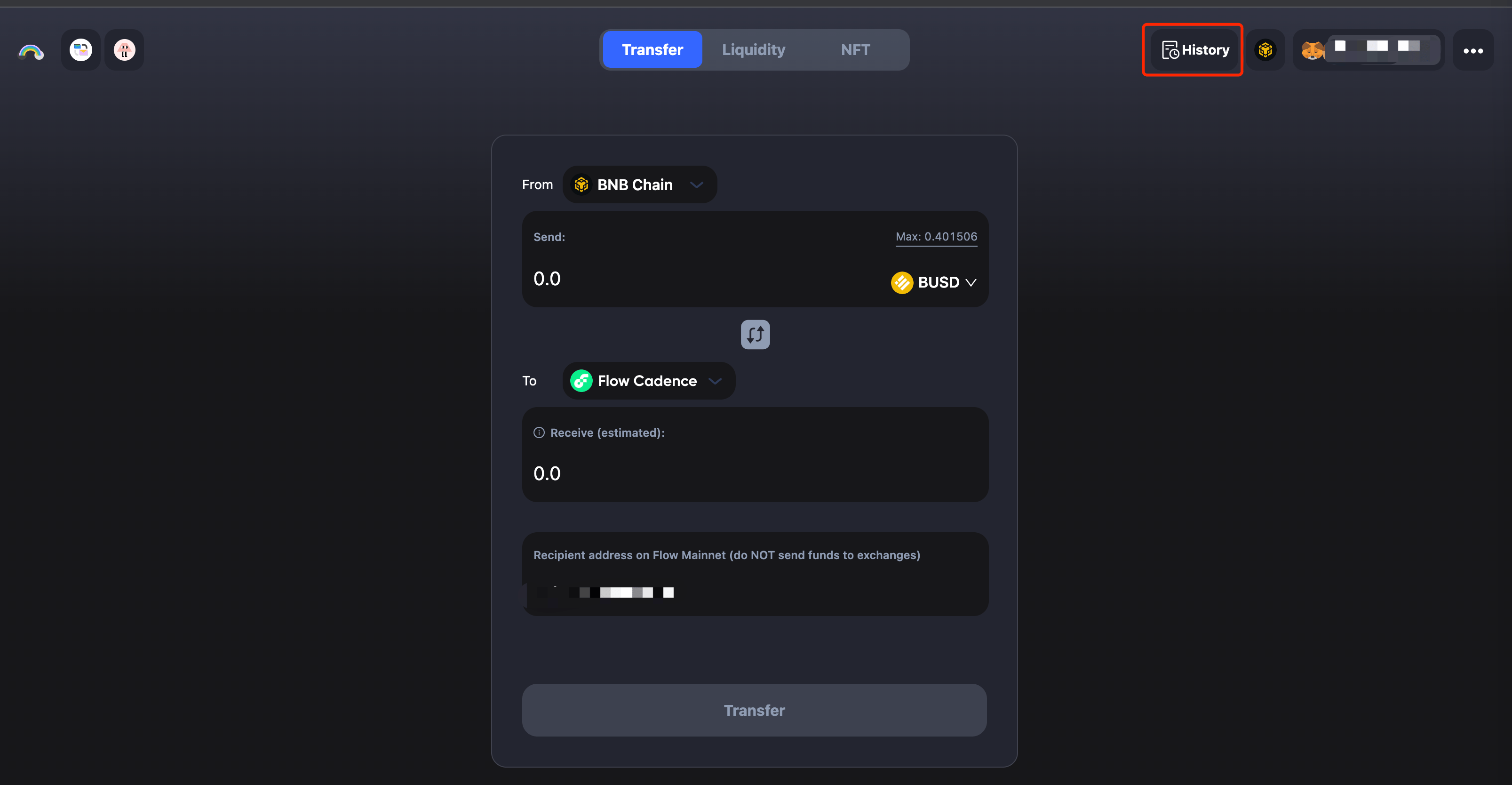

- You can check transaction status by clicking History button.

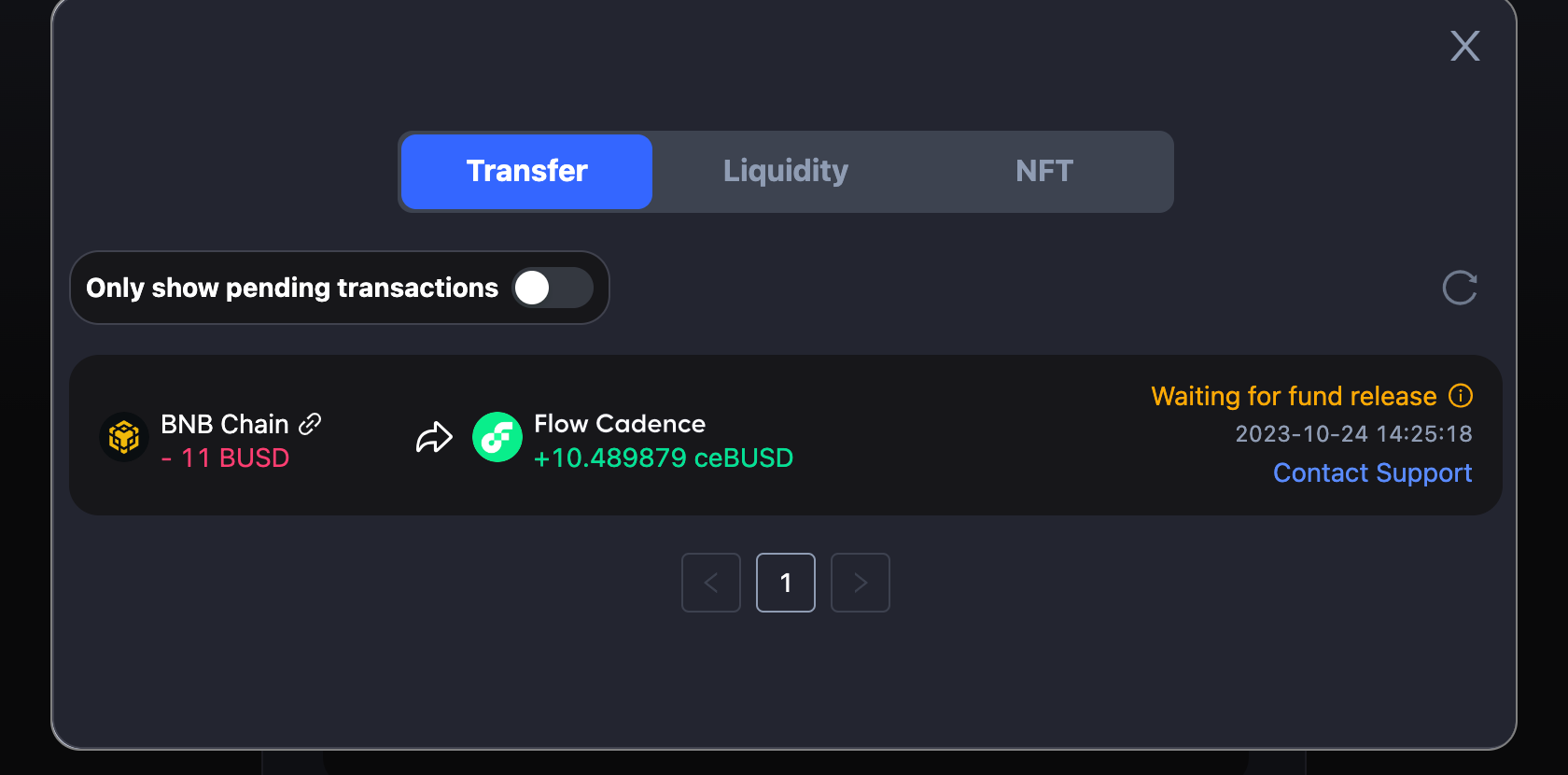

- Here are examples of transaction statuses. When it shows Completed, it means the transaction is done and the token should be received on Flow Cadence.

- You can also check token in your wallet.

.png)

Flow EVM Bridging Guide

Connect Your Wallet

Before you start transferring assets via cBridge, you will need to connect your wallet.

1. Click “Connect Wallet”, and you will be prompted to select a wallet. (cBridge now supports MetaMask, TokenPocket, Coinbase Wallet, WalletConnect, Clover and OKX Wallet on desktop browsers).

2. Select your wallet.

3. Allow cBridge to connect with your wallet.

4. Grant permissions to cBridge with necessary access to deliver the bridging actions accordingly.

Transfer Assets Across Chains

Let’s assume you want to transfer 100 USDC from Ethereum Mainnet to Flow EVM. The steps are made simple in cBridge:

1. Select “Ethereum Mainnet” in the dropbox next to “From” and “Flow EVM” in the dropbox next to “To”.

2. Enter the amount you want to send. You should see the estimated amount you will receive under “Receive (estimated)”.

Note that there will be a difference between the amount you send and the amount you receive, which is determined by the bridge rate and fees. For the exact definition of each item in the transaction, check the tooltips next to each of the terms.

3. Approve the token - You must give cBridge smart contracts permission to use your token (i.e. USDC in this case), which is an on-chain tx that consumes gas.

4. Once the token is approved, you can then review the transfer details. As you agree to proceed the bridging in accordance with the stated transfer details, click “Transfer”. You will receive a popup window to confirm the transfer.

5. Make a final review and click the “Confirm Transfer” button. Then you will be prompted with a confirmation on your wallet extension.

6. Once clicked “Confirm” on the wallet interface, the transaction will be submitted. The cBridge page will also show a “Transfer submitted” window as shown below. Please wait for a few minutes as the bridging is in progress.

7. You can check the transaction status by clicking the “History” button.

8. Here are some examples of the transaction statuses. When it shows Completed, it means that the wallet on Flow EVM has received the token.

9. You can also check the received token through the wallet.

Circle Cross-chain USDC Transfer Protocol V2 (CCTP V2)

For Circle Cross-Chain USDC Transfer Protocol V2 supported networks, the USDC flow is going through Circle bridge contracts and its attestation service instead of cBridge or peg bridge contracts and SGN.

The following content is an integration tutorial from frontend perspective.

.png)

CCTP V2 now supports both Fast Transfer and Standard Transfer, you can read more about how they work and differ in this doc https://developers.circle.com/cctp.

Proxy Contracts

| Supported Network | Address |

| Ethereum 1 | 0xC75fdd24820ddCdADeE9BB653aE6cD73BA8f0e80 |

| Avalanche 43114 | 0x358234B325EF9eA8115291A8b81b7d33A2Fa762D |

| Arbitrum One 42161 | 0x90811d8Ea6499D3e5CbfBa3B279FB4387EbDfce9 |

| Optimism 10 | 0xcfA5906d71e057BE50f4CF2a5bc41FF7bD0f0B91 |

| Base 8453 | 0xCD086225f47155937cc57b320f8D37933B683197 |

| Polygon PoS 137 | 0x04869755Da6E3F6eE5D190b8C6E56E1c33604cf2 |

| Plume Mainnet 98866 | 0x9B36f165baB9ebe611d491180418d8De4b8f3a1f |

Also you can get the related contract addressed from cBridge gateway api

https://cbridge-prod2.celer.app/v1/circleUsdcConfig

Quote Fee

Note that the CCTP quote the fees from the proxy contract instead of the cBridge gateway APIs.

For example, bridging USDC from Ethereum to Avalanch by totalFee method.

Inputs

amount: Your bridging amount with decimal, for example, 3000000 = 30USDC

dstChid: The destination chain you wanna send, in this case is 43114

Outputs

Output data is an array of fees [fee, txFee, percFe].

fee: total fee, txFee+percFee

txFee: transaction fee

percFee: percentage fee

For this bridging mode, the bridge rate is 1.

Bridge by depositForBurn

From the front-end side, lock the USDC to source proxy contract by the method depositForBurn. Circle attestation will bridge the assets to the destination chain in a trustless way. For more details refer to this:https://developers.circle.com/stablecoin/docs/cctp-protocol-contract

Contract Parameters

| Field | Des |

|---|---|

| amount | Bridging amount with decimal |

| dstChid | Bridging destination chain id |

| mintRecipient | Receiver address |

| burnToken | USDC token address in source chain, you can read the token address from this configuration: https://cbridge-prod2.celer.app/v1/circleUsdcConfig |

Once this depositForBurn happened on the source chain, you can get the source chain Deposited event.

event Deposited(address sender, bytes32 recipient, uint64 dstChid, uint256 amount, uint256 txFee, uint256 percFee, uint64 nonce);

Searching destination transaction status

Searching the final destination chain status by the gateway API: GetTransferStatus.

The API requires a tracking field transferId for the status queries.

- For API v2: Use the source chain transaction hash as the

transferIdvalue. - For API v1: Refer to the following example implemented with ethers.js:

getTransferId(): string {

return ethers.utils.solidityKeccak256(

["string", "address", "uint64", "uint64"],

[

"CircleTransfer", // fixed string

walletAddress, // wallet address of user

fromChainId, // source chain Id

nonce, // can be retrived from the Deposited event

],

);

}

API reference

Link gateway-gettransferstatus.md

cBridge SDK

cBridge SDK allows new and existing applications to integrate a rich subset of features that are available in the cBridge 2.0. Simple imported libraries and packages allow you to quickly implement the cBridge transfer functionality into new and existing applications.

cBridge Testnet Website

You can try our testnet website during the SDK integration

cBridge Testnet Endpoint

The testnet endpoint is: https://cbridge-v2-test.celer.network

cBridge Mainnet Endpoint

When you have finished implementation and testing on testnet, you are welcome to use cBridge mainnet for production test. The endpoint is: https://cbridge-prod2.celer.app/

SDK Working Flow

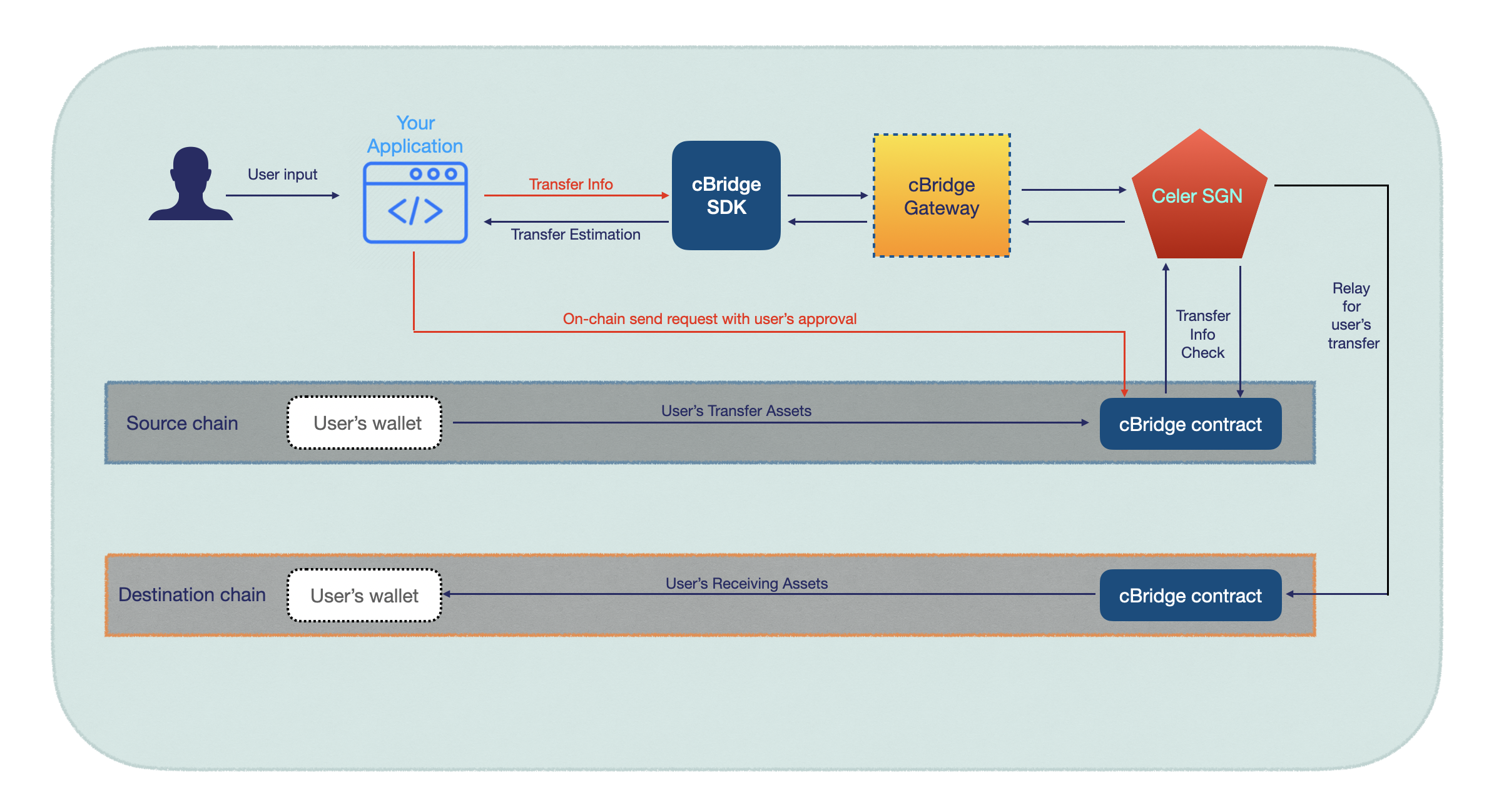

The following graph reveals a general cBridge SDK integration inside your application. In most cases, you need to support only two functions(red lines in the graph):

- Send request to cBridge gateway through cBridge SDK

- Send corresponding on-chain transaction to cBridge contract

Installation

It’s highly recommended to communicate with cBridge gateway by using grpc-web.

- You don’t need to put any effort for response value mapping. Since all messages are defined in protobuf, enum value could be used directly such as Completed instead of an integer value 1. It helps preventing bugs and errors due to random mapping issues

- Inside cBridge gateway, there are some post APIs needing serialized byteArray as input. It takes some steps to prepare format accepted request information. Just in case you prefer RESTful api request, we will provide some examples for you accordingly

- Since cBridge iterates frequently, the best way to keep everything updated is using grpc. You can always check the latest grpc generated files and keep in touch with the newest cBridge gateway

Note: You can always use REST apis when communicating with cBridge gateway. We will provide examples and details in each api reference.

1. Install the grpc-web

To begin development with cBridge SDK, each developer needs to install grpc-web for cBridge gateway communication

// Install via yarn

yarn add grpc-web

// Install via npm

npm install grpc-web

2. Download cBridge type-script client and contract

Download auto-generated protobuf files(including xxx_pb.d.ts, xxx_pb.js) in cBridge typescript client repo. You can find all needed messages including client, request constructs and contracts there.

3. Import cBridge SDK into your projects.

Import the file and type-defined messages, then they can be used in your project. The following is code snippet for type-script client usage in JavaScript project.

// import getTransferConfig request message

import {

GetTransferConfigsRequest

GetTransferConfigsResponse

}

from "../ts-proto/sgn/gateway/v1/gateway_pb";

// import grpc-web WebClient

import { WebClient }

from "../ts-proto/sgn/gateway/v1/GatewayServiceClientPb";

const request = new GetTransferConfigsRequest();

const client = new WebClient(`https://cbridge-prod2.celer.app/`, null, null);

const response = await client.getTransferConfigs(request, null);

API Reference

Once you have integrated cBridge SDK into your project, dive into the specifics of each API by checking out our complete documentation.

Need help?

If you’re looking for help, try join the community Discord

cBridge Pool-Based Transfer (xLiquidity)

Terminology

The followings are used to describe cBridge transfer flow

- The Source Chain is a chain contains the assets which users want to move.

- The Destination Chain is a chain where users want to receive their assets

- The cBridge Gateway provides related functionality to support users’ assets transfer.

- The cBridge contract will be deployed on different chains for transfer functionality

Flow Phrases

Transfer

A user request a on-chain transfer through cBridge contract on source chain. Then cBridge gateway and Celer SGN will coordinate token transfer from cBridge contract to user’s address on destination Chain

Transfer Refund

Once there is a transfer failure which requests refund, you will wait until cBridge has prepared on-chain refund transaction parameters. Then submit refund transaction and cBridge contracts will return user’s assets on source chain

.png)

Transfer

To accomplished user’s transfer, FE(front-end) needs to do the following things:

- Get basic transfer configs to get correct user’ input for assets transfer

- After collecting all needed information, always get updated estimation for the transfer.

- Check user’s on-chain token allowance for cBridge contract. If the allowance is not enough for user token transfer, trigger the corresponding on-chain approve flow

- Submit on-chain transfer request to cBridge contract on source chain

- Get transfer status repeatedly to check whether the transfer is complete.

Transfer Refund

Once the user’s previous transfer status is TRANSFER_TO_BE_REFUNDED, FE(front-end) needs to handle as follows to bring back user’s assets to his/her wallet:

- Polling GetTransferStatus until transfer status is TRANSFER_TO_BE_CONFIRMED

- Submit on-chain withdraw request to cBridge contract with information provided by cBridge gateway in GetTransferStatus response

- Once the refund transaction succeeds, the refund flow is complete.

Note: Basically, it may take some time for gateway to prepare withdraw information. If the transfer status is stuck as TRANSFER_TO_BE_REFUNDED more than 30 minutes, you may contact our custom support

cBridge Canonical Mapping Transfer (xAsset)

Terminology

The followings are used to describe cBridge transfer flow

- The Original Chain is the chain which supports the original token

- The Pegged Chain is the chain which has not supported original token yet.

- The Original Token is the existing token on the source chain

- The Pegged Token is the original token mapping on the pegged chain. The rate between original token and pegged token is 1:1

- The Original Token Vault is a contract deployed on the source chain locking and sending back user’s assets

- The Pegged Token Bridge is a contract deployed on the pegged chain minting and burning pegged token for users.

Flow Phrases

Mint(Deposit)

A user submit on-chain deposit/mint request to the OriginalTokenVault contract on source chain. Then user’s original tokens will be moved and locked in the OriginalTokenVault contract. Celer SGN will coordinate pegged token mint in PeggedTokenBridge contract and move generated tokens into user’s wallet address

Burn(Withdraw)

A user submit on-chain burn/withdraw request to the PeggedTokenBridge contract on pegged chain. Then user’s pegged tokens will be moved and burnt in the PeggedTokenBridge contract. Celer SGN will coordinate original tokens unlock and send back to user’s wallet address in OriginalTokenVault bridge on source chain.

Note: During the communication between you and cBridge gateway, you need to indicate it is a mint&burn transfer flow. Otherwise, cBridge gateway will treat it as a general pool-based transfer and may lead to unexpected error

// By refering pegged_pair_configs, we can determine whether

// it is a pegged transfer.

Scenario A:

5 <---> 69 Domi ====> Pool-Based Transfer

Scenario B:

5 <---> 97 Domi ====> Mint&Burn Transfer

"chains": [

{

"id": 5,

"name": "Goerli",

"icon": "https://get.celer.app/cbridge-icons/ETH.png",

"block_delay": 5,

"gas_token_symbol": "ETH",

"explore_url": "https://goerli.etherscan.io/",

//cbridge contract

"contract_addr": "0x358234B325EF9eA8115291A8b81b7d33A2Fa762D",

"drop_gas_amt": "0",

"suggested_gas_cost": "0",

"drop_gas_cost_amt": "0"

},

{

"id": 69,

"name": "Optimistic Kovan",

"icon": "https://get.celer.app/cbridge-icons/chain-icon/OP.jpg",

"block_delay": 8,

"gas_token_symbol": "ETH",

"explore_url": "https://kovan-optimistic.etherscan.io/",

//cbridge contract

"contract_addr": "0x265B25e22bcd7f10a5bD6E6410F10537Cc7567e8",

"drop_gas_amt": "0",

"suggested_gas_cost": "0",

"drop_gas_cost_amt": "0"

},

{

"id": 97,

"name": "BSC Testnet",

"icon": "https://get.celer.app/cbridge-icons/chain-icon/BSC.png",

"block_delay": 8,

"gas_token_symbol": "BNB",

"explore_url": "https://testnet.bscscan.com/",

"contract_addr": "0xf89354F314faF344Abd754924438bA798E306DF2",

"drop_gas_amt": "2000000000000000",

"suggested_gas_cost": "125624",

"drop_gas_cost_amt": "100000000000000"

},

]

{

"token": {

"symbol": "CELR",

"address": "0x5D3c0F4cA5EE99f8E8F59Ff9A5fAb04F6a7e007f",

"decimal": 18,

"xfer_disabled": false

},

"name": "Celer Network",

"icon": "https://get.celer.app/cbridge-icons/celr.png"

},

{

"token": {

"symbol": "DOMI",

"address": "0x646Ff87BE4F232C555c264465007f3AAE7a5626e",

"decimal": 18,

"xfer_disabled": false

},

"name": "Domi",